Report Code: 12184 | Available Format: PDF | Pages: 194

Drainage Consumables Market Research Report: By Type (Drainage Bags, Catheters, High/Low-Vacuum Consumables, Reservoirs), Application (Urinary, Wound, Pleural, Ventricular, Biliary) - Global Industry Revenue Forecast to 2024

- Report Code: 12184

- Available Format: PDF

- Pages: 194

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

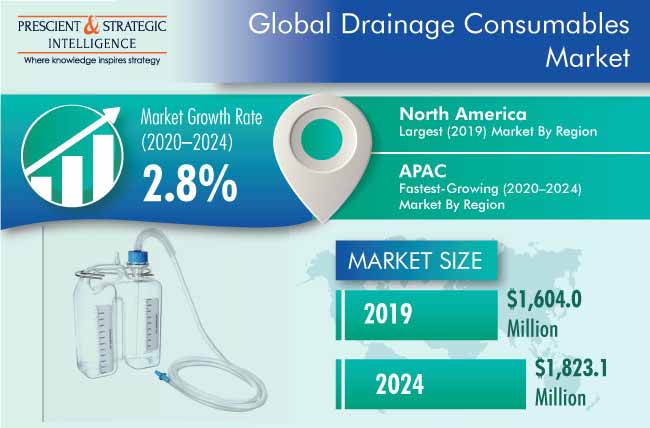

The global drainage consumables market generated revenue of $1,604.0 million in 2019, and it is projected to showcase a CAGR of 2.8% during the forecast period (2020–2024). The key factors responsible for the growth of the market include the increasing prevalence of chronic diseases, technological advancements, expanding healthcare infrastructure, rising number of surgeries, and increasing government initiatives for public healthcare.

Due to Increasing Demand for Sterile Bags, Drainage Bags To Dominate Market

The drainage bags category held the largest share in the drainage consumables market in 2019, based on product type. Furthermore, the category is expected to retain its position in the coming years due to the rising requirement for replacing the used drainage bags at a frequent rate, in order to prevent urinary tract infections (UTIs) among patients.

Owing to Rising Number of Road Accidents, Wound Category To Witness Fastest Growth

Wound is expected to be the fastest-growing category in the drainage consumables industry during the forecast period, based on application. This will be due to the rising number of road accidents and skin burn cases worldwide, which has resulted in a huge patient influx at healthcare centers with wounds.

Increasing Prevalence of CKDs Drove Market in North America

Geographically, North America was the largest contributor to the drainage consumables industry in 2019. This region is also expected to be in the dominating position in the coming years. This can be mainly attributed to the high-volume demand for drainage consumables arising from the U.S. healthcare sector.

Launch of New and Advanced Products Is Key Trend

Product launches are one of the key trends being observed in the drainage consumables market. The U.S. is home to large-scale manufacturers of drainage consumables, who are making hefty investments in the development of new products in order to expand their customer base and better their position in the market. For instance, in December 2019, Merit Medical Systems Inc. announced the launch of the ReSolve Mini locking drainage catheter for the percutaneous drainage of fluids from body cavities. With this launch, the company aimed to improve the standards of patient care and safety.

Increasing Prevalence of Chronic Diseases Is Boosting Market

Drainage consumables, such as drainage bags and catheters, are vital products required for patients undergoing treatment for chronic diseases, such as kidney diseases and diseases of the urinary system. With the rising prevalence of such chronic conditions, the usage of drainage consumables in the U.S. has increased. Similarly, according to the International Diabetes Federation (IDF), the Middle East and North Africa (MENA) region would have the highest age-adjusted prevalence of diabetes in adults in 2019, 2030, and 2045, of 12.2%, 13.3%, and 13.9%, respectively.

Market Players Are Focusing on Product Launches to Gain Competitive Edge

The drainage consumables market has various key players, such as Johnson & Johnson, Smith & Nephew PLC, Stryker Corporation, Zimmer Manufacturing Company, ConvaTec Group plc, McKesson Corporation, and B. Braun Melsungen AG.

In recent years, players in the drainage consumables industry have been actively involved in product launches to cut through the strong market competition.

- In October 2020, Cook Medical announced that the Hercules 100 Transnasal Esophageal Balloon is available to physicians in the U.S. With the Hercules 100, ear, nose, and throat (ENT) physicians have another tool to treat esophageal strictures. The product’s catheter is compatible with most endoscopes used by ENT specialists.

- In April 2020, Bactiguard AB launched the BIP Foley TempSensor, a urinary catheter, for patients in intensive care, surgery, and other settings where continuous temperature monitoring is important. BIP Foley TempSensor helps in the prevention of infections, and it is available in various sizes, both for adults and children. Moreover, with this launch, the company has created a complete product portfolio of infection-prevention urinary catheters.

| Report Attribute | Details |

Historical Years |

2015-2019 |

Forecast Years |

2020-2024 |

Base Year (2019) Market Size |

$1,604.0 Million |

Market Size Forecast in 2024 |

$1,823.1 Million |

Forecast Period CAGR |

2.8% |

Report Coverage |

Market Trends; Revenue Estimation and Forecast; Segmentation Analysis; Country Breakdown; Competitive Analysis; Companies’ Strategic Developments; Product Benchmarking; Company Profiling |

Market Size by Segments |

By Product Type; By Application; By Region |

Market Size of Geographies |

U.S. Canada; Germany; France; Italy; U.K.; Spain; Japan; China; India; Australia; Brazil; Mexico; South Africa; South Arabia |

Secondary Sources and References (Partial List) |

American Diabetes Association; Canadian Institute for Health Information; Commonwealth Fund; European Union; International Diabetes Federation; Medical Tourism; National Center for Biotechnology Information; National Health Service; National Kidney Foundation Inc. |

Explore more about this report - Request free sample

Key Players in Drainage Consumables Industry Include:

-

Johnson & Johnson

-

Smith & Nephew PLC

-

Stryker Corporation

-

Zimmer Manufacturing Company

-

ConvaTec Group plc

-

McKesson Corporation

-

B. Braun Melsungen AG

-

Becton, Dickinson and Company

-

Medline Industries Inc.

Market Size Breakdown by Segment

The global drainage consumables market report offers comprehensive market segmentation analysis along with market estimation for the period 2015–2024.

Based on Product Type

- Drainage Bags

- Catheters

- High/Low-Vacuum Consumables

- Reservoirs

Based on Application

- Urinary

- Wound

- Pleural

- Ventricular

- Biliary

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Italy

- U.K.

- Spain

- Asia-Pacific (APAC)

- Japan

- China

- India

- Australia

In 2024, the market for drainage consumables will generate $1,823.1 million.

In the drainage consumables industry, the highest demand is generated for drainage bags.

North America is the largest market for drainage consumables because of the high demand for such products in the U.S., government initiatives for public healthcare, and increasing incidence of CKDs.

Under the application segment of the drainage consumables industry, the wound category will grow the fastest.

Most players in the market for drainage consumables are launching improved products.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws