Corrugated Boxes Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024 - 2030)

Get a Comprehensive Overview of the Corrugated Boxes Market Report Prepared by P&S Intelligence, Segmented by Flute Type (A, B, C, E, F), Board Style (Single-Face, Single-Wall, Double-Wall, Triple-Wall), Box Style (Slotted, Telescope, Folder, Rigid), End Use (Processed Food, Fresh Food and Produce, Beverages, Paper Products, Electrical Goods, Personal/Household Care, Glassware and Ceramics, Chemicals, Tobacco, Wood/Timber Products, Textiles, Transportation, Direct Mail), and Geographic Regions. This Report Provides Insights From 2017 to 2030.

Corrugated Boxes Market Data

Market Statistics

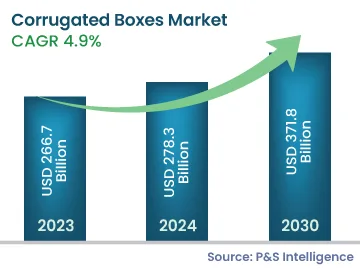

| Study Period | 2017 - 2030 |

| 2023 Market Size | USD 266.7 Billion |

| 2024 Market Size | USD 278.3 Billion |

| 2030 Forecast | USD 371.8 Billion |

| Growth Rate (CAGR) | 4.9% |

| Largest Region | Asia-Pacific |

| Fastest-Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

| Largest End Use Category | Processed Food |

Market Size Comparison

Key Players

Key Report Highlights

|

Explore the market potential with our data-driven report

Corrugated Boxes Market Analysis

The corrugated boxes market size stood at USD 266.7 billion in 2023, and it is expected to grow at a CAGR of 4.9% during 2024–2030, to reach USD 371.8 billion by 2030. This growth can be majorly attributed to the rising demand for lightweight and convenient packaging solutions across diverse industries.

The rise in the adoption of corrugated boxes over other packaging solutions, such as self-sealing boxes, plastic boxes, and retention packaging, is mainly due to the growing concerns over their sustainability in the value chain. Since corrugated boxes are easy to recycle (with the pulp & paper industry adept at converting these into new containerboards), these are witnessing a high demand in the market for packaging applications.

In addition, retail-ready packaging saves packaging time and labor costs. Other advantages of corrugated packaging include its eco-friendly nature and low cost, compared to other packaging products, which continue to drive the market of corrugated boxes globally.

Furthermore, an increase in population and a rise in disposable income are important factors fueling the demand for consumer goods, which, in turn, is driving the demand for corrugated boxes.

The manufacturing sector is heavily dependent on corrugated boxes for product transportation and handling. Corrugated boxes are widely utilized for the packaging of food and beverages, chemicals, glassware, consumer electronics, textiles, and personal care and household products. Moreover, since the market is highly unorganized, its contribution to the national income, although may not be traceable, is quite substantial.

Corrugated Boxes Market Trends & Growth Drivers

Growing Focus on Product Recycling and Sustainable Packaging Is a Key Trend

- Traditionally, corrugated boxes were disposed of after use, which led to an increased amount of waste accumulation in landfills, resulting in harmful environmental effects.

- However, manufacturers have now started using advanced technologies for shredding and compaction, which help in the recycling of corrugated boxes.

- When the corrugated material is recycled, fiber is produced, which can be utilized for the development of new corrugated boards. The major advantage of recycling this material is that it helps in reducing the cost of manufacturing new boards.

- Additionally, recycling helps in waste reduction, thereby benefiting the environment at large. Due to this, manufacturers are increasingly focusing on the recycling of old corrugated packaging materials for the development of new products.

- Thus, optimal resource utilization through the recycling of corrugated boxes to reduce wastage and create a sustainable environment is the key trend being observed in the market.

Growth in the Packaging Industry Is a Key Driver

- One of the key factors driving the corrugated boxes market is the growth in the packaging industry globally.

- The rise in demand for manufactured goods, ranging from smartphones and television sets to consumable items like candies, has pushed the demand for corrugated packaging, especially corrugated boxes, owing to their high structural strength and crush resistance.

- Moreover, with the rise in the standard of living, especially in China, India, and Brazil, there has been an increased demand for products such as cosmetics, food and beverages, and electronics. These products are generally packed in corrugated boxes.

- Corrugated boxes are mostly recommended for shipping applications, as they are pressure-resistant and stronger than regular cardboard box packaging. Hence, corrugated cartons are widely used for transporting heavy and fragile consumer goods.

- Additionally, robust growth in on-demand delivery services and online shopping has resulted in the increased use of corrugated boxes. Thus, the growth in the packaging industry is expected to continue driving the market for corrugated boxes in the coming years.

Low Strength and Poor Barrier Properties May Hamper the Market

- The low strength and poor barrier properties of corrugated boxes are expected to hinder their market growth to some extent.

- Corrugated boxes are mostly recommended for lightweight products, as they tend to bend, pucker, and crumple under pressure, often in the case of hefty products.

- This is because corrugated packaging is made up of three layers: an inside liner, an outside liner, and fluting, which runs in between. These layers, however, are not strong enough to handle extremely heavy loads.

- Also, corrugated packaging demonstrates little resistance to moisture. Direct contact with water or ambient moisture can make the material squashy.

- Moreover, corrugated boxes are not fire-resistant and can easily catch fire. All these factors hinder the adoption of corrugated boxes to some extent.

Corrugated Boxes Industry Outlook

Flute Type Insights

- The C category accounted for the largest share, around 40%, in 2023. This flute type finds high usage in corrugated boxes for shipping purposes, primarily for the packing of glass products, dairy products, furniture, and automotive components.

- For instance, market players provide such boxes for the packaging of engines, metallic body pieces, windshields, airbags, and car headliners.

- These boxes can be stacked and have a better compression strength since they feature a corrugated medium that is rather thick.

- Additionally, owing to its good crush resistance, high stacking strength, and suitability for high-quality printing, the C flute is widely preferred by end users.

Flute types covered in the report include:

- A

- B (Fastest-Growing Category)

- C (Largest Category)

- E

- F

Board Style Insights

- The single-wall category held the largest share of 45% in the market in 2023. Single-wall corrugated boxes are lightweight and, therefore, perfect for carrying low-weight objects. Besides, owing to their flexibility, they can be easily converted into any size, as per requirement.

- This type of board is compatible with the C flute, which is considered a medium-sized flute; the B flute, which is a fine flute; and the E flute, which is considered a micro-flute.

- Furthermore, the inner and outer liners give structural strength to the box, with the flute in between capable of absorbing shocks during the transportation of products.

- With the increasing demand for customized corrugated boxes, the demand for single-wall variants is further projected to grow at a significant rate during the forecast period.

- Moreover, to keep the various components separated in the outer packaging and provide additional protection to the packaged goods, single-face boards are also utilized as interior packaging materials.

- As there is just one fluted medium linked to the liner board, single-face boards are less durable than other types. However, they provide an environment-friendly alternative to bubble wrap or loose-fill containers made of plastic.

- Whereas, the double-wall category is expected to witness the fastest growth in the coming years, as this variant can be utilized for fanfold separation as well as stacking and strengthening applications.

- For instance, mangoes exported from India are packaged in boxes composed of corrugated fiberboard (CFB) of five plies, or double-wall boards, according to the Agricultural and Processed Food Products Export Development Authority (APEDA).

- These boxes can be sent via a variety of modes of transport, including air and land. As a result, these materials are utilized to create carton boxes, where the additional layers of paper provide the packed products with crush resistance.

The following board styles are included in the report:

- Single-Face

- Single-Wall (Largest Category)

- Double-Wall (Fastest-Growing Category)

- Triple-Wall

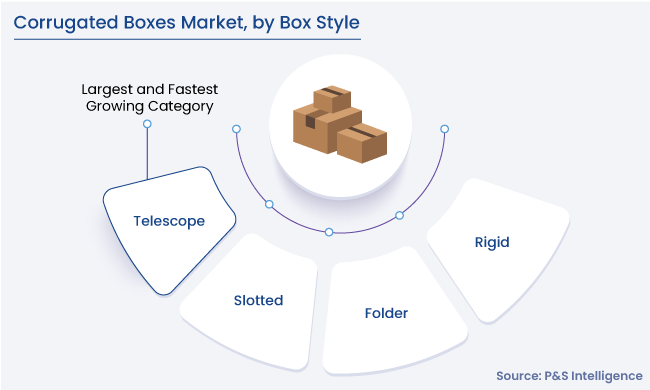

Box Style Insights

- By box style, the slotted category held the largest share in 2023. This is because it provides space optimization before and during transportation. Moreover, it is the most common type of box available in the market.

- The slotted box has maximum space and this type of box is considered for shipping various products including books, crockery, and other household stuff. Also, such boxes are generally used for shipping fragile products.

- In addition, overlapping flaps and fill-in pads provide extra cushioning to the materials being transported. Thus, the aforementioned attributes of slotted corrugated boxes encourage their high adoption in the market.

Box styles covered in the report are:

- Slotted (Largest and Fastest-Growing Category)

- Telescope

- Folder

- Rigid

End Use Insights

- Based on end use, the processed food category contributed the highest revenue, with a share of 25% in 2023.

- Due to the rising concerns over food freshness and safety, particularly during the shipping of grain-based food, canned & frozen food, and bakery & dairy products, the demand for corrugated boxes among processed food manufacturers is considerably high.

- These boxes ensure the safety and freshness of processed food items during their transit from manufacturers to retailers or end users.

It is further classified as:

- Processed Food (Largest and Fastest-Growing Category)

- Fresh Food and Produce

- Beverages

- Paper Products

- Electrical Goods

- Personal/Household Care

- Glassware and Ceramics

- Chemicals

- Tobacco

- Wood/Timber Products

- Textiles

- Direct Mail

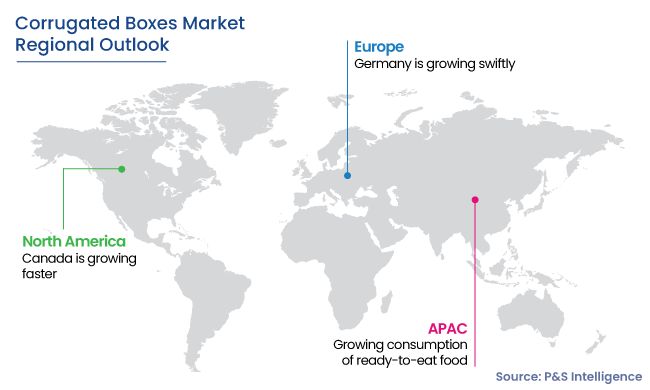

APAC Is the Largest Market

- The APAC market accounted for the largest revenue share of around 55% in 2023, and it is also expected to witness the fastest growth over the forecast period.

- The growing consumption of ready-to-eat food, which can be attributed to the busy lifestyle of people and rapid urbanization in the developing countries of APAC, is propelling the demand for corrugated boxes in the region.

- Moreover, the easy availability of raw materials and the increasing government initiatives to support sustainable development are encouraging the use of corrugated boards for primary and secondary packaging applications.

- China’s high industrial production can be viewed as an important growth driver for the corrugated boxes market in the country. Over the years, the country has emerged as one of the leading exporters of consumer electronics and automotive parts in the world.

- Besides, corrugated boxes are widely used in trade activities, owing to their suitability as a convenient packaging solution and their lower cost as compared to other packaging materials.

- India is another major market for corrugated boxes in the APAC region. The low land and labor costs in the country have resulted in the establishment of several manufacturing industries, such as textiles, footwear, and electrical goods.

- Besides, the e-retail industry in the country has witnessed considerable growth in the past few years, accounting for a high demand for corrugated packaging solutions. Hence, with urbanization and increasing disposable income, the demand for corrugated boxes is expected to grow in the country in the near future.

Further, regions and countries analyzed for this report include:

- North America

- U.S. (Larger Country Market)

- Canada (Faster-Growing Country Market)

- Europe

- Germany (Largest and Fastest-Growing Country Market)

- U.K.

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific (APAC) (Largest and Fastest-Growing Regional Market)

- China (Largest Country Market)

- Japan

- India (Fastest-Growing Country Market)

- South Korea

- Australia

- Rest of APAC

- Latin America (LATAM)

- Brazil (Largest Country Market)

- Mexico (Fastest-Growing Country Market)

- Rest of LATAM

- Middle East and Africa (MEA)

- Saudi Arabia (Largest Country Market)

- South Africa (Fastest-Growing Country Market)

- U.A.E.

- Rest of MEA

Market Nature – Fragmented

Although the market is currently fragmented in nature due to the presence of a large number of local players, it is gradually moving toward consolidation. Also, because the market is somewhat unorganized, end users are highly dependent on the local manufacturers to meet their packaging needs, owing to the low price and a wide variety of box designs and sizes offered by them.

Top Corrugated Boxes Manufacturing Companies:

- International Paper Company

- WestRock Company

- Georgia-Pacific LLC

- Smurfit Kappa Group plc

- Mondi Group

- Packaging Corporation of America

- Nine Dragons Paper (Holdings) Limited

- Oji Holdings Corporation

- DS Smith plc

- Stora Enso Oyj

- VPK Packaging Group NV

Corrugated Boxes Industry News

- In February 2024, Smurfit Kappa invested €54 million to double the capacity of its Ibi a Bag-in-Box plant.

- In December 2023, WestRock Company and Smurfit Kappa Group plc announced the transaction to create a global leader in sustainable packaging.

- In July 2022, Menasha Packaging Company LLC, a subsidiary of Menasha Corporation, announced the acquisition of Color-Box, a business unit of Georgia-Pacific LLC.

- In June 2022, Gatik Inc. announced a partnership with Georgia-Pacific, a provider of paper-based packaging. The aim of this collaboration is that Gatik would automate part of the Georgia-Pacific-KBX on-road transportation network.

Frequently Asked Questions About This Report

The corrugated boxes market is USD 278.3 billion in 2024.

The corrugated boxes industry is expected to reach a value of USD 371.8 billion in 2030.

The industry for corrugated boxes is currently fragmented because of the existence many of local participants. However, it is progressively moving toward consolidation.

APAC is leading the industry for corrugated boxes, with approximately 55% share in 2023.

The rising emphasis on product recycling as well as sustainable packaging are the major trends being witnessed in the corrugated boxes market.

Processed food is the leading end-use area in the corrugated boxes industry.

Request the Free Sample Pages

Want a report tailored exactly to your business need?

Request CustomizationWe are Trusted by

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws