Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 14.8 Billion |

| 2025 Market Size | USD 16.9 Billion |

| 2032 Forecast | USD 45.1 Billion |

| Growth Rate(CAGR) | 15.1% |

| Largest Region | APAC |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Report Code: 12545

This Report Provides In-Depth Analysis of the Electric Traction Motor Market Report Prepared by P&S Intelligence, Segmented by Type (AC, DC), Power Rating (Below 200kW, 200-400 kW, Above 400kW), Application (Railways, Electric Vehicle), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 14.8 Billion |

| 2025 Market Size | USD 16.9 Billion |

| 2032 Forecast | USD 45.1 Billion |

| Growth Rate(CAGR) | 15.1% |

| Largest Region | APAC |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

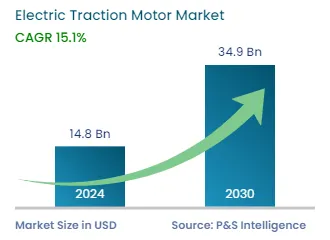

The electric traction motor market size stood at USD 14.8 billion in 2024, and it is expected to advance at a compound annual growth rate of 15.1% during 2025–2032, to reach USD 45.1 billion by 2032.

The market is driven by the robust expansion through essential changes in automobile and transportation markets. Growth of electric traction motors market represents a fundamental market driver due to rising electric vehicle (EV) consumer demand. The sales rise of electric vehicles over conventional internal combustion engine vehicles drives up the requirement for electric traction motors because these components power electric vehicles. The rising demand for electric vehicles receives additional support because governments implement regulations and offer incentives. The growing market demand for electric vehicles is driven by government initiatives that launch stricter emissions requirements along with funds such as subsidies and tax credits and rebates that encourage electric vehicle adoption thus increasing the requirement for electric traction motors.

Market expansion can be attributed to environmental sustainability along with various other reasons. Increased international efforts to decrease carbon pollution drive stronger attention to adopting greener forms of transportation. Electric vehicles provide a crucial method to decrease air contamination alongside petroleum fuel independence by functioning through electric traction motors. Private and public entities worldwide have established environmental targets while shifting toward electric propulsion systems becomes necessary to fulfill these targets across transport sectors.

The types analyzed here are:

The power ratings analyzed here are:

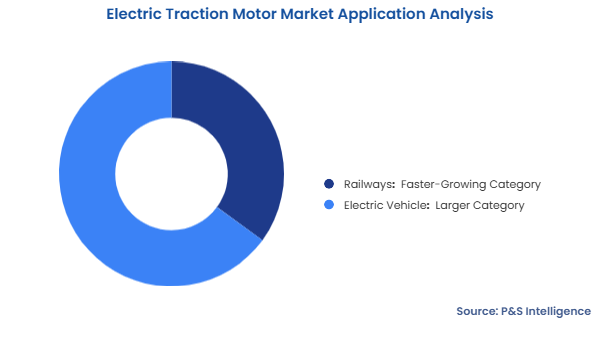

The applications analyzed here are:

Drive strategic growth with comprehensive market analysis

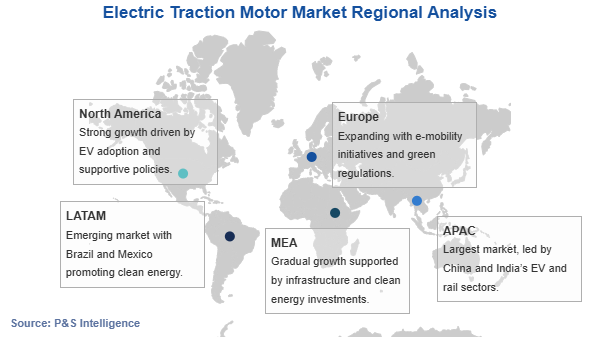

The Asia-Pacific region held the largest market share, of 50%, in 2024, driven primarily by China, Japan, and South Korea. These countries are leaders in the adoption of electric vehicles (EVs) and the electrification of railways. China is the world’s largest market for electric vehicles, contributing significantly to the demand for electric traction motors. The country also has an extensive and rapidly growing electric railway network, further boosting the demand for electric traction motors.

The overall growth of electric vehicle infrastructure and public transportation systems in Asia-Pacific continues to make it the largest region for electric traction motors. Asia-Pacific is home to several governments and businesses that are heavily investing in clean energy solutions, including electric transportation infrastructure. Moreover, continuous developments of the transportation infrastructure, which includes HEVs, railway connections, high-speed bullet trains, and metro rail systems; and the burgeoning demand for narrow gauges and industrial railway rolling stock, including electric, hybrid, and diesel-electric locomotives, contribute to the growth in demand for electric traction motors in APAC.

Europe has some of the most ambitious green energy goals and emission reduction targets, which are accelerating the transition to electric mobility. This includes the electrification of both personal vehicles and public transportation systems such as electric buses and trains. Countries like Germany, Norway, and the Netherlands are major drivers of the electric vehicle market, and this is creating a growing demand for electric traction motors.

Moreover, Europe is also actively electrifying its rail networks, including high-speed rail projects and light rail systems, contributing to the growing demand for electric traction motors in the railway sector. Europe is a leader in the electrification of public transport, including electric buses, trams, and metro systems. Cities across Europe are moving towards zero-emissions public transport, contributing to a rise in demand for electric traction motors used in these systems.

The regions analyzed here are:

The electric traction motor market is fragmented in nature because the market serves a wide variety of applications, including electric vehicles (EVs), railways, electric buses, e-bikes, and even electric marine transport. Each application has distinct requirements in terms of motor performance, power, and design, which leads to the presence of different manufacturers catering to each sector. The diversity of end-use applications has contributed to the rise of specialized suppliers, resulting in a fragmented landscape. Different regions have their own set of key players that cater to the local demand. For instance, some regions have more players focused on electric vehicle production, while others are more focused on railway electrification. This regional variation in focus further divides the market, as companies tailor their offerings to the specific needs and preferences of their local markets.

The entry of new players also contributes to the fragmentation. As more companies enter the market, especially in the rapidly growing electric vehicle segment, the supply of electric traction motors becomes even more diverse. New manufacturers often create their own designs and supply chains, which adds further complexity to the market, as these new entrants do not always rely on traditional suppliers of traction motors.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages