Report Code: 10342 | Available Format: PDF

Disposable Gloves Market: Size, Share, Key Trends, Growth Drivers, Regional Outlook, Revenue Estimation and Forecast, 2023-2030

- Report Code: 10342

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

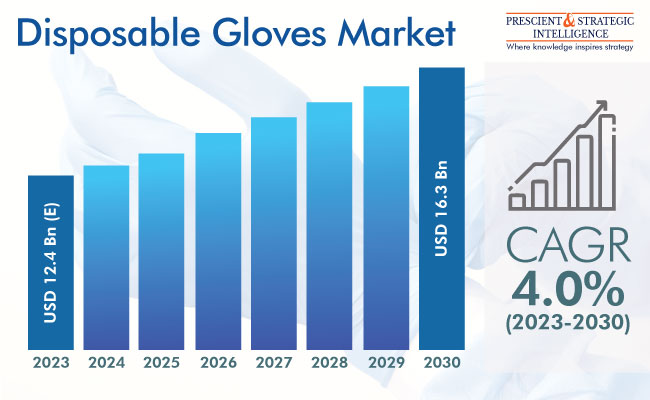

The global disposable gloves market is expected to reach USD 16.3 billion by 2030 from USD 12.4 billion (E) in 2023, witnessing 4% CAGR during 2023–2030.

The growth of the industry is attributed to the surging need for disposable gloves in the healthcare sector, with the increasing consciousness regarding HAI. The healthcare industry in key emerging economies is expected to observe substantial growth due to the rising funding from both the private and public sectors, as well as the mounting geriatric population and growing migrant influx. Moreover, the increasing expenses on healthcare will boost the requirement for disposable gloves.

Surging Implementation of Stringent Industrial Safety and Hygiene Regulations

A large number of work-related fatalities and injuries take place across industries each year. Improper safety measures can lead to accidents for workers as their hands are often exposed to dangerous chemicals and materials. In this regard, the chemicals & petrochemicals and oil & gas industries are significant contributors to the market growth.

Apart from workplace injuries, gloves prevent the contamination of the products being manufactured by microbes, dirt, and other foreign substances that might accumulate on workers’ hands. This makes the pharmaceutical and healthcare industries major users of gloves.

Superior Properties of Nitrile Gloves Are Key Driver

Nitrile is a synthetic rubber that is highly durable, which is why it is widely used to make gloves. Recently, nitrile has become more affordable and gained significant popularity in the food, medical, and cleaning industries. A key advantage offered by nitrile gloves is their higher puncture resistance compared to those made of any other material.

Furthermore, these pieces of attire fit easily, making it extremely comfortable for the user while working, and they are also utilized to prevent the allergies caused by natural rubber. The carpentry, automotive, and roofing industries are increasingly using nitrile gloves, which are layered with a robust coating for water and chemical resistance.

Growing Preference for Single-Use Products

Single-use products have become a major trend around the world, especially since the onset of the pandemic. COVID-19 has significantly elevated people’s awareness of how infections spread, which has highlighted the importance of disposable gloves in a range of applications, from medical to household. Further, HAIs remain a major concern, with 1 in 31 hospitalized patients in the U.S. contracting an HAI every day.

Natural Rubber Category Is Leading Material Segment

Based on material, the natural rubber category leads the industry in 2023. This is because natural rubber disposable gloves provide superior protection and performance in numerous applications, including food processing & service, healthcare & pharmaceutical, automotive, and janitorial & sanitation.

The nitrile category is expected to observe the highest growth rate during the forecast period. This will be owing to the surging requirement for these products in the painting, healthcare, chemical, and laboratory sectors. The higher chemical and puncture resistance of nitrile gloves than those made of natural rubber and vinyl will boost the progress of this category.

The vinyl category will also grow at a considerable rate, owing to the high tactile sensitivity and comfort of these variants than neoprene gloves. These wearables are ideal where a regular change is needed, for instance, food preparation. Vinyl disposable gloves are also used in printing shops and the food processing, healthcare, and manufacturing industries.

Powder-Free Category Is Major Contributor

Based on product, the powder-free category is the larger in 2023. This can be attributed to the strict guidelines on the utilization of powdered gloves by various governments across the globe. For instance, the U.S. Food and Drug Administration has banned the production, distribution, and sale of all powdered surgical gloves, the absorbable powders applied to them, and powdered patient investigation gloves.

Moreover, the surging fondness for powder-free gloves in the food processing and chemical industries is expected to boost the progress of this category. This is because of the increasing concerns for the allergies that result from cornstarch powder, which is applied to conventional gloves.

Medical & Healthcare Is Largest End User

Based on end user, the medical & healthcare category dominates the industry in 2023. This can be credited to the high effectiveness of such medical disposables in protecting both healthcare providers and patients from infections during medical procedures and examinations. A key concern in the medical sector, especially since the onset of the COVID-19 pandemic, is healthcare-acquired infections, which can have serious financial and health consequences.

Moreover, the mounting incidence of chronic illnesses, as well as the surging elderly population, drives the requirement for advanced healthcare services. As a result, various developing and developed countries have augmented the number of medical facilities, which, in turn, is likely to boost the advance of the industry.

The chemical & petrochemical category is also expected to witness a considerable CAGR till 2030. This is because of the surging acceptance of disposable gloves for handling corrosive chemicals, including strong acids and alkalis, in production plants and laboratories. The increasing concerns regarding employee safety and the initiatives to lessen the injury rates in this industry will boost the need for protective gloves.

| Report Attribute | Details |

Market Size in 2023 |

USD 12.4 Billion (E) |

Revenue Forecast in 2030 |

USD 16.3 Billion |

Growth Rate |

4.0% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

North America Is Dominating Industry

North America is the leader of the industry in 2023, as the outbreak of COVID-19 has led to the surging requirement for disposable gloves in the continent. The rising healthcare expenses, the increasing consciousness regarding HAIs, and the surging aging population are also expected to positively impact the regional industry.

The advancement of the public healthcare infrastructure with the surging investments by government and corporate entities is likely to boost the requirement for healthcare. In turn, the demand for durable and disposable gloves will surge because of the growing medical sector in the region. Further, the OSHA’s guidelines for workplace safety are rather strict in the U.S., which drives the demand for all kinds of industrial-grade personal protective equipment, including gloves, overalls, masks, and visors.

APAC will be the fastest-growing region during this decade, owing to the surging requirement for disposable gloves in food & beverage, industrial, and healthcare applications. Moreover, the widespread usage of these wearables in surgical applications in Indonesia, South Korea, India, and China is likely to boost the progress of the regional industry. Further, the region is an emerging hub for the semiconductor & electronics sector, where contamination control is paramount on account of the sensitive nature of semiconducting material.

Major Players in Disposable Gloves Market Are:

- Ansell Ltd.

- Adventa Berhad

- Cardinal Health Inc.

- Blue Sail Medical Co. Ltd.

- Ammex Corporation

- Hartalega Industries Sdn. Bhd.

- Dynarex Corporation

- Kimberly-Clark Corporation

- JIANGSU JAYSUN GLOVE CO. LTD.

- Kossan Rubber Industries Bhd.

- Kimberley-Clark Corporation

- Medisafe Technologies

- Semperit Technische Produkte Gesellschaft m.b.H.

- Medline Industries LP

- Paul Hartmann AG

- Top Glove Corporation Bhd.

- Supermax Corporation Berhad

- 3M

- B. Braun Melsungen AG

- Medline Industries Inc.

- Mölnlycke Health Care AB

- Semperit AG Holding

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws