Report Code: 12886 | Available Format: PDF | Pages: 250

Colorless Polyimide Film Market Size and Share Analysis by Application (Flexible Displays, Flexible Solar Cells, Flexible Printed Circuit Boards, Lighting Equipment), End User (Medical Devices, Solar PV Modules, Electronics) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12886

- Available Format: PDF

- Pages: 250

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Colorless Polyimide Film Market Size and Share

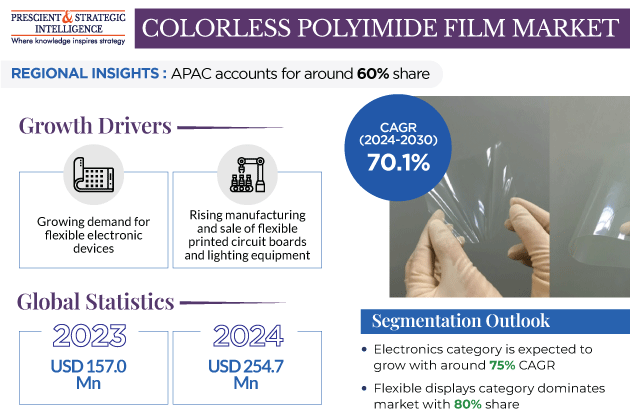

The global colorless polyimide film market was valued at USD 157.0 million in 2023, and the market size is predicted to reach USD 6,174.2 million by 2030, advancing at a CAGR of 70.1% during 2024 and 2030. This is mainly attributed to the growing demand for flexible electronic devices, such as laptops, iPads, and smartphones; and rising manufacturing and sale of flexible printed circuit boards and lighting equipment. Moreover, the increasing application of these materials in solar cells is a key factor driving their adoption.

- High-performance plastic films made from transparent or colorless polyimide are widely used in various industries.

- These films are prized for their excellent chemical resistance, thermal stability, mechanical strength, and transparency.

- Because smartphones, tablets, and other mobile devices are becoming increasingly popular, there is an increasing demand for flexible screens that can be rolled or folded.

- Colorless polyimide films make the ideal substrate for flexible screens due to their high flexibility and thermal stability.

Growing Solar Power Capacity due to Government Initiatives

Furthermore, the need for renewable energy sources is greater than ever due to the rising demand for energy and the depletion of non-renewable resources. On earth, solar energy is highly abundant, hence offering a viable solution for the generation of electricity. As a result, the use of solar panels is growing globally. The most-popular high-performance films for flexible solar cell applications are colorless polyimide films because of their high-temperature operability, transparency, toughness, and flexibility.

- Additionally, they can withstand extreme temperatures and pressures.

- Moreover, their chemical resistance, high mechanical strength, strong electrical properties, flexibility, and light weight make them ideal for flexible solar cells.

- According to the International Energy Agency, solar PV energy generation increased by a record 270 TWh in 2022, up by 26% from 2021, reaching almost 1,300 TWh.

Electronics Category Holds Largest Market Share

Based on end user, the electronics category holds the largest market share, and it is expected to register the fastest growth, of around 75% CAGR, in the coming years. This is mainly due to the thermal stability, flexibility, and electrical insulation of these materials, which is why they are majorly used in foldable smartphones, flexible screens for laptops, tablets, and curved displays for televisions. For instance, in May 2021, Kolon Industries supplied transparent and flexible polyimide films for the cover window of Xiaomi's foldable smartphone Mi MIX FOLD. It is primarily due to their heat resistance and flexibility that transparent polyimide films are finding increasing application in flexible displays.

- Moreover, wearable sensing devices, such as smartwatches, as well as fitness and health tracking bracelets, have become omnipresent in society.

- These wearable electronic devices are receiving greater attention because of their ability to monitor the heart rate, wrist pulse, blood pressure, motion, intraocular pressure, and other parameters to assess human health.

- In contrast to regular patient monitoring systems, such as blood pressure and heart rate monitors, wearable medical devices are portable and provide continuous, real-time, and recorded data that could help in detecting complex health conditions timely.

Moreover, the medical category is expected to grow the fastest in the coming years. This is mostly due to the greater optical quality, low weight, and thermal stability of these sheets. Furthermore, medical tubing for medication delivery is made out of them. The increasing geriatric population globally has been significantly driving the requirement for medical devices equipped with tubes.

- According to the World Health Organization, by 2050, the world’s population of people aged 60 years and older will double (2.1 billion).

- The number of persons aged 80 years or older is expected to triple between 2020 and 2050, to reach 426 million.

This factor is likely to escalate the usage of medical tubing in catheters, drug delivery systems, and many other medical devices.

Furthermore, a prominent use case for polyimide films in the aerospace industry was the Apollo 11, in which the lunar landing module and some other parts of the spacesuits were made of conventional Kapton polyimide films. According to the NASA, colorless polyimides were eventually employed in the sun shield for the James Web Space Telescope as well as by Lockheed Martin, Boeing, and Northrup Grumman. Additionally, transparent polyimide films are less-persistently dielectric than other optical plastic films. Due to the increasing use of wireless devices with the GPS, Bluetooth, Wi-Fi, and near-field communication (NFC) technologies, these insulating qualities are particularly helpful in shielding from the electromagnetic interference encountered in daily life.

| Report Attribute | Details |

Market Size in 2023 |

USD 157.0 Million |

Market Size in 2024 |

USD 254.7 Million |

Revenue Forecast in 2030 |

USD 6,174.2 Million |

Growth Rate |

70.1% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Application; By End User; By Region |

Explore more about this report - Request free sample

Flexible Displays Hold Largest Market Share

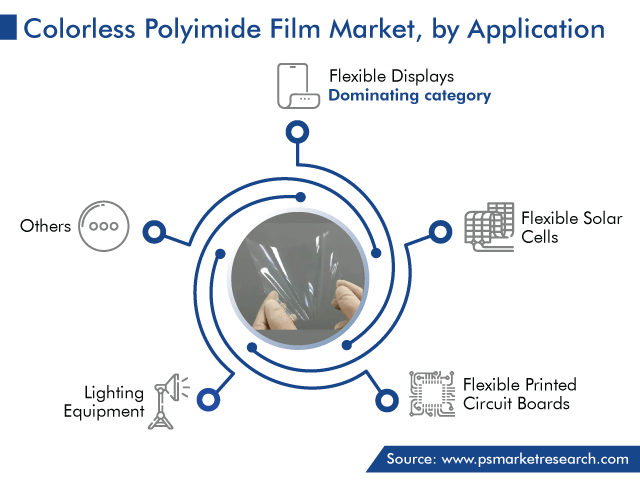

Based on application, the flexible display category dominates the market with 80% revenue share.

- This is mainly due to the rising demand for flexible displays for consumer electronics, such as smartphones and laptops.

- Smartphones, wearables, and other electronic devices are being incorporated with advancements, including full-screen displays with no borders or bezels, as the mobile device market shifts toward larger screens with improved portability.

- To meet these design specifications and ensure that displays reach the next degree of flexibility, i.e., foldability and rollability, new materials are required.

Further, colorless polyimide films have shown a great potential for flexible display applications due to their excellent optical transparency and outstanding thermal and mechanical properties. In recent years, there has been significant developments in flexible AMOLED display panels. Flexible substrates are being preferred by display manufacturers over hard glass as these substrates can make displays lighter, less fragmented, and thinner. In the recent past, three substrates—colorless polyimide films, ultra-thin glass, and metal foil—have become popular in flexible displays. These transparent polyimide films not only have ultra-thin glass but are also tougher compared to metal foils.

- In April 2022, HP launched its first foldable laptop, which has LG Display’s 17-inch 4K OLED panels, along with a transparent polyimide film provided by SK IE Technology.

- Similarly, in April 2021, Kolon Industries Inc. was contracted to supply colorless polyimide films for the foldable PCs manufactured by Lenovo.

- Furthermore, major electronics companies are developing next-generation flexible smartphones, such as Samsung’s Galaxy Fold, Xiaomi’s Mix Fold, and Huawei’s Mate X.

Furthermore, flexible printed circuit boards are expected to hold a significant market share in the coming years. This will mainly be to make printed circuit boards smaller, lighter, and more space-saving within electronic devices. Flexible printed circuit boards can be used in cameras and smartphones by folding them in extremely tight structures. Moreover, they are frequently used for flexible connections subject to permanent stress, such as those found in inkjet printers.

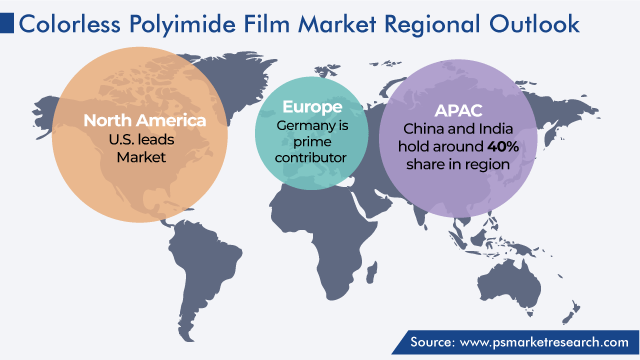

Asia-Pacific Market Holds Largest Share

Geographically, APAC held the largest share, of 60%, in 2023, and it is projected to grow at the highest CAGR.

- This is due to the increasing disposable income, economic development, and rising population, especially in China and India, which has resulted in the surging demand for consumer electronics products in these countries.

- In India, OnePlus, Xiaomi, Samsung, Oppo, and Vivo are the leading manufacturers of foldable electronic devices.

- Furthermore, market players manufacturing transparent polyimide films primarily have their manufacturing in Asian countries, such as Japan, China, South Korea, and Taiwan, which helps maintain the supply–demand equilibrium in the region.

Moreover, the increasing demand for flexible displays in the automotive and aerospace sectors propels the demand for colorless polyimide films. According to the Society of Indian Automobile Manufacturers, sales of passenger cars increased from 1,467,039 to 1,747,376 units, while those of utility vehicles rose from 1,489,219 to 2,003,718 units and those of vans 113,265 to 139,020 units in 2022–2023 from the previous year.

- Additionally, the rising elderly population in this region has significantly driving the requirement for medical devices equipped with tubes.

- According to an article, the number of people aged 60 and above in India will increase from 149 million in 2022 to 347 million in 2050, thus propelling the demand for medical devices.

North America is also expected to hold a significant market share in the upcoming years. This is mainly due to the government initiatives for supporting manufacturing industries, rising health awareness, and increasing interest in young adults in smartwatches.

- According to the National Institutes of Health, in 2023, almost one in three Americans uses a wearable device, such as a smartwatch or band, to track their health and fitness.

Top Colorless Polyimide Film Manufacturers Are:

- DuPont de Nemours Inc.

- KANEKA CORPORATION

- KOLON Industries

- Dr. Dietrich Müller GmbH

- NeXolve Holding Company LLC

- I.S.T Corporation

- Wuxi Shunxuan New Materials Co. Ltd.

- Zymergen Inc.

- Suzhou Kinyu Electronic Technology Co. Ltd.

Market Size Breakdown by Segment

This fully customizable report gives a detailed analysis of the colorless polyimide film Market from 2017 to 2030, based on all the relevant segments and geographies.

Based on Application

- Flexible Displays

- Flexible Solar Cells

- Flexible Printed Circuit Boards

- Lighting Equipment

Based on End User

- Medical Devices

- Solar PV Modules

- Electronics

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market size of the global colorless polyimide film market will attain USD 6,174.2 million by 2030.

The market will grow at a CAGR of 70.1% in the coming years.

The trend of increasingly demanding flexible displays in consumer electronics, particularly smartphones and laptops, is shaping the colorless polyimide film market landscape.

The flexible display category dominates the market for colorless polyimide film.

The APAC market for colorless polyimide film is the largest.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws