Report Code: 11966 | Available Format: PDF | Pages: 323

Commercial AC Market Research Report: By Type (VRF, Ducted Split/Packaged Unit, Split Units, Chillers, Room ACs), Installation Type (New Installation, Retrofit), End User (Offices & Buildings, Hospitality, Supermarket/Hypermarket, Transportation, Government, Healthcare) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 11966

- Available Format: PDF

- Pages: 323

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Variable Refrigerant Flow (VRF) to Witness Fastest Growth in Commercial Air Conditioner (AC) Market

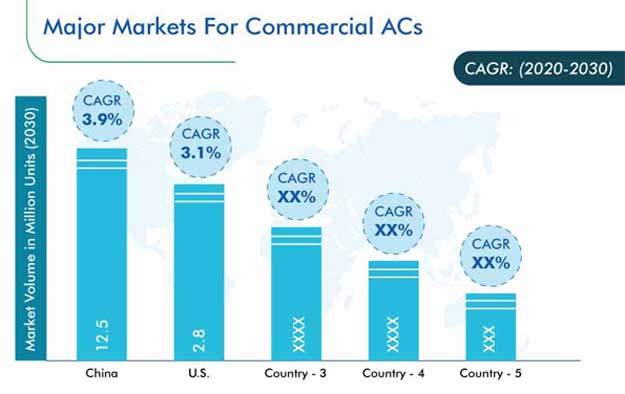

From 17.6 million units in 2019, the total sales in the global commercial air conditioner (AC) market are expected to rise to 25.4 million units by 2030, at a CAGR of 3.5% during the forecast period (2020–2030). The key drivers for the growth of the market are the increasing number of construction projects around the world and surging disposable income of people.

Segmentation Analysis of Commercial AC Market

The variable refrigerant flow (VRF) category is predicted to witness the fastest growth in the commercial AC market during the forecast period, under segmentation by type. This is because such appliances are cost-effective and energy efficient and offer flexibility during installation, which is why they are swiftly replacing chillers in commercial settings.

In 2019, new installations accounted for higher sales volume, based on installation type, as the number of construction projects is rising due to the development of smart cities and FIFA World Cup 2026. With new infrastructure projects being initiated and completed, the demand for the installation of new AC systems is surging.

The hospitality division would hold the largest share in the commercial AC market in 2030, on the basis of vertical, due to the consistent rise in tourist activities. As per the United Nations World Tourism Organization (UNWTO), the international tourism industry grew by 7% in 2016–17. Tourism activities are expected to rise further, with the upcoming FIFA World Cup 2022 in Qatar, Expo 2020 in the U.A.E., and FIFA World Cup 2026 in the U.S., Canada, and Mexico, thereby leading to the construction of hotels, which would, in turn, lead to an increasing demand for commercial cooling systems.

During the historical period (2014–2019), Asia-Pacific (APAC) held the largest share in the market, on account of its huge construction sector, which already generates around 60% of the worldwide construction revenue. This is itself a result of the growing disposable income and migration of people from rural areas into urban pockets. For instance, the World Bank says that in 2011, 27.8% of the population lived in urban area, and this percentage had risen to 34% in 2018.

Low-Global-Warming-Potential (GWP) Refrigerants Trending in Market

The key trend in the commercial AC market is the use of refrigerants with a low global warming potential (GWP). Currently, R507, R22, and R404A, which are based on hydrochlorofluorocarbons (HCFC) and chlorofluorocarbons (CFC), are the most widely used refrigerants, owing to their easy availability. But, due to the increasing awareness about their harmful effects on the environment, they are being replaced by R32 and other low-GWP variants. In October 2016, 197 countries signed the Montreal Protocol, under which high-GWP refrigerants are to be phased out by 2020 in developed countries and by 2030 in developing nations.

Growing Construction Sector Driving Market for Commercial ACs

Among the numerous factors behind the advance of the commercial AC market, the most important one is the growing construction industry. From $10.5 trillion in 2017, the global construction sector is set to reach $12.8 trillion by 2022. The infrastructure pipeline includes metro rail systems, office complexes, and airports, which will require cooling equipment when complete. For instance, India plans to construct 100 airports in the next 15 years, while China is pursuing 216 airports’ completion by 2035. Similarly, an increasing number of skyscrapers are being erected, for instance 42 in Chicago, Illinois, U.S.; and 115 in London, U.K.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Market Size by Segments |

Type, Installation Type, End User |

Market Size of Geographies |

U.S., Canada, Germany, U.K., Greece, Netherlands, Poland, Russia, Switzerland, Italy, France, Spain, China, Japan, India, South Korea, Indonesia, Malaysia, Pakistan, Thailand, Philippines, Australia, Brazil, Mexico, Argentina, Venezuela, Colombia, South Africa, Saudi Arabia, Egypt, Nigeria |

Explore more about this report - Request free sample

Product Launch is Most Important Strategic Measure in Market

Players in the commercial AC market are launching new cooling equipment to attract customers and dominate the competition. For instance, in September 2019, a VRF system with the R32 refrigerant was introduced in the U.K. by Mitsubishi Electric Corporation, to cater to the increasing demand for eco-friendly electrical appliances.

In the same vein, in 2019, a new range of single commercial air conditioners was launched by LG Electronics Inc. in the Philippines. These energy-efficient systems have been developed to answer the problem of the high electricity costs in the country. They are suitable for small and medium-sized offices and stores and restaurants.

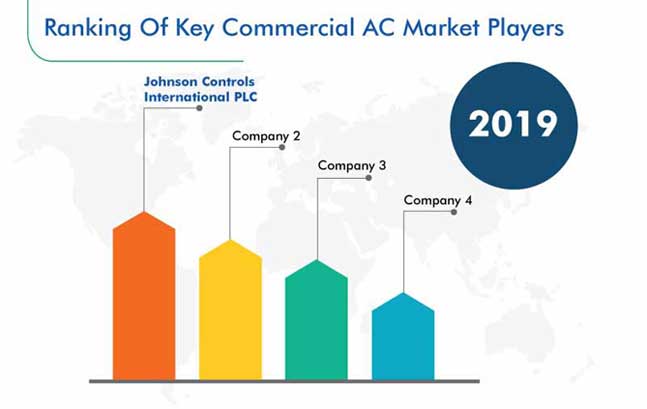

Key companies in the global commercial AC market are Johnson Controls International PLC, Samsung Electronics Co. Ltd., Ingersoll-Rand plc, United Technologies Corporation, Daikin Industries Limited, Mitsubishi Electric Corporation, Toshiba Corporation, LG Electronics Inc., Midea Group Co. Ltd., Gree Electric Appliances Inc. of Zhuhai, and Danfoss A/S.

Market Size Breakdown by Segment

The commercial AC market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Type

- VRF

- Ducted Split/Packaged Unit

- Split Units

- Chillers

- Room ACs

Based on Installation Type

- New Installation

- Retrofit

Based on End User

- Offices & Buildings

- Hospitality

- Supermarket/Hypermarket

- Transportation

- Government

- Healthcare

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Greece

- Netherlands

- Poland

- Russia

- Switzerland

- Italy

- France

- Spain

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Indonesia

- Malaysia

- Pakistan

- Thailand

- Philippines

- Australia

- Latin America (LATAM)

- Brazil

- Mexico

- Argentina

- Venezuela

- Colombia

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- Egypt

- Nigeria

The commercial AC market will witness a growth of 3.5%, in terms of sales volume, during 2020–2030.

New installations have proven more fruitful for the commercial AC industry.

Refrigerants with a low GWP are trending in the commercial AC market.

The commercial AC industry report covers North America, Europe, APAC, LATAM, and MEA.

Product launches are shaping the competition in the commercial AC market.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws