Report Code: 10199 | Available Format: PDF | Pages: 346

Commercial Refrigeration Equipment Market Research Report: By Product (Walk-In Coolers, Beverage Refrigeration Equipment, Display Showcases, Ice Merchandisers & Ice Vending Equipment), Distribution Channel (Specialty Stores, Hypermarkets/Supermarkets, Online), Application (Food Service, Food & Beverage Production, Food & Beverage Retail), End User (Hospitality, Hypermarkets/Supermarkets, Departmental Stores, Healthcare, Offices & Buildings, Convenience Stores, Government) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 10199

- Available Format: PDF

- Pages: 346

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Commercial Refrigeration Equipment Market Overview

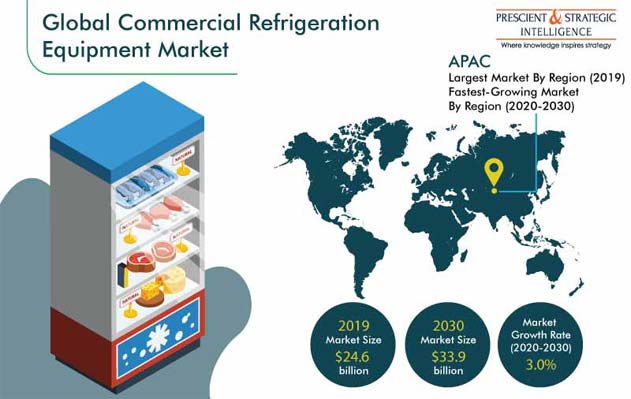

The global commercial refrigeration equipment market size, which was $24.6 billion in 2019, is expected to witness a CAGR of 3.0% during the forecast period (2020–2030), to reach $33.9 billion in 2030. The major reasons behind the advance of the industry are the increasing demand for ready-to-eat products and expansion of the organized food retail sector.

The commercial refrigeration equipment market size is witnessing subdued growth during the COVID-19 pandemic, as the manufacturing of the final products and the supply of the components and raw materials, especially from China, has drastically reduced. Additionally, due to restrictions on the import–export of products, the supply of refrigeration systems has further been hit. Additionally, even the demand at the end-user level has reduced, as restrictions have been put on the movement of people for non-essential goods.

Segmentation Analysis

Walk-In Coolers Held Largest Commercial Refrigeration Market Share

The walk-in coolers division, under segmentation by product, had the largest size in 2019. With the increasing demand for personalized walk-in coolers by customers, this share of this category is expected to advance further, thereby driving the commercial refrigeration equipment market growth. In addition, market players are focusing on research and development (R&D) to come up with low-global-warming-potential (GWP) refrigerants, to enhance such systems’ efficiency and also save energy.

Online Distribution Channels To Witness Fastest Sales Growth

During the forecast period, the online category, based on distribution channel, would experience the fastest growth in the commercial refrigeration equipment market. This is owed to the increasing penetration of the internet and rising uptake of smartphones and the fact that e-commerce channels offer customers the chance to see the specifications of a range of products, avail of numerous discounts and offers, and have the refrigeration equipment delivered at their doorstep.

Food Service To Be Largest Application in Market till 2030

The food service classification, on the basis of application, is predicted to continue holding the largest commercial refrigeration equipment market share throughout the forecast period. This is ascribed to the rise in the number of restaurant chains, expansion of the tourism sector, and increase in the government support for deploying sustainable refrigeration solutions at restaurants, hotels, educational institutions, hospitals, and fast food joints.

Hospitality Sector Contributed Highest Revenue during 2014–2019

During the historical period (2014–2019), the hospitality category, under the end user segment, generated the highest revenue in the commercial refrigeration equipment market, as the food and beverage sector and food service sector are growing, particularly with the rising number of quick-service restaurants. Other reasons for the dominance of this category on the sector are the advancements in infrastructure, rising awareness about improving the aesthetics and food quality, for higher customer satisfaction, and surging investments in green technologies.

Geographical Outlook

Asia-Pacific (APAC): Largest and Fastest-Growing Market

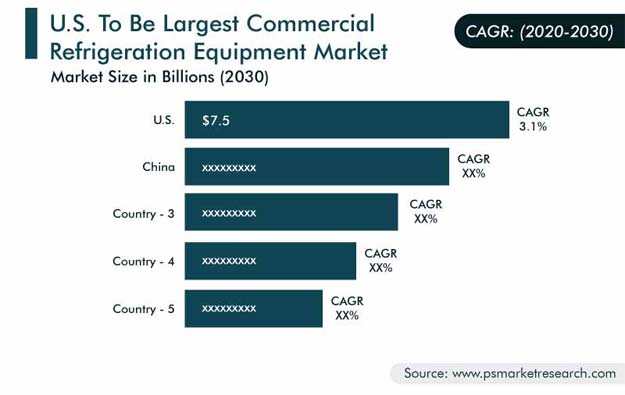

Asia-Pacific (APAC) had been home to the largest commercial refrigeration equipment industry during the historical period, and it will also witness the fastest growth during the forecast period. This is because the region is home to the highest number of developing countries in the world; moreover, the regional population and its disposable income are rising. According to the World Bank, from 2017, the gross domestic product (GDP) of South and East Asia grew at a rate of 6.7% and 6.3%, respectively, in 2018. With the increasing preference of inhabitants for eating out, the number of restaurants is rising, which is leading to the expansion of the food and beverage sector. Similarly, the number of convenience stores, hypermarkets, and supermarkets is also surging, thereby resulting in a high adoption of commercial refrigeration equipment.

Trends & Drivers

Shift to Eco-Friendly Gases Is Key Market Trend

The most prominent trend in the commercial refrigeration equipment market is the shift from fluorinated gases (F-gases) to natural refrigerants. For instance, Carrier Corporation has introduced the MiniCO2OL refrigeration systems with carbon dioxide as the cooling agent, for small and mid-sized retailers. Since the 1990s, most developed countries have banned the use of F-gases in cooling systems, but emerging economies still have a long way to go. This is because these countries lag the technology needed to make the switch to cleaner refrigerants. Brazil, Russia, India, China, and South Africa (BRICS) are currently following the Kyoto Protocol, which mandates them to reduce their carbon emissions. But, due to the increasing pressure to follow the stricter Montreal Protocol, the demand for eco-friendly refrigerating gases is expected to pick up sharply in such countries in the coming years.

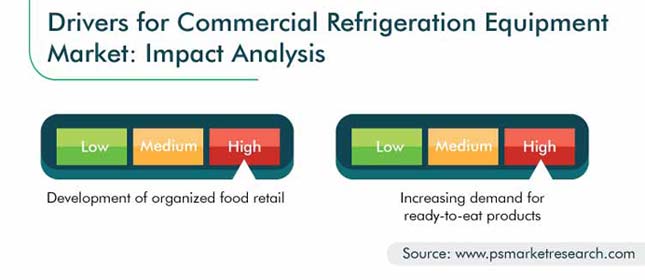

Growing Demand for Ready-to-Eat Products Is Important Market Driver

One of the key drivers for the commercial refrigeration equipment market size is the rising demand for ready-to-eat products. The middle class, especially in the Eastern world, is rapidly demanding ready-to-eat products, on account of their rising disposable income and growing influence of the Western lifestyle. Such changes in the food consumption pattern of people are resulting in the increasing number of supermarkets, hypermarkets, and food and restaurant chains. Seeing this, even the smaller grocery stores and unorganized restaurants are upgrading their infrastructure, by procuring large refrigeration equipment, thereby helping the market advance around the world.

Development of Organized Food Retail Sector Driving Market

Another key driver for the commercial refrigeration equipment market growth is the expansion of the organized food retail sector, which includes supermarkets, organized restaurant chains, and hypermarkets. The growth is this sector is especially fast in China, India, and Brazil, owing to the rapid urbanization here. For instance, the urban population in China is expected to Grow from 782 million in 2016 to around 1.4 billion by 2025. Similarly, the Indian urban population, which was 438 million in 2016, is expected to reach around 1.4 billion by 2023-end. This would drive the procurement of refrigeration equipment in food processing plants, hypermarkets, tier-I and tier-II restaurants, and mid-sized grocery stores.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$24.6 Billion |

Forecast Period CAGR |

3.0% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Company Share Analysis, Major Countries Analysis, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

Product, Distribution Channel, Application, End User, Region |

Market Size of Geographies |

U.S., Canada, France, Germany, Greece, Italy, Netherlands, Poland, Russia, Spain, Switzerland, U.K., China, India, Australia, Japan, Indonesia, Malaysia, Pakistan, South Korea, Thailand, Philippines, Brazil Argentina, Mexico, Colombia, Venezuela, Saudi Arabia, Egypt, Nigeria, South Africa |

Secondary Sources and References (Partial List) |

Air-Conditioning, Heating, and Refrigeration Institute (AHRI), Air Conditioning Contractors of America Association Inc. (ACCA), All India Air Conditioning & Refrigeration Association (AIACRA), Brazilian Chamber of the Construction Sector (CBIC), Building Performance Institute Europe (BPIE), International Council of Air-Conditioning, Refrigeration, and Heating Manufacturers Association (ICARHMA), International Monetary Fund (IMF), Ministry of Statistics and Programme Implementation (MoSPI), National Restaurant Association, United Nations World Tourism Organization (UNWTO) |

Explore more about this report - Request free sample

Product Launches Are Strongest Strategic Measures in Market

The global commercial refrigeration equipment industry is fragmented in nature, owing to the presence of players such as The Middleby Corporation, Ali Group S.r.l., Johnson Controls International plc, United Technologies Corporation, Panasonic Corporation, Illinois Tool Works Inc., Daikin Industries Ltd., Dover Corporation, Frigoglass S.A.I.C., and Midea Group.

As per analysis, currently, the strongest strategic measures in the market are product launches, as they are being strongly focused upon by the players to enhance their portfolio and business potential.

For instance, in February 2020, the Carrier Global Corporation subsidiary of United Technologies Corporation introduced two refrigerated chiller islands — the EasyCube chiller island and Areor total transparency unit — for convenience stores, grocery stores, and hypermarkets in Europe.

In the same vein, in September 2019, Dover Food Retail, owned by Dover Corporation, introduced the Ecoblade shelf-edge technology in North America. The Hillphoenix open refrigerated display cases driven by this technology are designed to decrease the consumption of electricity by up to 33% and improve the temperature of the products. This two-blade system manages the airflow in front of the shelves, within open multi-deck cases.

The players in the commercial refrigeration equipment market report are:

-

The Middleby Corporation

-

Ali Group S.r.l.

-

Johnson Controls International plc

-

United Technologies Corporation

-

Panasonic Corporation

-

Illinois Tool Works Inc.

-

Daikin Industries Ltd.

-

Dover Corporation

-

Frigoglass S.A.I.C.

-

Midea Group Co. Ltd.

-

Western Equipments

-

Elan Professional Appliances Pvt. Ltd.

-

True Manufacturing Co. Inc.

-

Tefcold A/S

-

Akreeti Industries

-

Iron Mountain Refrigeration & Equipment LLC

-

Williams Refrigeration Australia Pty. Ltd. (Ali Group S.r.l.)

-

Standex International Corporation

-

Omega Refrigeration

-

Viessmann Werke GmbH & Co. KG

Commercial Refrigeration Equipment Market Size Breakdown by Segment

The commercial refrigeration equipment market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Product

- Walk-In Coolers

- Beverage Refrigeration Equipment

- Display Showcases

- Ice Merchandisers & Ice Vending Equipment

Based on Distribution Channel

- Specialty Stores

- Hypermarkets/Supermarkets

- Online

Based on Application

- Food Service

- Food & Beverage Production

- Food & Beverage Retail

Based on End User

- Hospitality

- Hypermarkets/Supermarkets

- Departmental Stores

- Healthcare

- Offices & Buildings

- Convenience Stores

- Government

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- France

- Germany

- Greece

- Italy

- Netherlands

- Poland

- Russia

- Spain

- Switzerland

- U.K.

- Asia-Pacific (APAC)

- China

- India

- Japan

- Indonesia

- Malaysia

- Pakistan

- Australia

- South Korea

- Thailand

- Philippines

- Latin America (LATAM)

- Brazil

- Mexico

- Colombia

- Venezuela

- Argentina

- Middle East and Africa (MEA)

- Saudi Arabia

- Egypt

- Nigeria

- South Africa

During 2020–2030, the commercial refrigeration equipment market is forecast to experience a CAGR of 3.0%.

The dominance of the food service application area in the commercial refrigeration equipment market is credited to the increasing network of restaurant chains and advancing tourism sector.

The commercial refrigeration equipment market will witness the fastest growth in APAC in future, driven by its booming population and rising disposable income.

Product launches have been the strongest strategic developments among the major companies in the commercial refrigeration equipment industry.

Online sales are increasing in the commercial refrigeration equipment market because of the rising internet and smartphone penetration and varied benefits offered by e-commerce portals.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws