Corrugated Boxes Market Analysis

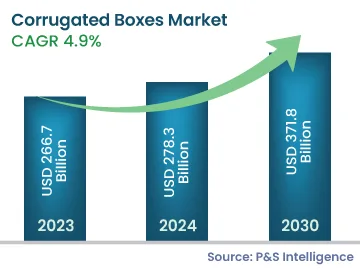

The corrugated boxes market size stood at USD 266.7 billion in 2023, and it is expected to grow at a CAGR of 4.9% during 2024–2030, to reach USD 371.8 billion by 2030. This growth can be majorly attributed to the rising demand for lightweight and convenient packaging solutions across diverse industries.

The rise in the adoption of corrugated boxes over other packaging solutions, such as self-sealing boxes, plastic boxes, and retention packaging, is mainly due to the growing concerns over their sustainability in the value chain. Since corrugated boxes are easy to recycle (with the pulp & paper industry adept at converting these into new containerboards), these are witnessing a high demand in the market for packaging applications.

In addition, retail-ready packaging saves packaging time and labor costs. Other advantages of corrugated packaging include its eco-friendly nature and low cost, compared to other packaging products, which continue to drive the market of corrugated boxes globally.

Furthermore, an increase in population and a rise in disposable income are important factors fueling the demand for consumer goods, which, in turn, is driving the demand for corrugated boxes.

The manufacturing sector is heavily dependent on corrugated boxes for product transportation and handling. Corrugated boxes are widely utilized for the packaging of food and beverages, chemicals, glassware, consumer electronics, textiles, and personal care and household products. Moreover, since the market is highly unorganized, its contribution to the national income, although may not be traceable, is quite substantial.