Market Statistics

| Study Period | 2019 - 2024 |

| 2024 Market Size | 23.8 Billion |

| 2025 Market Size | 27.9 Billion |

| 2030 Forecast | 63.9 Billion |

| Growth Rate(CAGR) | 17.9% |

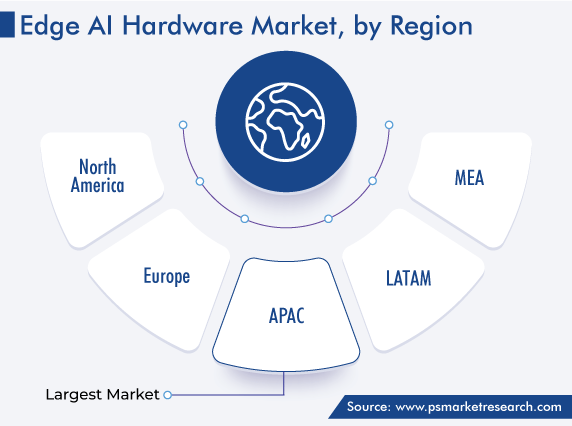

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12538

Get a Comprehensive Overview of the Edge AI Hardware Market Report Prepared by P&S Intelligence, Segmented by Device (Smartphones, Surveillance Cameras, Robots, Wearables, Edge Servers, Smart Speakers, Automotive, Smart Mirrors), Power Consumption (Less Than 1W, 1-3W, 3-5W, 5-10W, More Than 10W), Function (Training, Inference), Processor (CPU, GPU, FPGA, ASIC), Vertical (Consumer Electronics, Smart Home, Automotive & Transportation, Government, Healthcare, Industrial, Aerospace & Defense, Construction), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2024 |

| 2024 Market Size | 23.8 Billion |

| 2025 Market Size | 27.9 Billion |

| 2030 Forecast | 63.9 Billion |

| Growth Rate(CAGR) | 17.9% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The edge AI hardware market reached 23.8 billion in 2024, and it is projected to grow at a CAGR of 17.9% between 2024 and 2030, to reach 63.9 billion by 2030. This is due to the development of edge computing devices and services as well as the improvement of real-time low latency. By incorporating artificial intelligence into such apparatus, an enhanced functionality, easier, faster, and more accurate data processing is made possible. Additionally, the industry is seeing chances for growth as a result of rising R&D expenditures for developing advanced gadgets and growing privacy and security concerns.

Moreover, the market is expected to rise, as a result of the rapidly expanding adoption of AI, IoT, and 5G technologies across industrial verticals, such as government, BFSI, retail, hospitality, and consumer goods. Also, the surging adoption of hardware boosts the demand for edge AI software in the industry. Furthermore, potential areas of industry advancement include the surging requirement for edge computing in IoT and specialized processors for on-device image analytics; the rising need for IoT-based edge computing solutions; and the increasing uptake of 5G networks to integrate IT and telecom.

In addition, the increased adoption of Industry 4.0 across several industries is driving the demand for these solutions. This is also due to the possibility of doing AI inference without transferring data. Further, AI and edge computing are expected to establish new business models and boost productivity.

Moreover, the demand for AI-enabled devices and services is increasing, with the surging need for edge computing in self-driving cars, high-tech medical devices, and robotics, where real-time automatic decision-making machines are becoming more significant. The demand for edge AI devices has been driven by end-user industries, including government, consumer electronics, automotive, healthcare, manufacturing, and others. Their adoption can also assist businesses in lowering their operational costs in critical cases where latency and accuracy are highly required.

For edge computing, latency is essentially non-existent because this approach makes nearly zero separation between the locations where data is generated and processed (edge data centers). Artificial intelligence processes IoT-generated data to near-end devices using machine learning algorithms to overcome issues of low security and high latency. An IoT device collects a lot of data, which is sent to the cloud where ML models run and send the processed data back to the device, potentially delaying the response. Thus, network speed is increased and latency is decreased using edge computing. Every millisecond counts toward data accessibility, as a result, microseconds rather than milliseconds are used to assess latency.

On-device AI, however, minimizes data transfer, enabling a quicker response to the generated query. Additionally, storing a lot of data in the cloud might not be practical. Since the processing capacity for edge AI is located on the device, it is not necessary to transfer data to the cloud.

Smart cities combine a variety of systems to support the life cycle of people better in both qualitative and quantitative manner. These systems come in a variety of forms, including smart farming, smart energy, smart buildings, smart manufacturing, smart homes, and smart healthcare. As more people choose to live in cities, there will likely be greater demand for automated services in everyday life. Thus, the demand for smart homes is turning from luxury to major requirements.

Moreover, several consumer electronics used in smart homes, including smart speakers, wearables, gaming consoles, drones, and robots for home automation, utilize edge artificial intelligence. The applications of this technology are centered on computer vision, natural language processing, HMI, and customer experience.

Many countries have created initiatives to make their cities smart in order to take advantage of rapid urbanization. Smart cities enable increased operational effectiveness, environmental sustainability, and the development of new services for citizens. As a result of the rising need for smart homes and smart cities, the market for edge hardware for smart homes is experiencing a growth rate of around 21% in the forecast period.

Governments all around the world are making use of advanced technologies to address the essential problem of ensuring the security and protection of citizens. For instance, a general blockchain plan has been outlined by the U.A.E. government to increase security and transparency. Two examples of advanced AI gear used for this purpose by government entities are drones and surveillance cameras.

Due to improved edge computing capabilities and the prudent application of deep learning and machine learning, computing devices have gotten more inventive. Without transferring data to remote cloud servers, AI enables devices to give real-time insights and predictive analytics. Now, various businesses are making use of this by implementing intelligent manufacturing solutions. Thus, to proactively avoid unplanned and frequent downtime and support industrial IoT devices installed in modern factories, the demand for edge AI hardware products is increasing.

Due to the arrival of 5G in the region, the rising number of IoT-integrated devices, and the increasing smartphone penetration in China, Japan, India, and South Korea, the APAC region contributed the largest revenue share in 2024 to the global market. Another important factor in the rising demand for vision processing unit integration to speed up AI activities is wearable technology. The region has enormous potential for end-use industries, including manufacturing, telecommunications, and automotive, which create a higher need for such devices.

In the APAC edge AI hardware market, China accounted for the largest revenue share, of around 35%, in 2024, which is followed by Japan. This is due to the presence of numerous industry players in the country and the growing automotive, electronics, and semiconductor industries that are investing heavily in artificial intelligence technology. Moreover, the number of patents issued over the past year in this area has increased, which leads to the accelerated development in China's edge AI business, demonstrating rapid innovation in the industrial sector.

Several market players have been adopting several development measures to outgrow their competitors and gain a competitive edge, such as product launches, partnerships, mergers and acquisitions, funding, and others.

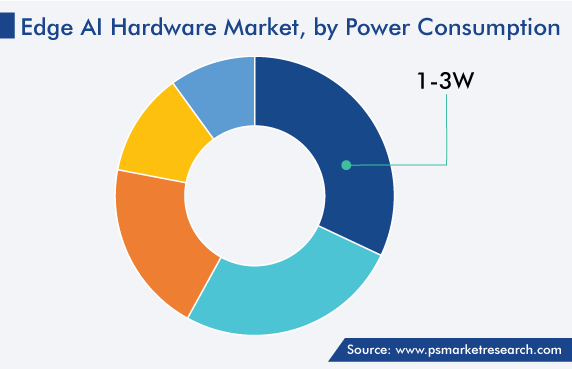

The 1–3 W category holds a significant share in the industry. The is because most edge AI devices consuming 1–3 W power. Moreover, smartphones are key devices that consume 1–3 W of electricity. As the need for smartphones is increasing, the demand for 1–3 W-based AI devices is likely to grow significantly in the coming years.

Based on Device

Based on Power Consumption

Based on Function

Based on Processor

Based on Vertical

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages