Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1,781.9 Million |

| 2030 Forecast | USD 3,516 Million |

| Growth Rate(CAGR) | 12% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12539

Get a Comprehensive Overview of the Closed System Transfer Devices Market Report Prepared by P&S Intelligence, Segmented Type (Membrane-to-Membrane, Needleless), Technology (Diaphragm Based, Compartmentalized, Air Cleaning/Filtration), Closing Mechanism (Push-to-Lock Systems, Click-to-Lock Systems, Luer Lock Systems, Color-to-Color Alignment System), Component (Vial Access Devices, Syringe Safety Devices, Bag/Line Access Devices, Accessories), End User (Hospitals & Clinics, Oncology Center), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1,781.9 Million |

| 2030 Forecast | USD 3,516 Million |

| Growth Rate(CAGR) | 12% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

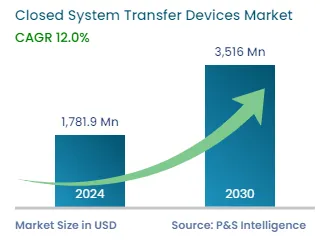

The closed system transfer devices market size stood at USD 1,781.9 million in 2024, and it is expected to grow at a compound annual growth rate of 12% between 2024 and 2030, to reach USD 3,516 million by 2030. This is ascribed to the increasing demand for CSTDs to tackle the harmful effects of drugs such as cytotoxic or antineoplastic agents used to cure cancer, antiviral drugs, hormone agents, and bioengineered drugs.

The population of the world is rising and this will trigger the demand and development of oncology drugs. With more and more increasing cases of cancer in the world, the number of health workers who prepare or administer hazardous medicines to cure cancer or workers who work in areas where they can get exposed to these agents is also rising. For instance, according to the World Health Organization, cancer is one of the leading causes of death worldwide, accounting for around 10 million deaths in 2020.

With the surging cases of cancer, the demand for curing drugs is also rising. Healthcare workers can get exposed to these drugs through accidental hand-to-mouth ingestion, skin contact, inhalation, or needle stick and sharps injuries, which can cause reproductive reactions (including infertility and congenital malformations), skin rashes, leukemia, fetal malformation, and impact bone marrow. Thus, the National Institute for Occupational Safety and Health (NIOSH) has recommended the use of closed system transfer devices (CSTDs) to eliminate the risk of these harmful reactions.

According to a survey by the American Society of Health-System Pharmacists (ASHP), around 41% of hospitals around the world use CSTDs. These can also help in eradicating the exposure from aerosols that are generated by chemotherapeutic agents and reducing surface drug contamination. Moreover, various initiatives by governments, SOPs for handling hazardous drugs, and awareness among nurses and healthcare personnel regarding the safe usage of these medications are expected to contribute to the growth of the closed system transfer devices market.

Oncology drugs are one of the most important areas of interest for pharmaceutical companies in the world. With new developments in the drugs area, there will be more treatment options available and more safety issues occur with every new medicine. According to the FDA, 207 cancer drug approvals were given in the oncology and malignant hematology field between 2016 and 2021; out of which, 14% were first-line therapies that expatriate cancer therapies earlier considered and approved to be the standard of care for their sign. With the increasing number of drugs for oncology, the requirements of using precautionary solutions are also rising, such as CSTDs.

Healthcare professionals have started using CSTDs in areas other than cancer drugs. CSTDs are used for the reconstitution of hazardous drugs into infusion bags, while preserving the sterility of the products and preventing the escape of liquids and aerosols into the environment. Now, they are being used in areas like antiviral drugs, hormone agents, and bioengineered drugs.

Viral infection is extremely pathogenic, and often there are no effective treatments existing and the risk of contamination is very high. To prevent these contaminations, CSTDs can be used that permit the rebuilding of liquid or pre-dissolved powder medicines into flexible bottles, infusion bags, or syringes, while protecting the sterility of the products, avoiding both the escape of hazardous drugs and the entry of contaminants into the system, in whatever arrangement it may occur, into the close environment. Thus, the increasing applications of CSTDs with different types of drugs are driving the market growth.

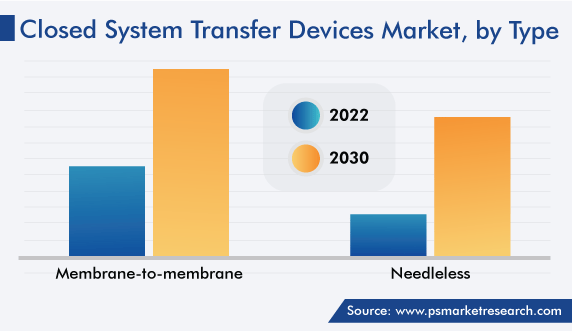

Based on type, the membrane-to-membrane category accounted for a larger revenue share, of 63%, in 2022, and it is expected to witness the same trend during the forecasted period as well. This is due to the ease of usage of these membranes and the less chance of contamination in these double-membrane devices. Also, the volume loss in this category is very less as compared to needleless. Some products that are being offered in this category by companies are the OnGuard Tevadaptor device, PhaSeal, Halo, Equashield I and II, and the SureConnect products.

On the other hand, the needleless category is expected to grow at a higher rate in the coming years. This can be due to the increasing advantage of using needleless devices such as needle-free transfer of medication and the surging product launches by key players in the industry. Some examples are ChemoClave, ChemoLock, SureConnect, Vialshield, and Texium.

On the basis of end user, the hospitals & clinics category holds the largest revenue share. This is attributed to the huge population base of cancer patients, who are being cured and handled by a large number of hospitals and clinics. Due to a large number of cancer cases and healthcare facilities, the number of healthcare workers who are working directly in contact with hazardous drugs is very high.

Moreover, the high purchasing power of hospitals is making them the biggest end users of these high-priced devices. Also, hospitals and clinics have to comply with all regulatory guidelines that are being given by regulatory bodies. Thus, these factors drive the demand for CSTDs in this category.

Based on component, the vial access category accounted for the largest share in 2022. This is due to the increasing usage of these devices by nurses for the transfer of hazardous drugs such as antineoplastic drugs from vials into the infusion chamber of the patient. It is a pressure equalization system, applying a closed expansion chamber that creates and keeps neutral pressure when diluent or air is inoculated into or enunciated from the vial.

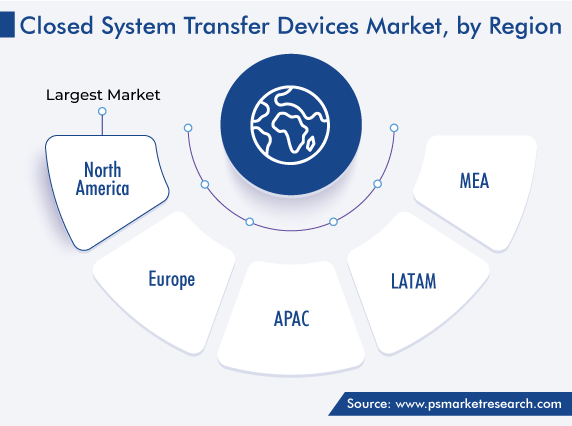

In 2022, North America accounted for the largest market share, due to the increasing awareness of healthcare workers toward hazardous drugs and their effects, and the presence of major players who are manufacturing these devices in the region. In North America, the U.S. holds a larger revenue share, owing to the large number of cancer cases in the country. For instance, according to the American Cancer Society, there were around 1.9 million new cancer cases diagnosed and 609,360 cancer deaths in the U.S.

On the other hand, the APAC market will witness the fastest growth in the coming years. This can be ascribed to the rising number of cancer cases in the region. Cancer is the second-leading cause of death after cardiovascular diseases in APAC. Also, the region accounts for 50% of the world’s new cancer cases each year. In addition, due to the increasing healthcare investments and demand for better services, major players are focusing on the region for increasing the sales of CSTDs.

There are various organizations and associations that are working toward improving global health standards to ensure the quality, safety, and benefit of medicines. The United States Pharmacopeia (USP) is one of them, which has described the practices and standards for handling hazardous drugs to promote patient safety, worker safety, and environmental protection through the use of closed system transfer devices.

Moreover, initiatives by the European Union under Article 5 of the Directive 2004/37/EC promote the protection of workers from risks related to exposure to mutagens or carcinogens at work with the use of closed systems. Also, the Austrian Ministry of Health recommends the use of closed systems and needle-free drug transfer systems for the disposal of cytotoxic drugs. In addition, the Government of Israel has mandated the use of CSTDs such as Chemfort for pharmacists during reconstitution and preparation of hazardous drugs.

Based on Type

Based on Technology

Based on Closing Mechanism

Based on Component

Based on End User

Geographical Region

The closed system transfer devices market size stood at USD 1,781.9 million in 2024.

During 2024–2030, the growth rate of the closed system transfer devices market will be around 12%.

Hospitals & Clinics are the largest end user in the closed system transfer devices market.

The major drivers of the closed system transfer devices market include the rising incidence of cancer and the increasing demand for CSTDs to tackle the harmful effects of drugs on healthcare workers.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages