Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 4,311.9 Million |

| 2030 Forecast | USD 7,447 Million |

| Growth Rate(CAGR) | 9.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12564

Get a Comprehensive Overview of the Dedicated Outdoor Air System Market Report Prepared by P&S Intelligence, Segmented by Capacity (Less Than 20 Tons, 20-40 Tons, 40-60 Tons, Greater Than 60 Tons), Implementation (New Construction, Retrofit), Application (Commercial, Residential, Industrial), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 4,311.9 Million |

| 2030 Forecast | USD 7,447 Million |

| Growth Rate(CAGR) | 9.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global dedicated outdoor air system market size stood at USD 4,311.9 million in 2024, which is expected to reach USD 7,447 million by 2030, advancing at a CAGR of 9.5% between 2024 and 2030. This is attributed to the increasing acceptance of these systems in residential and commercial applications, the surging government regulations for HVAC equipment, and the rising attention to ideal indoor air and environmental quality.

A dedicated outdoor air system (DOAS) is a subset of the HVAC system. While ventilation is not a primary function of HVAC devices, the main objective of DOAS is to provide sufficient outdoor airflow. It also separates the external air from the air that regulates the building's interior temperature. Both humidity management and space temperature control are enhanced by using a single system to supply and dehumidify all ventilated air. The equipment successfully splits the latent and sensible loads by conditioning the outside air and recirculating air separately.

Moreover, the primary HVAC unit eliminates the sensible load to provide a contented temperature, while DOAS removes the latent load to manage humidity. Additionally, it can support the main HVAC systems by monitoring smaller internally produced amounts of latent load that are naturally made by inhabitants and other sources.

Based on capacity, the market is categorized into less than 20 tons, 20–40 tons, 40–60 tons, and greater than 60 tons. During the projection period, the 40–60 tons category is set to witness the highest growth rate, of 9.1%, during 2022–2030. With extra features and a multi-zone capacity, a dedicated outside air system with a 40–60-ton capacity offers exceptional efficiency and 100% outside air proficiency while decreasing outdoor circulation by conditioning just the quantity of air required for each zone.

Moreover, units with a 40-ton capacity also offer chilled or hot water for hydronic heating or cooling applications, radiant floor heating, and fan coil handlers that pre-treat outside air. Also, DOAS with this capacity is frequently utilized in commercial and industrial structures. For instance, the need for high-capacity DOAS is increasing, as a result of the expansion of technological centers in Asian nations.

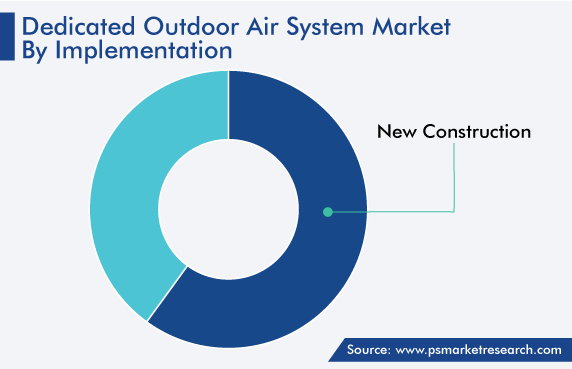

Based on implementation, the market is categorized into new construction and retrofit. Of these, the new construction category held a larger revenue share, of more than 60%, in 2022. This is attributed to the increasing investment by major developing economies in the commercial sector to develop infrastructure.

Moreover, the need for these devices is boosted by the rapidly expanding construction industry and the increasing number of energy-efficient structures created to preserve water, cut back on pollution, and safeguard human health. Additionally, the HAVC industry is expanding as a result of increased urbanization, economic expansion, and disposable income in developing nations of Asia-Pacific and the Middle East and Africa.

Whereas, the retrofit category is expected to witness faster growth during the projection period. To achieve the desired efficiency in energy consumption, cost savings, and comfort, retrofits are a good solution. The internet of things (IoT) and integrated smart technologies have improved the efficiency of DOASs relative to earlier systems. There are certain benefits to retrofitting older buildings, such as cost savings from using less energy and water, as well as increased comfort levels from better circulation and temperature control. Retrofitting also enhances the building's sustainability and lowers GHG emissions.

Based on application, the market is classified into commercial, residential, and industrial. Among these, the commercial category dominates the market. This is because air handling systems are used to heat and cool indoor air in commercial settings. Using affordable and energy-efficient technology, these devices offer improved air quality in commercial buildings. Also, these appliances are becoming more popular in commercial building applications since they are designed to withstand extreme weather conditions.

Whereas, the residential category is expected to witness the highest growth rate of around 9%, during the projected period. This can be attributed to the rise in the disposable income of consumers worldwide. People's ability to buy cutting-edge goods and services is increasing as disposable income rises, which makes it possible for these air-cleaning devices to enter the domestic market.

Drive strategic growth with comprehensive market analysis

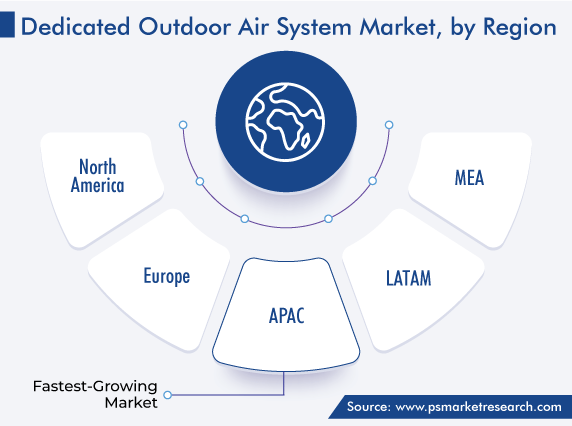

North America accounted for a significant market share in 2022. This is due to the existence of numerous well-developed businesses, medical facilities, and commercial spaces, where the need for DOASs is high; the presence of major industry players; and the high demand from residential buildings to enhance indoor air quality, in the region. Moreover, government regulations in this area have helped the sector expand. For instance, the Weatherization Assistance Program (WAP) and the ENERGY STAR Verified HVAC Installation Program are government initiatives promoting the expansion of the DOASs.

On the other hand, the APAC market will witness the highest CAGR, of 9.5%, from 2022 to 2030. This can be ascribed to friendly government policies, the rising population, the increasing building activities, and shifting climatic conditions. Moreover, the industry is fueled by a number of governmental laws and regulations, and organizations advocate the usage of DOASs in the region. Also, the requirement for such systems is high in the residential and commercial sectors, with considerable demand coming from countries like China and Japan.

In China, the manufacturing and construction industries are growing at a significant rate over the past few years, owing to the increased government expenditure on the development of infrastructure projects. The country accounts for 20% of all construction investment worldwide and is supposed to spend almost USD 13 trillion on developing infrastructure and construction activities by 2030. Due to these large expenditures and a rise in real estate construction, the market for DOAS is growing in the country.

Based on Capacity

Based on Implementation

Based on Application

Geographical Analysis

The dedicated outdoor air system market size stood at USD 4,311.9 million in 2024.

During 2024–2030, the growth rate of the dedicated outdoor air system market will be around 9.5%.

Commercial is the largest application area in the dedicated outdoor air system market.

The major drivers of the dedicated outdoor air system market include the increasing implementation of strict government regulations for HAVC equipment to limit airborne pollutants, the rising awareness of the importance of indoor air quality, and the growing adoption of these devices for residential and commercial applications.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages