Market Statistics

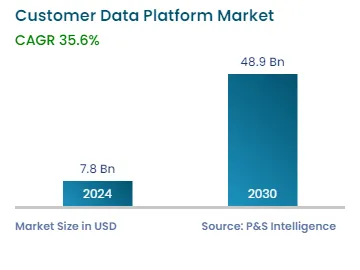

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 7.8 Billion |

| 2030 Forecast | USD 48.9 Billion |

| Growth Rate(CAGR) | 35.6% |

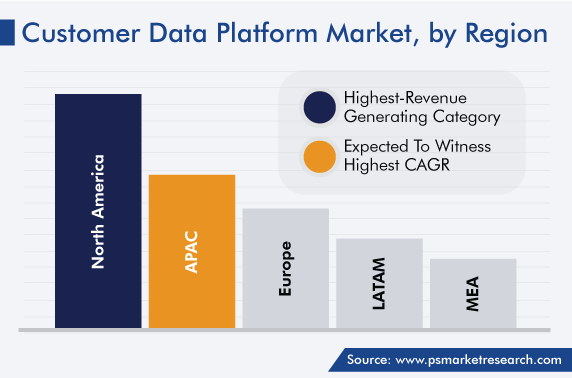

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Report Code: 12627

Get a Comprehensive Overview of the Customer Data Platform Market Report Prepared by P&S Intelligence, Segmented by Component (Platform, Service), Capability (Access, Analytics, Campaign), Deployment Type (Cloud, On-Premises), Organization Size (Large Enterprises, SMEs), Application (Personalized Recommendations, Predictive Analytics, Sales and Marketing Data Segmentation, Customer Retention and Engagement, Risk and Compliance Management), Vertical (BFSI, Retail and eCommerce, Media and Entertainment, Travel and Hospitality, Telecom and IT, Healthcare), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 7.8 Billion |

| 2030 Forecast | USD 48.9 Billion |

| Growth Rate(CAGR) | 35.6% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The global customer data platform market revenue was USD 7.8 billion in 2024, and it is expected to reach USD 48.9 billion by 2030, advancing with a CAGR of 35.6% during 2024–2030. The prime factors that drive the market are the growing rate of digitalization and urbanization, rising per capita income, continuously advancing telecom & IT industry, and surging funding by private and public sectors to improve marketing capabilities.

Moreover, the mounting demand for omnichannel experiences driven by a user-centric approach will boost the market growth.

Nowadays, the cloud has become the prime location for organizations to store their data, with a majority of them having already shifted their applications to cloud platforms. And, those who still have their data on premises are planning to move to the cloud soon. Several companies across the industrial vertical are trying to modernize their data platforms to support advanced applications and analytics, by moving their data to the cloud. Moreover, the rising cost and the need to improve the performance of IT operations are the major factors behind the rapid adoption of the cloud by organizations, as it offers greater efficiency and operational agility.

trends are transforming data infrastructures even in sectors such as semiconductor, which have been relatively sluggish to adopt a cloud solution for analysis. On-premises have historically been relied upon heavily, but hybrid architectures, which combine on-premises enterprise data center resources with public cloud services, are gradually replacing them. According to a 2021 Semiconductor Engineering article, organizations are turning to cloud analytics to handle the exponential expansion in data quantities, as well as the rising complexity of data types and supply chain processes.

Conventional data management techniques merely gather summaries of data. However, CDPs can create fully connected user information, which is simple for enterprises to access. In effect, by connecting various information sources, effective CDP utilization creates a framework for stronger marketing efforts.

The market is undergoing a number of innovations to fulfill the consumer demand for a robust data platform. For instance, in July 2022, a U.S.-based CDP company, named Tealium Inc., announced the launch of its pharmaceutical solution, which improves collaboration between healthcare providers, patients, and pharma companies.

Similarly, in June 2022, Adobe Inc. unveiled updates for its consumer data platform, to assist brands in switching from third-party cookies to first-party data. The solution can be adopted in numerous industries as it offers enhanced user accounts with commerce, AI-based targeting, segment match throughout channels, and new privacy and security capabilities.

The level of competitiveness in every market is extremely high and rising further as a result of globalization. Thus, it is difficult for startups to establish a foothold in the market because the established players already have a solid portfolio of products. On the other hand, when startups enter any sector with fresh, exciting product proposals, it can be difficult for the established competitors to survive. As a result, businesses will spend more money each year on marketing and advertising, which will boost the usage of consumer data platforms in many sectors.

The cloud category will register the faster growth during the forecast period, with a CAGR of 33.9%. This will be due to the fact that cloud-based software is more scalable, easy to handle, cost-efficient, and rapidly being integrated with innovations such as AI and machine learning. Additionally, such technology breaks data silos at speed with automated data transfers, drives predictive engagements faster with integrated AI/ML, augments consumer information with different public datasets, and democratizes the access to insights.

Furthermore, as the emphasis on individually using the public or private clouds has reduced, the deployment of customer data platforms as unified cloud solutions has increased.

The BSFI category accounted for a significant revenue share in 2022. This is due to the increasing usage of CDPs to handle customers’ information for several purposes, such as retention, engagement, and personalized recommendations. Additionally, the demand for such platforms is fueled by the growing dependence of the BFSI sector on the computer technology for marketing to a certain consumer base.

The travel & hospitality industry will witness the highest growth rate in the coming years, of around 34%. This can be ascribed to the augmenting requirement for improved customer experiences, based on which companies in the sector are mostly judged; retaining customers, and encouraging repeat transactions. Moreover, it is necessary for businesses to ensure customer loyalty, for which good travel experiences are mandatory; this can be done via such platforms.

Furthermore, the healthcare category contributed significant revenue in 2022. This was due to the growing healthcare infrastructure as a result of the high capital investment by private and public companies and the rising demand for telemedicine, as it offers patients access to doctors from anywhere, thus becoming cost- and time-effective, especially in times of crisis.

In addition, hospitals possess an expansive volume of patient data, created in several departments, which further builds a need for CDPs, which offer details into individual patients by assimilating information from multiple channels, linking data from those channels, and storing it to further track the condition of customers. Thus, the fact that patient data continues to mount and change with time raises the need for such platforms.

The platform category accounted for the larger revenue contribution in 2022, and it is further expected to maintain its dominance during the prediction period. This will be due to the rising need for real-time and personalized data analysis. Moreover, CDPs offer insights into the choices of users, thus aiding businesses in engaging them and developing a proper customer experience plan.

Additionally, the majority of the CDP solution vendors deliver a platform or software package that combines customer information from several channels, such as points of sale, e-commerce, email signups, and product registrations, into a unified database, to provide a 360-degree customer view.

Customer retention and engagement applications contribute significant revenue to the market. This is due to the burgeoning requirement of businesses to retain their customers and encourage repeat transactions. This helps businesses attain a stronger position and maintain their brand value amidst the emergence and expansion of other organizations in their sphere of operation.

Drive strategic growth with comprehensive market analysis

North America accounted for the largest revenue share, of 46%, in 2022, and it is further expected to maintain its position during the prediction period. This is due to the presence of pure-play vendors and providers of CDP as a sub-product, established IT infrastructure, and high adoption rate of advanced technologies.

Additionally, the developed healthcare sector, surging need for personalized recommendations in the BFSI and media & entertainment sectors, and the growing demand for predictive analytics, particularly in the healthcare sector, result in the high revenue generation in the region.

Moreover,

APAC will witness the fastest growth in the coming years. This is due to the rapid digitalization and urbanization, surging per capita income, booming telecom & IT and retail & e-commerce sectors owing to the rising standards of living, and burgeoning travel & hospitality industry.

Additionally, the growing funding by giants across industries in CDP startups, rising usage of OTT platforms, which creates the need for personalized recommendations; and increasing need to improve marketing technologies are responsible for the growth in the demand for CDPs in APAC.

Moreover,

Furthermore, Europe held a significant revenue share in 2022, due to a rise in the number of tourists, which boosts the travel & hospitality industry; burgeoning usage of such platforms in the BFSI sector, and increasing internet penetration in the region.

This report offers deep insights into the customer data platform industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Component

Based on Capability

Based on Deployment Type

Based on Organization Size

Based on Application

Based on Vertical

Geographical Analysis

The 2024 size of the market for customer data platforms was USD 7.8 billion.

The customer data platform industry is propelled by the rampant digitization across industries and the need to analyze customer behavior.

By 2030, the market for customer data platforms will generate USD 48.9 billion.

Platforms dominate the customer data platform industry.

North America is the largest market for customer data platforms.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages