Report Code: 10497 | Available Format: PDF

Data Center Cooling Market Report: Size, Share, Strategic Developments, and Growth Potential Estimation, 2023-2030

- Report Code: 10497

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

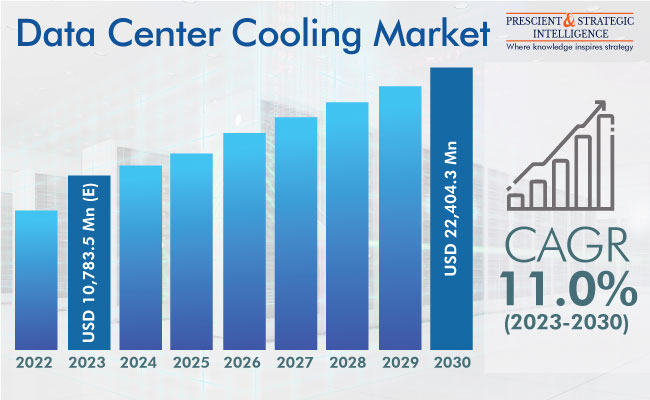

The data center cooling market is forecasted to reach USD 22,404.3 million by 2030 from an estimated revenue of 10,783.5 million in 2023, at 11% CAGR during 2023–2030.

This is primarily ascribed to the surging volumes of structured and unstructured data and the ever-increasing global demand for cloud computing services. As enterprises face an ever-growing need for more-advanced data processing capabilities and expanded storage, they are rapidly scaling up their data center infrastructure.

Efficient cooling plays an important role in ensuring the smooth functioning of data centers. It involves the deployment of specialized equipment and cutting-edge technologies to prevent system overheating and optimize performance. Maintaining a cool environment within such places is essential as the extreme heat generated by the processors can lead to data loss, operational disruptions, and system impairment. As a result, cooling systems are strategically installed in data centers to regulate temperatures and prevent potential damage.

Increasing Data Storage Requirement Is Key Market Driver

There is a significant surge in the data center deployment rate due to the escalating demand for additional storage capacity, to accommodate the vast volumes of data being generated. As per the latest edition of the Ericsson Mobility Report, monthly mobile data traffic stood at 93 Exabytes in 2022, and it is expected to reach 329 Exabytes per month by 2028.

The rise in the count of data centers all over the world has inevitably contributed to a surge in the density of processors and computing hardware packed in often tight spaces in data centers, which leads to excessive heat production and electricity consumption. As a result, there is a growing demand for energy-efficient cooling solutions around the world for data centers.

Advanced Cooling Solutions Witnessing Rising Demand

The adoption of advanced technologies, such as the internet of things (IoT) and Industry 4.0, are significantly shaping data center spending. Their advent has prompted numerous businesses to embark on digital transformation, thus further increasing the need for enhanced data centers that offer rapid deployment, scalability, security, availability, and flexibility. This trend encourages the construction of tier IV and hyperscale data centers, which have a huge storage capacity and must operate continuously, with almost no downtime.

This shift in business trends has opened doors for the development of innovative solutions that are highly agile, software-defined, and cost-effective. Consequently, software-based data centers are playing a pivotal role in contributing to market growth, by offering enhanced automation capabilities.

Furthermore, the adoption of advanced cooling solutions is expected to play an important role in optimizing power consumption, thus leading to enhanced energy efficiency and reduced operational costs.

Additionally, the increasing data processing capabilities and capacity requirements have resulted in massive heat generation within data centers. By adopting heat recovery systems, the heat expelled from these facilities can be used for space heating.

Air Conditioning Solutions Lead Market

The air conditioning category dominates the data center cooling market, based on solution, and it is projected to exhibit significant growth in the years to come. Tightly packed data racks generate significant amounts of heat, making air conditioners indispensable for maintaining the required temperature levels and ensuring proper system functionality. Air conditioners act as effective heat exchangers, maintaining optimal room temperatures in sensitive environments.

The liquid cooling category is expected to record rapid growth over this decade, as this technology can remove heat rapidly and cost-effectively. Also known as immersion cooling, the process involves submerging entire servers and computer systems in a liquid that conducts heat, but not electricity. The hot liquid is then sent through a heat exchanger, before being returned to the apparatus containing the server and other hardware components.

IT and Telecom Sector Is Major Revenue Contributor

The IT and telecom category is the largest contributor to the data center cooling market, as it encompasses a diverse range of hosting services, including cloud services and web hosting. Web 2.0 giants, such as Facebook, Google, and Twitter, are the key players in this category with a substantial demand for data center cooling solutions.

The telecom industry, in particular, incurs significant energy consumption and initial operating costs in powering and cooling the supporting infrastructure. For instance, mobile switching centers (MSC) are equipped with a plethora of heavy electronic equipment, such as cables, batteries, and servers, necessitating the maintenance of specified temperatures to ensure optimal equipment performance.

The healthcare category is expected to experience a high compound annual growth rate due to the increasing adoption of EHRs, wearable health trackers, and remote patient monitoring systems. This results in a heightening demand for data centers to store the massive volumes of critical healthcare data, in turn, propelling the market.

| Report Attribute | Details |

Market Size in 2023 |

USD 10,783.5 Million (E) |

Revenue Forecast in 2030 |

USD 22,404.3 Million |

Growth Rate |

11.0% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

North America Is Market Leader

Globally, North America leads the data center cooling market, and it is projected to continue advancing at a significant rate in the years to come. The growth in this region is largely attributed to the substantial presence of colocation service providers in the U.S. and Canada.

Moreover, the rising demand for software and services provided via the cloud and the increasing data center leasing activities, especially in northern Virginia, are expected to boost the market expansion. Additionally, the gradual shift in the workload toward hosting companies offering cloud and colocation services will significantly influence the data center cooling market in Canada.

The U.S. boasts the highest number of data centers in the world, thus establishing itself as a major user of the associated cooling systems. Further, companies in the U.S. allocate significant resources and capital to data centers.

Meanwhile, APAC is set to experience the highest compound annual growth rate in the years to come. This growth is primarily fueled by the escalating demand for data centers in Southeast Asian countries, especially Singapore and Vietnam. Moreover, the expansion of major IT companies in the region plays an important role in driving data center construction, benefitting from stable infrastructure and rising demand for cloud computing technologies.

The European data center cooling market is also projected to account for a significant share. After North America, Europe is the major consumer of data and user of advanced technologies. Moreover, the U.K., Germany, France, the Netherlands, Russia, Italy, and Poland have a large number of data centers, with many more being set up every year.

Key Companies in Data Center Cooling Market

- Coolcentric

- Emerson Electric Co.

- Rittal GmbH & Co. KG

- Hitachi Ltd.

- STULZ GmbH

- Schneider Electric SE

- Vertiv Holdings Co.

- ABB Ltd.

- Asetek Inc.

- Mitsubishi Electric Corporation

- Johnson Controls International plc

- Daikin Industries Ltd.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws