Report Code: 12062 | Available Format: PDF | Pages: 195

Edge Data Center Market Research Report: By Component (Solutions, Services), Organization (Large Enterprises, SMEs), Application (Retail, BFSI, Logistics & Transportation, Healthcare, Government, IT & Telecom) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 12062

- Available Format: PDF

- Pages: 195

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

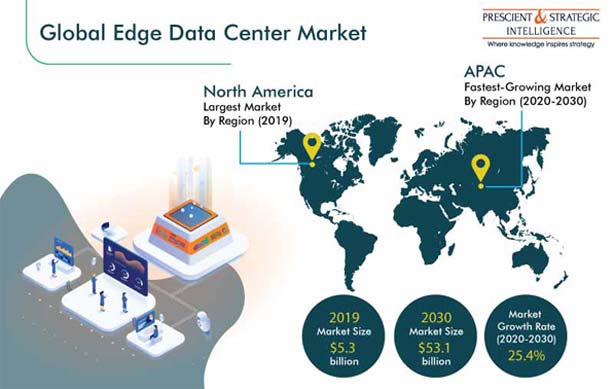

The edge data center market size will be $53.1 billion by 2030, and it is expected to witness a CAGR of 25.4% during 2020–2030, since standing at $5.3 billion in 2019. The growth thrives on the commercialization of 5G, dense mobile data traffic and over-the-top traffic (OTT) traffic, and high demand for internet of things (IoT) devices.

COVID-19 Impact Analysis

The demand for edge data centers has witnessed a tremendous rise during the COVID-19 pandemic due to the global adoption of the work-from-home policy. Despite the high demand, the construction of such spaces was halted due to the ongoing health crisis. Labor unavailability and scarce raw material supplies have resulted in the slow or halted construction of such facilities during the COVID-19 period. However, the health emergency will have a positive impact on the edge data center industry in the long term owing to the accelerating digitization rate.

Solutions Emerged as Larger Revenue Contributor

The solutions category, within the component segment, generated the higher revenue in 2019. Within the solutions category, the power & uninterruptible power supply (UPS) classification accounted for the largest share owing to the omnipresent need for prime and backup power at data centers. Moreover, the booming investments in the research and development (R&D) of UPS technologies will drive the growth of this category in the edge data center market. Additionally, the benefits offered by such devices such as reliable power backup, higher efficiency, and equipment protection against power fluctuations will support the category growth in the coming years.

Small & Medium Enterprises (SMEs) Held Larger Share

At present, the SMEs category, under the organization segment, holds the larger market share due to the rising investments in and deployment of edge data centers among these companies. Additionally, SMEs are expected to rapidly adopt edge data center solutions in the coming years because they are observing robust digitalization and offering online services, which need data-intensive applications. The increasing investments in information technology (IT) facilities and quick shift toward digital solutions have transformed the SMEs sector. Edge data centers, therefore, serve as a complete data center solution for such firms.

Banking, Financial Services, and Insurance (BFSI) Category To Advance at Rapid Pace

In the coming years, the BFSI application will generate the highest demand for edge data centers due to the increasing focus of BFSI companies on efficient robust IT infrastructure and their rising need for storing and processing consumer data securely. In 2019, the BFSI sector spent more than 10% of its revenue on IT solutions and services. Moreover, these edge data center market end users are working on enabling consumers to transact securely and gather real-time data.

North America Region Generates Highest Revenue

At present, North America accounts for the largest market share due to the commercialization of 5G, rising data traffic, and increasing government initiatives for the deployment of data centers. The U.S. is the largest user of such solutions, its states offer higher financial incentives for data centers than Canadian territories and provinces and heft investments in these centers by private companies.

For example, in March 2020, Google LLC publicized its plan to invest $10 billion in the development of data centers and its U.S. offices. With this investment, the company will construct new data centers in Pennsylvania, California, Georgia, New York, Washington, Oklahoma, Colorado, Nebraska, and Massachusetts.

Asia-Pacific (APAC) To Display Fastest Growth

APAC is expected to demonstrate the fastest growth in the adoption of edge data center solutions in the coming years. This is attributed to the growing internet penetration in emerging economies, such as India, Indonesia, and China, and swift digitization. According to the Internet & Mobile Association of India (IAMAI), India had more than 504 million active internet users in November 2019, which was a 12% surge from March 2019. In essence, the edge data center market in APAC will be driven by the rising adoption of IoT devices and shift toward OTT content.

IoT Proliferation Is Key Market Trend

IoT proliferation, especially in the global automotive and healthcare industries, has become a prominent trend in the market for edge data centers. The total number of connected smart devices is estimated to reach over 41.0 billion by 2027 from 14.2 billion in 2019. The surging number of smart cities in Germany, the U.K., and India is expected to further boost the deployment of IoT, which would lead to the creation of vast amounts of data. As a result, the need for ample storage space at cost-effective rates will surge, which would eventually drive the establishment of edge data centers.

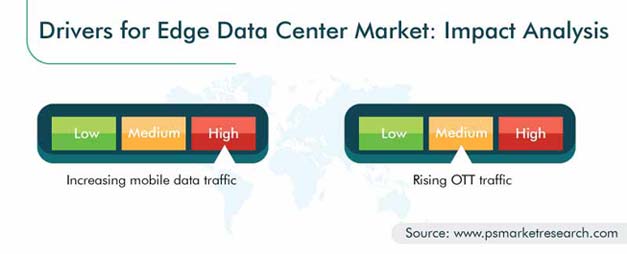

Rising Mobile Data Traffic Is Prime Market Driver

The increasing mobile data traffic will be a major contributor to the market for edge data centers. The surging adoption of IoT devices and smartphones has led to a rise in the mobile data traffic. To manage the increasing amount of data, a large number of edge data centers are being established across the world.

Growing OTT Traffic Propelling Market Advance

The rising OTT traffic is also expected to play a key role in the growth of the edge data center market. The augmenting demand for OTT services and surging shift toward online content are the primary reasons behind the OTT traffic increase. As conventional data centers are often located far from users, OTT content sometimes experiences latency, because of which the song or video keeps buffering. Thus, to offer an uninterrupted OTT experience by reducing the time it takes for the data transmitted from the source to reach its destination, edge data centers are being established closer to users.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$5.3 Billion |

Forecast Period CAGR |

25.4% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Company Share Analysis, Major Countries Analysis, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

Component, Organization, Application, Geography |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Spain, Japan, China, India, Australia, South Korea, Brazil, Mexico, U.A.E., South Africa |

Secondary Sources and References (Partial List) |

Advancing Data Center and IT Infrastructure Professionals (AFCOM), Africa Data Center Association (ADCA), Asian Development Bank (ADB), BCS Data Center Specialist Group (DCSG), Brazilian Association of Software Companies (ABES), Building and Construction Authority (BCA – IDA Singapore), Building Research Establishment (BRE), China Data Center Committee (CDCC), China Internet Network Information Center (CNNIC), Data Centre Alliance (DCA), International GNSS Service (IGS), Telecommunication Industry Association (TIA), |

Explore more about this report - Request free sample

Product Launches Helping Companies Increase Their Revenue

The edge data center market is fragmented in nature, due to the presence of a large number of industry players, such as Microsoft Corporation, IBM Corporation, 365 Operating LLC, and EdgeConnecX Inc. In recent years, several companies in the edge data center market have launched new products, in order to provide technologically advanced products to customers. For instance:

- In May 2020, IBM Corporation and Red Hat together launched new edge computing solutions for the 5G era, at the IBM Think Digital Conference. The new solutions are IBM edge application manager, IBM telco network cloud manager, and edge-enabled applications and services (including IBM Visual Insights, IBM Connected Manufacturing, and IBM Visual Inspector).

- In February 2020, Huawei Technologies Co. Ltd. launched a new UPS power module FusionPower 2.0 at Huawei Industrial Digital Transformation Conference 2020. The new product enables the power density of a single module to reach 100 kilowatts (kW)/3 Units, which is higher than the industry standards.

- In December 2019, Schneider Electric SE in partnership with Iceotope Technologies Limited and Avnet, Inc. launched an integrated rack immersive liquid cooling technology, for deployment in data centers. The product is ideal for compute-intensive applications.

Some of the key players in the edge data center market report include:

-

365 Operating LLC

-

EdgeConneX Inc.

-

Huawei Technologies Co. Ltd.

-

Eaton Corporation

-

Microsoft Corporation

-

Fujitsu Ltd.

-

Hewlett Packard Enterprise Company

-

Hitachi Vantara

-

IBM Corporation

-

Panduit Corporation

-

Schneider Electric SE

-

Vapor IO Inc.

-

Vertiv Holdings Co.

-

VxChnge Holdings LLC

Edge Data Center Market Size Breakdown by Segment

The edge data center market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Component

- Solutions

- Cooling

- Power and uninterruptible power supply (UPS)

- IT racks & enclosure

- Networking equipment

- Storage

- Data center infrastructure management (DCIM)

- Services

- Installation & integration

- Managed

- Consulting

Based on Organization

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Based on Application

- Retail

- Banking, financial services, and insurance (BFSI)

- Logistics & Transportation

- Healthcare

- Government

- IT & Telecom

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Asia-Pacific (APAC)

- China

- India

- Japan

- South Korea

- Australia

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East and Africa (MEA)

- U.A.E

- South Africa

In 2019, the edge data center market size was $5.3 billion.

During the COVID-19 pandemic, the edge data center industry is growing on account of the rising consumption of data, due to the work-from-home strategies.

Small and medium enterprises (SMEs) will be the faster-growing organizations in the edge data center market.

The key driver for the edge data center industry is the increasing over-the-top traffic.

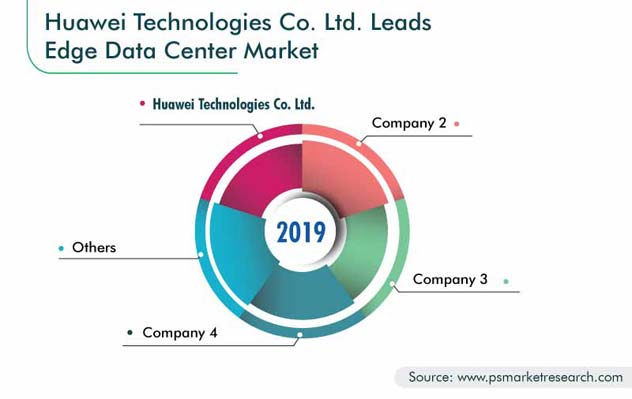

The top-ranked player in the edge data center market is Huawei Technologies Co. Ltd.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws