Market Statistics

| Study Period | 2019 - 2030 |

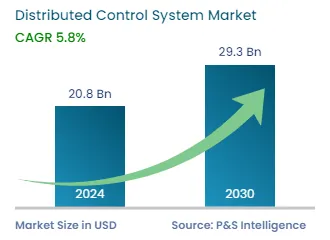

| 2024 Market Size | USD 20.8 Billion |

| 2030 Forecast | USD 29.3 Billion |

| Growth Rate(CAGR) | 5.8% |

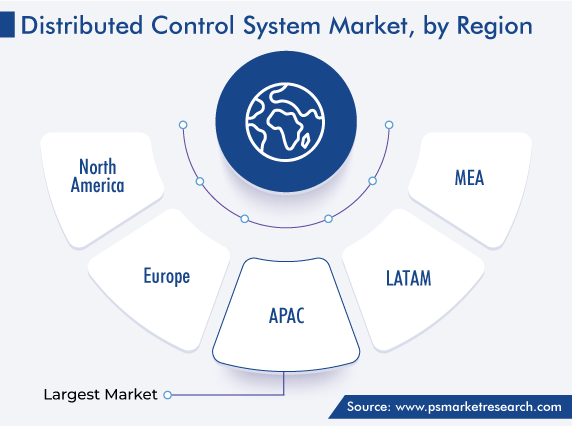

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Report Code: 12573

Get a Comprehensive Overview of the Distributed Control System Market Report Prepared by P&S Intelligence, Segmented by Component (Hardware, Software, Services), Application ( Continuous Process, Batch-oriented Process), End-Use (Oil & Gas, Power Generation, Chemicals, Food & Beverages, Pharmaceutical, Metals & Mining, Paper & Pulp), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 20.8 Billion |

| 2030 Forecast | USD 29.3 Billion |

| Growth Rate(CAGR) | 5.8% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The distributed control system market size stood at USD 20.8 billion in 2024, and it is expected to advance at a compound annual growth rate of 5.8% between 2024 and 2030, to reach USD 29.3 billion by 2030.

The growth is attributed to the rapid economic development and increase in the adoption of the internet of things, clean energy, energy-efficient technologies, and smart applications.

A DCS is a computerized control system for a process or plant, which often has a lot of control loops. It distributes autonomous controllers across the system, but there is central operator supervisory control. DCSs are used for managing and controlling the industrial outcome. These solutions are widely adopted across process industries, in line with the general trend of using automation to increase the overall efficiency and functioning.

In addition, the advancement of the technologies has not only birthed control systems but also made them better. DCS is suitable for every large and complex business process, as it helps meet the demand for efficiency and reliability. In India, while the manufacturing industry is continuously growing, concerns with maximizing productivity and product quality persist. Thus, in February 2023, ABB Ltd. unveiled its Symphony Plus DCS to enable digital transformation for the water and power generation sectors. With HTML5 web-based mobile operations, the DCS improves plant collaboration, uptime, and efficiency.

IIoT has helped in making decisions utilizing more-exact real-time data and birthed a new generation of automation systems. These systems play a significant role in industrial automation, which eliminates the gap in the connectivity between operations and IT technologies.

For instance, Emerson offers a wireless IIoT base that enables an instant access to distributed control systems and maintenance data, due to which the operational cost is reduced.

Moreover, IoT helps make the existing power grid systems more flexible, reliable, secure, and durable. Moreover, 5G cellular networks are predicted to help in the smooth functioning of IoT-equipped power generation systems. A distributed control system uses LANs to connect with sensors, actuators, controllers, and other process control technologies.

The batch-oriented process category generated market revenue of USD 11,455 million in 2022, and it is predicted to remain dominant till 2030. This process is generally used where the products are made in sets, or when the volume of production is low but the demand for excellent quality is a key concern. Process industries, where every step of the production process is carefully monitored and controlled, include steelmaking & mining, pharmaceuticals, cement, glass & paper, food & beverages, and sugar industry.

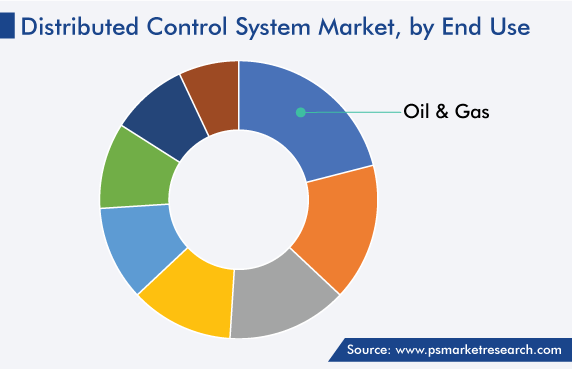

The oil & gas category accounted for the largest revenue share, of approximately 21%, in 2022, and it is expected to maintain the trend over the forecast period. All the main divisions of E&P operations—downstream, midstream, and upstream—are significant revenue generators for the distributed control systems market. In the upstream sector, crude oil and natural gas are extracted and produced. In the midstream sector, these hydrocarbons are stored and transported. In the downstream sector, businesses are engaged in the refining of crude oil, the production of petroleum products, and their sale through wholesale and retail channels.

In addition, oil & gas is a process industry with complex monitoring processes. A DCS enables the control of operations with the help of HMIs and controllers, by integrating safety processes, such as alarm management systems. The processes in the oil & gas industry are crucial, lengthy, and complicated, due to which distributed control systems are widely adopted to provide safety, reliability, and profitability.

China National Petroleum Corporation, China Petroleum & Chemical Corporation, and China National Offshore Oil Corporation are some of the major players in the Chinese energy sector. Similarly, in India, the oil & gas industry is a main part of the economy. The country has 23 refineries, and it was the third-largest consumer of oil in the world in 2021.

The chemicals category is expected to grow at a significant rate, because chemical companies are adopting advanced distributed control systems to improve their production efficiency, safety, reliability, and cost-effectiveness and reduce human errors. A DCS has multiple controllers inside a plant or production unit that are linked to a central console, which helps centralize plant operations and allow for the control and monitoring of every element's process in one place. It also helps manage complex production processes.

Drive strategic growth with comprehensive market analysis

The Asia-Pacific region held the largest market share, of 34%, in 2022, and it is predicted to be dominant throughout this decade. The growth of the market is ascribed to the increasing power generation in the region, augmenting industrial infrastructure, and booming usage of nuclear and other forms of renewable energy. Hence, the market is expected to grow in China, India, and other regional countries because of the ongoing power generation projects and technological inventions. The DCS market in this region is also growing rapidly because of the rapid automation, urbanization, and financial growth.

In China, the market is growing due to the government support for clean energy projects and focus on reducing carbon emissions, which drive its renewable energy industry. Essentially, the rapid economic expansion would increase the power demand, which will, in turn, create the requirement for greater funds for the expansion of the power plant infrastructure. Moreover, industrial automation is one of the biggest trends in the Asia-Pacific region due to the increasing demand for high-quality products and increasing manufacturing costs. In this regard, DCS will help decrease the labor wages and the overall requirement for manpower.

The North American region is expected to grow at a significant rate and hold a considerable share during the forecast period. The rapidly growing natural gas industry is a key driving factor for the distributed control systems market in the region. The oil & gas sector in the region is process-driven, with continuing operations and detailed monitoring techniques. It is difficult for operators to monitor and control the use of the equipment in the industry all by themselves. Hence, several North American E&P companies are adopting HMIs and a controller, or DCS, to manage operations and make them cost-efficient.

DCSs also play a vital role in controlling the operations of nuclear power plants, which is why the rising nuclear power capacity is a key driver for the demand for these solutions. In addition, in this region, solution integration in the chemical industry is gaining momentum with the enhanced reliability, remote monitoring, and lower installation costs it provides. Various enterprises in the chemical industry are moving from outdated DCS systems to more-advanced ones to improve production, efficiency, and safety and reduce human mistakes.

Based on Component

Based on Application

Based on End-Use

Geographical Analysis

The market for distributed control systems generated USD 20.8 billion in 2024.

The distributed control system industry is driven by the rapid digitization of industries, enabled by the adoption of IoT and 5G.

The market for distributed control systems is segmented on the basis of type, application, end user, and region.

Oil & gas companies account for the largest distributed control system industry share.

APAC dominates the market for distributed control systems.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages