Report Code: 10349 | Available Format: PDF

Clinical Laboratory Service Market Research Report: Size, Share, Key Trends, Growth Drivers, Regional Outlook, Revenue Estimation and Forecast, 2023-2030

- Report Code: 10349

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

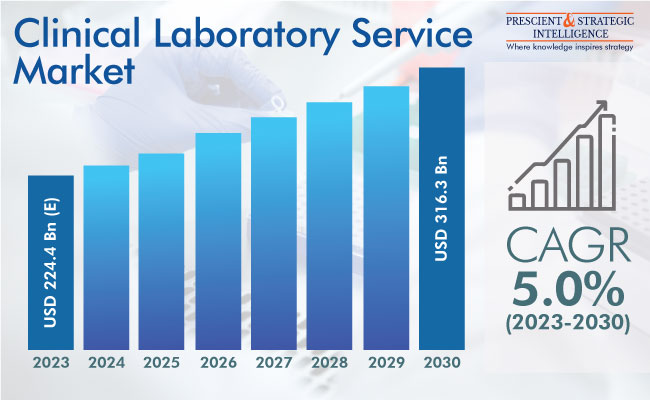

The clinical laboratory services market values USD 224.4 billion (E) in 2023, and it will grow at a rate of 5% during 2024–2030, to reach USD 316.3 billion in 2030.

The market is experiencing development because of the growing load of chronic illnesses and the rising demand for early diagnoses. Furthermore, the fast improvements in information management and sample preparation, because of the rising count of samples to test, are projected to drive the market during the forecast period.

Though there was a reduction in repetitive testing in the first three months of 2020 because of the lockdown, the market has progressively started to experience development, credited to augmented testing volume for COVID-19. There was a steady surge in the count of individuals going through COVID-19, highlighting the vital requirement for fast testing.

For instance, as of February 2022, there were around 391 million established COVID-19 cases and 5.7 million demises globally. Clinical laboratories were extensively utilized to spot and measure numerous biological agents in bodily fluids to confirm the presence of the infection. Guaranteeing the precise and timely identification of severe diseases is crucial for optimal clinical outcomes and public wellbeing.

The growing load of cancer is also projected to propel the requirement for clinical diagnostics. According to Globocan Statistics 2020, there were 19.3 million new cancer cases globally, and by 2040, it is projected to touch 30.2 million. Initial blood, urine, and sputum tests are an important part of cancer diagnosis as they help determine the presence and level of several proteins and enzymes associated with the condition.

Clinical Laboratory Services Industry Opportunities

In nations such as China and India, where access to medical diagnostic services is inadequate, there is a substantial opportunity for independent labs. Hence, the count of independent labs is growing, with over 6,900 NABL-accredited medical labs in India as of March 2022 fulfilling the rising demand for clinical services.

The number of independent labs is growing, in part, as companies are concentrating on collaborations and partnerships to improve the access to medical diagnostics. For example, in October 2022, GC Laboratories inked a new agreement with a global partner in Thailand to construct a robust diagnostics network and enlarge its presence in Southeast Asia.

Clinical Chemistry Services Are Availed of Most Widely

The type segment is dominated by the clinical chemistry category, on account of the wide usage of these techniques for studying the urine, serum, plasma, and other body fluids for the presence of various kinds of proteins and other biomolecules. Clinical chemistry techniques include spectrophotometry, electrophoresis, and immunoassays, which are widely used for an initial assessment, before more-complex and specific tests are employed.

Hospital-Based Laboratories Are Largest Revenue Contributors

The hospital-based laboratories category holds the largest revenue share, and it is projected to grow at the fastest pace in the future. This can be credited to the high count of patient tests for various severe and mild illnesses and the growing number of hospitals with fully functional clinical labs.

The rising count of outreach programs by infirmaries, to cater to the increasing number of patients with complex and severe diseases, is also projected to boost the category. For example, in 2022, Quest Diagnostics purchased a share in Summa Health’s outreach laboratory facilities in an all-cash contract. This will aid in giving patients easier access to clinical laboratory services.

The standalone laboratories category is projected to grow at a considerable pace over the projection period, because of the ongoing efforts to advance patient outcomes by offering diagnosis at lower rates. Further, standalone laboratories are located within communities and offer services free from the hassles of the lengthy hospital admission process.

Bioanalytical & Lab Chemistry Category Is Dominating Market

The bioanalytical & lab chemistry services category is dominating the industry, based on application. Bioanalytical & lab chemistry utilize an extensive variety of methods and technologies to meet diagnostic requirements. Mass spectroscopy, ELISA, immunochemistry, chromatography, and molecular biology are the most-often utilized technologies in bioanalytical & lab chemistry applications. In 2021, Labcorp introduced a bioanalytical lab in Singapore to enhance its bioanalytical existence in APAC.

Toxicology Testing Services Category To Witness Fastest Growth

The toxicology testing services category is projected to witness the fastest growth during the forecast period. Toxicology studies involve drug of abuse testing and scanning for chemicals and other poisonous elements that impact patients. This aids clinicians in forecasting future toxin impacts, confirming a diverse analysis, or suggesting a treatment. Moreover, tox screens are a vital forensic technology, especially when a poisoning is suspected.

| Report Attribute | Details |

Market Size in 2023 |

USD 224.4 Billion (E) |

Revenue Forecast in 2030 |

USD 316.3 Billion |

Growth Rate |

5.0% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

APAC Is Projected To Be Fastest-Growing Regional Industry

APAC is projected to be the fastest-developing regional industry, credited to the numerous technical research activities, high unfulfilled healthcare requirements, financial development, and advancing healthcare regulatory ecosystem. Furthermore, the optimistic changes associated with medical insurance, growing consciousness among the populace regarding prompt diagnoses, and the obtainability of high-end treatments are expected to aid the regional market’s development.

Additionally, clinical labs attained enormous importance during the COVID-19 epidemic, credited to the growing demand for testing. Since then, many major companies have been concentrating on partnerships for offering new lab testing services. So high was the increase in the demand for testing that many point-of-care testing laboratories were established in local communities, to offer rapid antigen and other simpler and quicker tests.

Similarly, because of the existence of an efficient healthcare system and repayment guidelines for laboratory tests, the increasing elderly populace, and the growing occurrence of chronic illnesses, North America is projected to witness substantial development. Additionally, the continent is home to all major biotechnology companies, which results in an easy availability of laboratory testing kits, enzymes, and consumables.

Recent Developments

In September 2022, Bionano Genomics Inc. declared the introduction of Bionano Laboratories, an association that syndicates Bionano’s optical genome mapping information services with the clinical testing facilities provided by Lineagen. It also introduced Bionano Labs’ first OGM-based laboratory-developed test.

In March 2022, Mindray introduced its new BC-700 Series hematology analyzers for mid-sized and small labs. The analyzers can perform both erythrocyte sedimentation rate (ESR) and complete blood count (CBC) tests.

Key Companies in Clinical Laboratory Service Market

- QIAGEN GmbH

- Quest Diagnostics Inc.

- OPKO Health Inc.

- Abbott Laboratories

- Siemens Healthineers

- NeoGenomics Laboratories

- Fresenius Medical Care AG and Co. KgaA

- ARUP Laboratories

- Sonic Healthcare Limited

- Laboratory Corporation of America Holdings

- Eurofins Scientific SE

- Charles River Laboratories International Inc.

- Myriad Genetics Inc.

- Merck KgaA

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws