Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 3,621.9 Million |

| 2030 Forecast | USD 7,013 Million |

| Growth Rate(CAGR) | 11.6% |

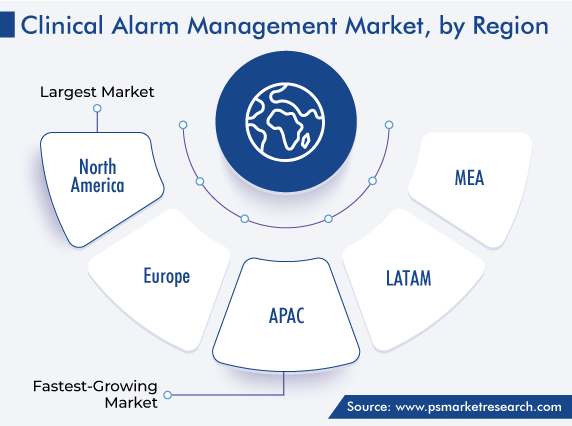

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12561

Get a Comprehensive Overview of the Clinical Alarm Management Market Report Prepared by P&S Intelligence, Segmented by Product (Nurse Call Systems, Physiological Monitors, EMR Integration Systems, Bed Alarms, Ventilators), Component (Solutions, Services), End User (Hospitals & Clinics, Home Care Settings, Ambulatory Care Centers, Long-Term Care Facilities, Specialty Centers), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 3,621.9 Million |

| 2030 Forecast | USD 7,013 Million |

| Growth Rate(CAGR) | 11.6% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global clinical alarm management market was valued at USD 3,621.9 million in 2024, which is expected to reach USD 7,013 million by 2030, growing at a CAGR of 11.6% between 2024 and 2030.

Over the years, hospitals have seen a significant surge in the adoption of technologically advanced patient care equipment. With these developments come complex and intricate monitoring tools, many of which are developed with audible alerts built into them. Now, the majority of the modern gadgets come with a working alarm. Respiratory monitoring tools, hospital beds and chairs, infusion pumps, wound vacuum devices, patient call systems, sequential compression devices, cardiac monitors, feeding pumps, and ventilators are just a few examples of the equipment commonly seen in acute care units that have built-in alarms.

The significant players are working harder than ever to differentiate themselves from rivals, which has increased the focus on technical breakthroughs at the lowest possible cost and, eventually, fueled the market expansion. For instance, in order to increase the effectiveness of care at three of its hospital locations, a German healthcare foundation has hired Ascom Holding AG, which is a Switzerland-based company, to implement the Ascom Digistat software.

The need for medical alarms is increasing quickly due to the rising patient population and growing healthcare demand. These alert systems have the ability to reduce expenditure and chances of medical errors, thereby enabling improved patient care, which is a major driver for the industry growth given the rising disease occurrence and expanding senior population.

Additionally, there has been a stark increase in the number of facilities and institutions for elderly people and awareness of the value of clinical alarm management solutions in these facilities. Reducing alert fatigue has become crucial for protecting patients, by freeing up the healthcare staff to respond to the alerts that actually require action. In order to find the core cause of alert fatigue, solutions necessitate a multidisciplinary examination at the systems level.

There are several benefits offered by clinical alarm management systems, including operational, financial, and clinical. Reduced alert fatigue, higher employee satisfaction, less exhaustion, better efficiency, and optimized nurse resource usage are among the operational advantages.

Moreover, the decrease in personnel turnover, shorter hospital stays, prevention of patient harm, and elimination of the probability of the possibly expensive ramifications of ICU transfers, prolonged hospital stays, and litigation are just a few of the financial advantages. In addition, the clinical advantages include improved sleep and rest, fewer non-actionable alerts, shorter alarm protocol gaps, enhanced patient safety and care, and fewer missed actionable alarms.

The nurse call systems category held the largest share, of over 26%, in 2022 globally. This is because product advances fueled by automation and wireless technology, as well as the desire to enhance clinical workflow and lower operational expenses for the medical institution, while maximizing the use of the existing resources, are responsible for this prominent share.

Major industry participants are also concentrating on catering to the requirement for improved patient response times, as well as minimized nurse fatigue, in light of the increase in the count of home healthcare and nursing facilities. By integrating their products with various diagnostic technologies and solutions, vendors also try to set their products apart from the competition.

An increasing number of medical facilities are implementing real-time location systems (RTLS) integrated with the wireless technology. To improve productivity, RTLS enables healthcare institutions to monitor the movement of staff and equipment. One such integrated platform is Televic's AQURA Care Communication, which includes modules for nurse call, personal localization, patient and staff safety, alert delivery, personal mobility, and mediator control. During the projection period, it is predicted that the increasing financing for wireless technologies and IP-based nurse call systems would accelerate the industry growth.

Additionally, the EMR integration systems category is predicted to witness the highest CAGR, of around 10.6%, during the forecast period. This is due to the growing pace of digitalization in healthcare, spiking use of EHR and EMR solutions from clinics to hospitals, and growing interoperability across digital healthcare solutions. Moreover, the rising patient load, rigorous regulatory mandates for patient care, encouragement to implement hospital EMR systems, to improve the quality and comprehensiveness of patient records; as well as the various advantages of EMRs, in terms of data security, contribute to the sector’s growth.

The bed alarm category is also predicted to grow significantly during this decade. The easy and quick access to patient health information provided by the bed alarm, for quick treatment, enhances the category’s growth. The older population's widespread use of these alarms to determine their health condition greatly surges the sector’s revenue.

On the basis of component, the solutions category held the larger share in 2022, because connected care technologies are increasingly being used in healthcare. Furthermore, the top firms are taking initiatives such as the launch of alert fatigue solutions that are tailored to meet the institution’s needs, which would further propel the category’s growth. The strong need to lessen alert fatigue and the number of adverse patient events and false or bothersome alerts and ensure compliance with the regulatory requirements will continue to propel the adoption of advanced clinical alarm management software.

Further, due to the initiatives by both public and private medical institutions, expanding service offerings of top players, and increasing demand to reduce the risks to patient safety, the services category is expected to witness the higher growth rate in the coming years. Other factors that are predicted to drive the demand for the associated services include technological enhancements and the growing number of service providers.

Over the years, there has been a tremendous increase in the provision of consulting services for alert management by major firms. For instance, Philips’ alarm and noise management consulting services are geared toward cutting down on unwanted noise and non-actionable alarms, while unifying alarm management procedures, thereby enhancing patient care.

Drive strategic growth with comprehensive market analysis

North America held the largest market share, of over 46%, in 2022. The biggest reasons for this sizable share are its well-established healthcare system, development of new products, growing instances of alert fatigue, favorable healthcare regulatory environment in both the U.S. and Canada, and the presence of major competitors in the industry.

Furthermore, hospital consolidation in the region is happening quickly, which has increased competitiveness. Consequently, in order to enhance patient care, healthcare organizations are making significant investments in infrastructure upgrades, such as in alert management systems.

Additionally, it is predicted that the expansion of the regional clinical alarm management market will be fueled by the presence of a sizable population pool, increasing healthcare spending, and rising focus on offering top-notch healthcare services. This is due to the fact that one or more chronic diseases, such as diabetes, cancer, heart disease, and stroke, affect six out of ten Americans. In addition, the primary causes of death and disability in the U.S. are chronic diseases, which, in turn, fuels the demand for such alarms in the healthcare field.

Based on Product

Based on Component

Based on End User

Geographical Analysis

The market for clinical alarm management solutions valued USD 3,621.9 million in 2024.

The clinical alarm management industry is driven by the rising incidence of alert fatigue in healthcare settings and burgeoning adoption of EHRs.

Nurse call systems are sold the most widely in the market for clinical alarm management solutions.

Solutions are the larger category in the clinical alarm management industry.

North America is the largest market for clinical alarm management solutions, while APAC will witness their fastest-growing adoption.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages