Market Statistics

| Study Period | 2019 - 2030 |

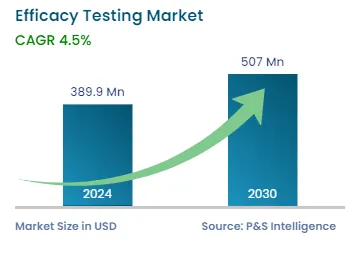

| 2024 Market Size | USD 389.9 Million |

| 2030 Forecast | USD 507 Million |

| Growth Rate(CAGR) | 4.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12607

Get a Comprehensive Overview of the Efficacy Testing Market Report Prepared by P&S Intelligence, Segmented by Service Type (Antimicrobial, Disinfectant), Application (Biopharmaceutical Application, Cosmetic And Personal Care Products, Consumer Products, Medical Device), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 389.9 Million |

| 2030 Forecast | USD 507 Million |

| Growth Rate(CAGR) | 4.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global efficacy testing market generated revenue of USD 389.9 million in 2024, which will reach USD 507 million by 2030, advancing at 4.5% CAGR between 2024 and 2030. This is attributed to the growth in the demand for a higher quality and efficiency of biologics and other drugs. Moreover, the growing number of regulations for product approvals is significant for this market. The regulations of the FDA and many other regional and national regulatory agencies addressing the safety of pharmaceutical and cosmetic products are rather stringent.

Moreover, the effectiveness of active pharmaceutical ingredients (APIs) is the major concern among patients, healthcare professionals, and even the manufacturers. Thus, to meet the regulations to be followed for the validation of pharmaceutical products, numerous methods for preservation efficacy testing (PET) have been advanced over time by regulatory agencies, standards organizations, industry players, and individual compliance firms, such as the International Council on Harmonisation of Technical Requirements for Registration of Pharmaceuticals for Human Use and Good Clinical Practices (GCP). The main purpose of these regulatory bodies is to demonstrate the proper documentation standards and rationalize practices.

Furthermore, the growth in the pharmaceutical and biotechnological industries with the support of governments and the positive trends in research and development continue to push up the demand for efficacy tests. In addition, pharmaceutical and biotechnological companies are increasingly outsourcing research activities to academic and private contract research organizations (CROs), with the objective of staying competitive and flexible in a world of exponentially increasing knowledge and growing adoption of advanced technologies.

The growing adoption of the QbD approach by pharmaceutical and biotechnological companies because of the importance of the stability and efficacy of any drug among patients and themselves is a major trend in the healthcare sector. Many companies are adopting this approach to ensure that all the sources of variability affecting a process are identified, explained, and managed with appropriate measures and to maintain the quality of the drugs. This enables the finished medicine to consistently meet the predefined performance characteristics from the start.

Hence, right since the introduction of QbD concepts, they have been quickly accepted by the industry to ensure that the quality of pharmaceutical and biotechnological products meet all the compliance requirements, being designed and created using the approved R&D and manufacturing procedures. Many of the quality requirements are related to the way in which a pharmaceutical or biotechnological product is designed. A poorly designed product will show poor safety and efficacy no matter how many tests or analyses have been done to verify its quality. Thus, the QbD approach becomes advantageous for pharma and biopharma companies by demonstrating that the drug quality will not improve by merely increasing the tests performed on the products; a proper R&D approach is essential.

The global efficacy testing market is expected to grow owing to the surge in the demand for novel drugs and therapies across the world. This is itself due to the rising prevalence of chronic and infectious diseases, such as cancer, diabetes, TB, and heart diseases. The boom in the geriatric population riddled with chronic diseases is another factor behind the rising demand for novel drugs and therapies. According to the WHO, in 2020, cancer was a leading cause of death worldwide, with nearly 10 million deaths. Hence, governments are taking initiatives for enhancing their healthcare infrastructure, which leads to the growth of the pharmaceutical industry.

Furthermore, the demand for personalized drugs is rising due to the growing incidence of genetic disorders and cancer. Moreover, due to individuals’ varying susceptibility to infections as well as the inter-individual unpredictability while designing a prognosis and treatment for the ailment, the demand for personalized medicines is growing. Furthermore, the large pool of patients leads to wide variations in individual behavior and bodily response, which drives the demand for personalized medicines for better efficacy, thus propelling the demand for testing of the efficacy of the drugs.

Well-established as well as growing pharmaceutical companies have large numbers of orders for manufacturing, due to which they are shifting toward the outsourcing of efficacy testing. This approach is adopted by many players as it allows them to improve their focus on their core business activities, increase their efficiency, control their costs, and utilize more funds in other areas of business. Moreover, outsourcing helps increase efficiency because CROs and CDMOs specialize in these processes, which can help the actual pharma and biopharma companies achieve a more-productive, efficient service, often of a greater quality.

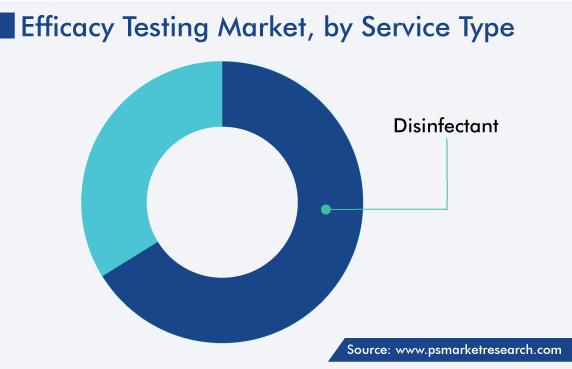

Based on service type, the disinfection category accounted for the larger share, of around 64%, in the global efficacy testing market in 2022, and it will further maintain its dominance in the future. This is owing to the growing awareness of personal & environmental hygiene, which has resulted in the increasing use of surface disinfectants.

Further, the advancements in technologies and the surge in the R&D investments by the leading players to deliver the emerging technologies in the market are driving the growth of the category. Moreover, the growing need to ascertain how effective disinfectant and sanitizing agent is at eliminating microbes is projected to fuel the volume of such tests.

Drive strategic growth with comprehensive market analysis

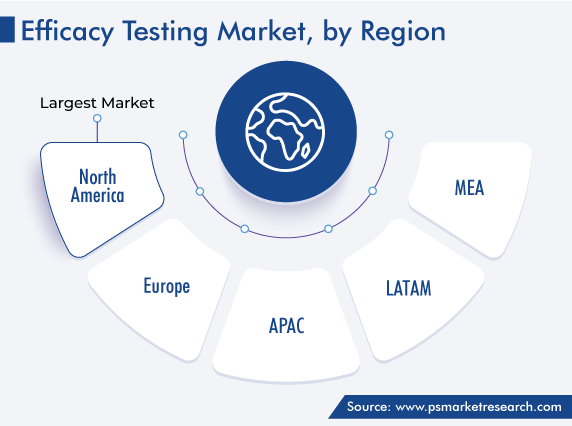

North America captured the largest revenue share in the market, of around 52%, in 2022, and it is further expected to maintain its dominance during the forecast period. The major reasons for this include the high adoption rate of advanced techniques and diagnostic tools, highest healthcare and R&D expenditure, and growing outsourcing of testing procedures by pharmaceutical and cosmetics companies in the region. Moreover, the strong presence of the major service providers in the region makes its market lucrative for investors and players. Moreover, the existence of stringent regulations for drug development in the U.S. and the rising count of government initiatives and funding for startups in the domain of life sciences are the other factors that increase the demand for efficacy testing in the U.S.

Further, North America has most of the world’s leading pharma and medical device corporations as well as market players’ headquarters, and other competitors have also concentrated on expanding their geographical presence to advance their market opportunities and capabilities. Additionally, regional governments are investing amply in CDMOs for the manufacturing of drug components and substances, to expand drug manufacturing capacities. As part of such initiatives, the U.S. Department of Health & Human Services invested USD 628 million in Emergent BioSolutions in June 2020 to advance the manufacturing competencies for COVID-19 vaccines.

Moreover, Canada’s contribution in making North America dominant on this market is expected to grow steadily over this decade. This would be owing to the growing pharmaceutical and cosmetics industries and their rising dependence on third-party efficacy testing service providers.

Furthermore, Europe accounts for a significant share in the market. This is owing to the increasing stringency of the regulatory policies for the safety of drugs and the presence of a robust healthcare infrastructure. Additionally, the presence of many key players providing outsourcing services drives the market in the region.

Based on Service Type

Based on Application

Geographical Analysis

The 2030 size of the market for efficacy testing services will be USD 507 million.

Biopharmaceutical applications dominate the efficacy testing industry.

The market for efficacy testing services is segmented by service type, application, and region.

The efficacy testing industry is growing because of the stringent regulations around the world for the safety and effectiveness of drugs and cosmetics.

North America has the largest size in the market for efficacy testing services, and APAC will have the highest CAGR.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages