Key Highlights

| Study Period | 2019 - 2032 |

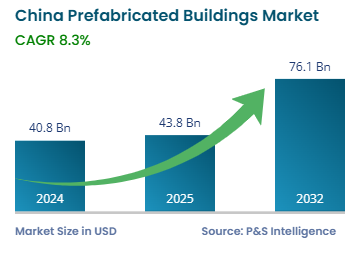

| Market Size in 2024 | USD 40.8 Billion |

| Market Size in 2025 | USD 43.8 Billion |

| Market Size by 2032 | USD 76.1 Billion |

| Projected CAGR | 8.3% |

| Largest Region | East |

| Fastest Growing Region | East |

| Market Structure | Fragmented |

Report Code: 13610

This Report Provides In-Depth Analysis of the China Prefabricated Buildings Market Report Prepared by P&S Intelligence, Segmented by Product (Skeleton, Panel, Cellular, Combined), Application (Residential, Commercial, Industrial), Modular (Bathroom pods, Kitchenettes), Material (Concrete, Glass, Metal, Timber), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 40.8 Billion |

| Market Size in 2025 | USD 43.8 Billion |

| Market Size by 2032 | USD 76.1 Billion |

| Projected CAGR | 8.3% |

| Largest Region | East |

| Fastest Growing Region | East |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The Chinese prefabricated building market size was worth USD 40.8 billion in 2024, and it will grow by 8.3% during 2025–2032, to reach USD 76.1 billion by 2032.

The market growth is driven by the strong government support for infrastructure development, increasing urban population, and need for eco-friendliness, affordability, minimal waste, and high labor efficiency. The government’s green infrastructure rules and the rising use of digital tools also drive this market. As per the World Bank, China's urban growth rate increased from around 19% in 1980 to 64.6% in 2023. Additionally, various government projections and national plans expect the urban population to reach over 70% of the total by 2030 and 75–80% by 2035.

The 14th Five-Year Plan of the MoHURD mandates that 30% of the construction in urban areas by 2025 should be prefabricated. Moreover, tax incentives, green-building certifications, and low-interest loans promote market expansion. Additionally, the governments of the provinces of Zhejiang, Jiangsu, and Guangdong have created pilot projects, such as hospitals and schools, to promote prefabricated construction.

The panel category held the largest market share, of 35%, in 2024, since they provide easy-to-use methods, flexible designs, and speedy delivery. This makes them ideal for residential and commercial buildings, the construction of which is underway on a large scale in the country. As per government sources, RMB 6,888.0 billion worth of new commercial buildings were sold in the People’s Republic between January and September 2024. The wall, roof, and floor panels in these systems are manufactured in factories and then assembled at the project site.

The cellular category will have the greatest CAGR, of 8.3%. This system consists of kitchen units, bathroom pods, and 3D building blocks, which are completely manufactured in factories. These systems are widely preferred for hospitals and hotels for better quality. The CIMC modular student housing project is being built the prefabricated way for quick completion and high quality.

The products analyzed in this report are:

The residential category held the largest market share, of 40% in 2024, because of the rising need for cost-effective houses in high-density cities. As per reports, China’s population was approximately 1.408 billion in 2024, over half of which lived in cities. The rapid urban growth and the need for better efficiency and lower emissions from construction impel real estate firms to take initiatives for quicker construction with reduced ecological impact. A new affordable rental housing program has been launched by the government to build a million units for the young and new urban population in top-tier cities.

The commercial category will have the highest CAGR, of 9.5%, due to the rising demand for new offices, shopping malls, hotels, schools, and other structures, especially in tier-1 and tier-2 cities. These constructions are affordable, require less manual labor, and offer better quality. The continuous proliferation in the number of international companies opening regional offices in cities such as Beijing, Shanghai, Chengdu, Shenzhen, Hong Kong, Guangzhou, Chongqing, and Macao drives the demand for affordable business spaces that are available in quick time.

The applications analyzed in this report are:

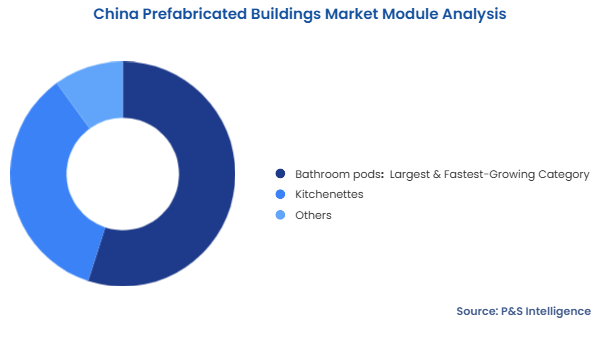

The bathroom pods category held the largest market share, of 55% in 2024, and they will have the highest CAGR, of 10%, during the forecast period. This is due to the simple installation methods, time-saving benefits, and practicality for large projects, such as hospitals. These pods are manufactured in factories with fully pre-assembled utilities, which reduces the need for field labor. The rising demand for modular and fast prefabricated solutions and the strong government support for clean and modular buildings drive the demand for prefabricated bathroom pods.

The modules analyzed in this report are:

The concrete category held the largest market share, of 55%, in 2024, because it provides high strength, durability, and heat resistance, which makes it ideal for the commercial and residential sectors. They also provide enhanced thermal efficiency, affordable mass production in factories for a controlled environment, and accessibility to modular designs.

The metal category will have the highest CAGR, of 9.2%, due to their low weight, high strength, construction-friendliness, and increasing use in modern prefab buildings, especially commercial ones. The high demand for sustainable solutions and advances in metalworking technologies drive the growth. The increase in the number of warehouses and implementation of various manufacturing projects also boost the demand for prefabricated metallic structures, as they are easy to assemble.

The materials analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The East region held the largest market share, of 35% in 2024, and it will have the highest CAGR, of 8.5%, during the forecast period. This is due to the high rate of urbanization, strong government support, direct access to construction materials and factories, and large prefabrication activity in cities, such as Shanghai, Shenzhen, and Guangzhou. This region has supportive policies, an established supply chain, and various public projects in housing, schools, and hospitals. Local authorities in Jiangsu and Shanghai provide subsidies and land grants for quick, affordable, and eco-friendly construction. This region also possesses advanced technologies and skilled labor, making it a leading hub for prefab construction. The region is relatively flat, features a milder climate than the south, west, and north of the country, and is the only one with seaports.

The regions analyzed in this report are:

The market is fragmented due to the presence of many local and regional players operating in various segments, such as manufacturing components, including panels and steel frames; and on-site installation. Various SMEs focus on providing components to projects in their local areas, creating uneven building quality with significant variations. As a result, no single company controls the market, making it highly competitive.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages