Report Code: 10030 | Available Format: PDF | Pages: 248

Diaper Market Research Report: By Age (Baby Diaper, Adult Diaper), Distribution Channel (Pharmacies, Convenience Stores, Online, Supermarkets/Hypermarkets), Absorption Level (High, Low) - Global Industry Analysis and Demand Forecast to 2030

- Report Code: 10030

- Available Format: PDF

- Pages: 248

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Diaper Market Overview

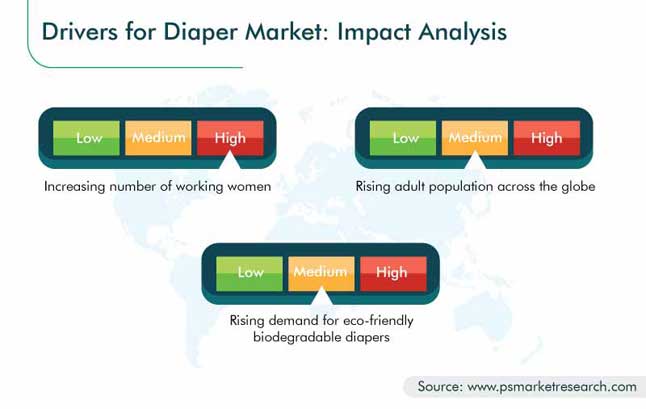

The global diaper market size was $50.5 billion in 2019, and it is projected to register a CAGR of 5.7% over the forecast period (2020–2030). The increasing number of working women and rising adult population across the globe are some of the major growth factors propelling the overall diaper industry. In addition, rapid progress is expected from Asia-Pacific (APAC) and the Middle East and Africa (MEA) during the forecast period, owing to the surging number of working women, increasing population, and rising urbanization rate.

The COVID-19 pandemic that started in late 2019 has severely impacted the market across the globe. The stringent lockdown measures implemented by governments have plummeted the global diaper market and put a major strain on the production of diapers. Most of the countries were already witnessing slow economic growth, and this pandemic has weakened their manufacturing capabilities further, on account of a complete or partial lockdown.

.jpg)

Segmentation Analysis

Adult Diapers Are Faster-Growing Category in Industry During Forecast Period due to Increasing Elderly Population

In the diaper market outlook, the adult diapers category registered the faster growth till 2019, based on age, and it is expected to retain its pace over the forecast period. The growing number of adult incontinence cases around the world has led to a widespread adoption of adult diapers. The increasing awareness about adult diapers has made them an important part of personal hygiene. In addition, the reducing hesitation among adults and the easy availability and affordability of such products are also playing an important role. With the geriatric population expected to rise in the future, the demand for adult diapers would also shoot up significantly over the forecast period.

Supermarkets/Hypermarkets To Be Fastest-Growing Distribution Channel Category due to Their One-Stop Shopping Experience

The distribution of diapers via supermarkets/hypermarkets channel is expected to grow at the highest pace over the forecast period. This can be attributed to the rise in the popularity of supermarkets among buyers around the world. These places offer consumers a wide variety of diapers under one roof, apart from discounted prices, thereby giving consumers a greater buying power. These advantages offered by supermarkets/hypermarkets are boosting the overall diaper market. The growth in supermarkets is complemented by a rise in the urbanization rate and increasing disposable income of the population, especially in countries such as China, India, and South Korea.

High-Level-Absorbent Diapers Are Larger Category due to their Growing Preference

High-level absorbent diapers have gained huge traction recently, which is why this category held the major market share in 2019 and is expected to maintain its dominance over the forecast period. The growth is owed to their high absorbing capacity and fine quality, thereby making them highly preferred for a majority of the population, including babies and adults with the incontinence problem. These diapers provide better leakage prevention compared to others, hence witness wide adoption.

The high-level-absorbent category is also expected to register the faster growth in the coming years.

Geographical Outlook

Asia-Pacific (APAC) – Largest Regional Market due to Growing Awareness about Personal Hygiene

The APAC region held the largest diaper market share during the historical period (2014–2019). The dominance of the region on the worldwide diaper industry can be owed to the growing population, because of high birth and fertility rates and increasing life expectancy, and the surging number of adult patients with incontinence. The growing awareness on baby hygiene and reducing hesitations to adopt adult diapers are some other factors leading to a rise in the diaper demand in the region. Moreover, awareness campaigns and advertisements to overcome the taboo of adult incontinence have led people to give up traditional practices and use diapers instead.

Asia-Pacific (APAC) – Fastest Growing Regional Market owing to High Birth Rate

APAC is also expected to be the fastest-growing region throughout the forecast period. Among the major factors driving the market growth in the region is the rise in the number of working women, which has led to a wider use of baby diapers. This factor is supported by a surge in the activities to promote both baby and adult diapers and product innovations and lifestyle changes in countries such as China, India, Japan, and South Korea, which are together contributing to the growth of the diaper market in the APAC region.

Trends & Drivers

Development of Absorbent-Core Technology is Key Market Trend

A noticeable trend being observed in the diaper market is the development of the absorbent-core technology. Since the introduction of this technology in recent years, the market for absorbent materials has expanded dramatically, thus leading to a stronger influence on the overall market. The super-absorbent polymer is created from the polymerization of acrylic acid combined with sodium hydroxide, in the presence of an initiator, to form a sodium salt of poly-acrylic acid.

Rising Geriatric Population and Rising Awareness on Hygiene Are Driving Market

The rise in the number of older persons around the world is poised to result in significant transformations in the diaper market. The aging population is leading to the increasing prevalence of the incontinence disease among people. For instance, it currently affects more than 13 million people in the U.S. It is more common in aging women, occurring at a ratio of 2 to 1, compared to men, due to various reasons. The developing economies in APAC, including India, China, South Korea, and Thailand, also have a large aging population.

The availability and awareness on the benefits of adult incontinence products are rising, which, in turn, are helping raise the acceptance of adult diapers among elderly people. Hence, the growing acceptance of such products, along with the rising purchasing power parity, is driving the overall diaper market.

Rising Demand for Eco-Friendly Biodegradable Diapers around the World

The rising demand for eco-friendly biodegradable diapers is another major driver for the diaper market around the globe. With babies using between 2,500 and 3,000 disposable diapers in the first year of their life, a huge strain is being created on the environment.

For instance, disposable diapers account for a mere 2% of the U.S.’s landfill waste, meaning that most are left unattended. Since conventional single-use diapers are non-biodegradable in nature, eco-friendly biodegradable diapers have gained huge traction in recent times and are now making a significant contribution to the diaper market. These diapers are not manufactured from petrochemicals, other eco-unfriendly materials, or skin irritants, therefore are safe for the sensitive skin of babies.

Market Players Are Launching Innovative Products to Stay Competitive

The market is fragmented and competitive in nature, with the presence of numerous market players, such as The Procter & Gamble Company, Kimberly-Clark Corporation, Unicharm Corporation, Essity Aktiebalog, and Kao Corporation.

In recent years, players in the diaper industry have launched several new and advanced products, to stay ahead of their competitors. For instance:

- In July 2019, The Procter & Gamble Company announced the launch of smart diapers that can alert parents via a smartphone app, if a diaper needs changing. The app also helps parents in keeping an eye on the baby, via a video camera installed in the nursery. It also hosts an all-in-one connected care system, featuring two activity sensors and a video monitor.

- In March 2019, The Procter & Gamble Company launched the Pampers Cruisers 360 Fit diaper that features a stretch waistband, designed for toddlers and active babies. It can be put on by pulling on the diaper like a pant and removed in simple steps. It is available in sizes 3 to 6, across all major retailers.

- In March 2019, Domtar Corporation launched its new absorbent product line in the Attends family, which includes briefs, underpads, and underwear, for the North American healthcare market, through both online and in-store channels.

Some of the Players in the Diaper Market Are:

-

Bumkins Finer Baby Products Inc.

-

Domtar Corporation

-

Essity Aktiebolag (pubI)

-

Hengan International Group Limited

-

Johnson & Johnson

-

Svenska Cellulosa Aktiebolaget SCA (pubI)

-

Kao Corporation

-

Nobel Hygiene Private Limited

-

Oji Holdings Corporation

-

The Proctor & Gamble Company

-

Kimberly-Clark Corporation

-

Unicharm Corporation

-

Ontex BVBA

-

Vivia International Private Limited

-

Turkosan Hijyen Ltd.

-

Bumpadum Manufacturing and Traders Private Limited

-

Nile Converting Co.

-

Avgol Ltd.

-

TRADIS INC.

-

Hunan Kings diaper Co. Ltd.

Diaper Market Size Breakdown by Segment

The diaper market offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Age

- Baby Diaper

- By product

- Disposable

- Ultra-absorbent

- Regular

- Super absorbent

- Cloth

- All-in-one diaper

- Flat diaper

- Pocket diaper

- Prefold diaper

- Fitted diaper

- Biodegradable

- Cloth training pants

- Cloth swim diapers

- Disposable

- By baby weight

- 0–6 kg

- 6–7.5 kg

- 7.5–9 kg

- 9–10.5 kg

- 10.5–12 kg

- Over 12 kg

- By absorption level

- High

- Low

- By product

- Adult Diaper

- By product

- Disposable

- Tab style

- Briefs

- Pads & Liners

- Cloth

- Swim diapers

- Biodegradable

- Disposable

- By size

- Small

- Medium

- Large

- By gender

- Men

- Women

- By absorption level

- High

- Low

- By product

Based on Distribution Channel

- Pharmacies

- Convenience Stores

- Online

- Supermarkets/Hypermarkets

Based on Distribution Channel

- High

- Low

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- Russia

- U.K.

- France

- Italy

- Asia-Pacific (APAC)

- China

- India

- Japan

- Indonesia

- Latin America (LATAM)

- Brazil

- Mexico

- Argentina

- Middle East & Africa (MEA)

- Saudi Arabia

- Nigeria

- South Africa

During 2020–2030, the CAGR of the diaper market will be 5.7%.

The diaper industry players are increasingly targeting adults in their marketing campaigns, as this age group is witnessing the rising prevalence of urinary incontinence.

The diaper market will likely prosper the most in APAC.

The key drivers for the diaper industry are the increasing geriatric population, rising awareness on personal hygiene, and surging popularity of biodegradable and eco-friendly adult diapers.

The Procter & Gamble Company held the largest share in the diaper industry in 2019.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws