Key Highlights

| Study Period | 2019 - 2032 |

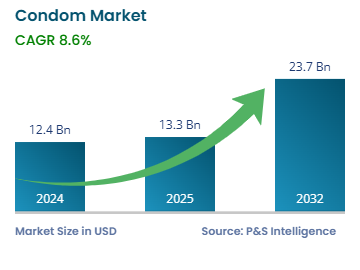

| Market Size in 2024 | USD 12.4 Billion |

| Market Size in 2025 | USD 13.3 Billion |

| Market Size by 2032 | USD 23.7 Billion |

| Projected CAGR | 8.6% |

| Largest Region | APAC |

| Fastest Growing Region | MEA |

| Market Structure | Fragmented |

Report Code: 13598

This Report Provides In-Depth Analysis of the Condom Market Report Prepared by P&S Intelligence, Segmented by Type (Latex, Non-Latex), End User (Men, Women), Distribution Channel (Mass Merchandisers, Drug Stores/Pharmacies, Online Retail Stores), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 12.4 Billion |

| Market Size in 2025 | USD 13.3 Billion |

| Market Size by 2032 | USD 23.7 Billion |

| Projected CAGR | 8.6% |

| Largest Region | APAC |

| Fastest Growing Region | MEA |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The condom market revenue was USD 12.4 billion in 2024, and it is expected to witness a CAGR of 8.6% from 2025 to 2032, reaching USD 23.7 billion in 2032. This growth can be attributed to the increasing awareness of sexual health and STIs, such as HIV/AIDS, gonorrhea, chlamydia, warts, herpes encephalitis, and syphilis.

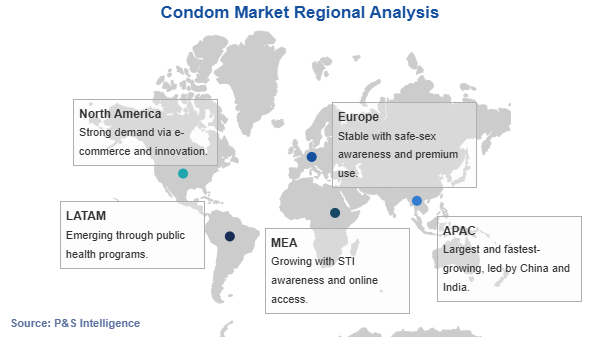

Government in Sub-Saharan Africa and parts of Asia have begun distributing condoms free through large-scale intervention programs as these countries have a high HIV prevalence. In India, the National AIDS Control Programme (NACP) and Mission Parivar Vikas have created widespread awareness of the importance of condom use, focusing on states that have high fertility and low contraceptive usage rates.

Additionally, the expansion of the online marketplace, sexual wellness websites, and app-based pharmacies has given options to consumers and reduced the stigma associated with buying condoms at physical stores, especially in conservative societies, such as India and those in the Middle East.

Furthermore, businesses are working on product innovation with a focus on ultra-thin condoms, flavored variants, textured designs, glow-in-dark versions, vegan products, sustainable options, those with antimicrobial coatings to prevent STDs, and smart condoms, which measure several performance metrics.

In December 2024, Condombazaar from CA Gain Healthcare Private Limited launched Love Light Glow condoms, which bring excitement and fun to the bedroom, while promoting safe intimacy.

Moreover, the increasing awareness and normalization of sexual intercourse in the developed markets promote condom sales as a part of comprehensive sexual wellness strategies. People here also demand premium products, such as textured-ultra-thin, and non-latex condoms. As per the World Health Organization, 1 million new cases of STDs are detected around the world each year. Moreover, 2022 saw 1.1 million deaths due to hepatitis B, a common STD.

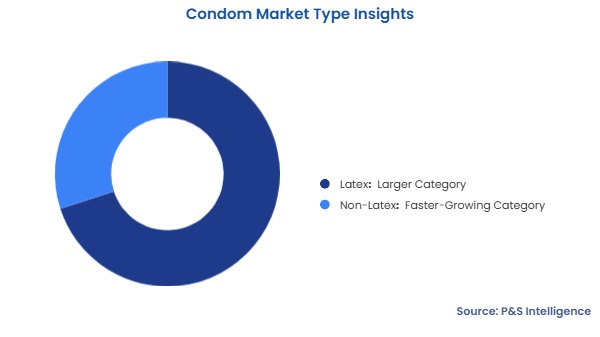

The latex category held the larger market share, of 70%, in 2024. This is due to their material advantages, cost-effectiveness, manufacturing ease, and regulatory approval. The low production cost allows manufacturers to produce these condoms on a large scale with higher profitability rates, which is important in price-sensitive regions, such as APAC, LATAM, and Africa.

The non-latex category will grow at the higher CAGR, of 9.0%, during the forecast period. This growth can be attributed to the rising awareness of latex allergy and sensitivity and the increasing consumer demand for improved comfort and a more-natural sexual experience. As per the Allergy & Asthma Association, almost 6% of the population of the U.S. is allergic to latex.

Additionally, the rise in the demand for premium sexual wellness products in North America, Europe, and Japan drives the category. Consumers here often spend more on products that offer odor-free experiences, sustainability, and better comfort. Furthermore, companies in the market are introducing latex-free condoms for fulfilling the demand of consumers. For instance, in March 2023, the Durex brand of Reckitt Benckiser Group PLC launched the Real Feel line of condoms, which are made of polyisoprene. It is softer than latex, which gives people a chance to connect with their partners more emotionally and physically.

Based on type, the market has the following categories:

Men are the larger category, with 95% market share in 2024, due to the ease in their use, affordability, and wider distribution than female condoms. Additionally, the distribution programs across Asia, Africa, and Latin America distribute males’ condoms exclusively or primarily, rather than female condoms.

The women category will grow at the higher CAGR during the forecast period. This is because female condoms offer dual protection and greater control over STI prevention, especially where male partners refuse to use condoms. Additionally, organizations such as the UNFPA, WHO, and Population Services International (PSI) promoted female condoms to reduce gender-based vulnerability to STIs and empower women. In September 2024, condom manufacturer RKT.L announced a shift in its approach toward targeting women and rural consumers.

Based on end user, the market has the following categories:

Drugstores/pharmacies are the largest category, with 45% market share in 2024. This is because drugstores and pharmacies enjoy customer trust, wide geographical reach, and consumer preference for health-related purchases from medical outlets. Additionally, consumers also receive expert guidance while purchasing from drugstores and pharmacies.

Online retail stores will grow at the highest CAGR during the forecast period. This is due to the rise in the e-commerce platforms, which provide consumers with a wide range of product options in different price ranges. The feeling of complete privacy and anonymity also encourages people in conservative societies to buy sexual wellness products online.

Based on distribution channel, the market has the following categories:

Drive strategic growth with comprehensive market analysis

The APAC region held the largest market share, of 40%, in 2024, due to the huge sexually active population in China, India, Indonesia, Bangladesh, and the Philippines. Additionally, the region has a well-established network of domestic manufacturers and supply channels. Furthermore, governments in the region are proactive in distributing condoms for free to low-income and less-educated individuals to tackle STIs.

The MEA will grow at the highest CAGR, of 9.1%, during the forecast period. This growth can be attribute to the presence of countries such as Nigeria, Kenya, and Egypt, which have high birth rates and a growing youth population. Africa is also the most-afflicted with STDs. As per the WHO, each year, Africa registers 357 million new STD cases among people aged 15–49, including 131 million of chlamydia, 78million of gonorrhea, 6 million of syphilis, and 142 million of trichomoniasis.

Based on geography, the, the market has the following categories:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages