Market Statistics

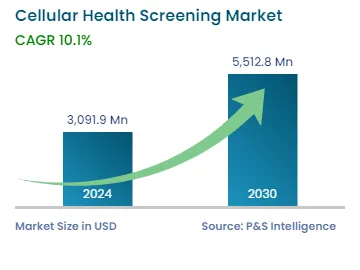

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 3,091.9 Million |

| 2030 Forecast | USD 5,512.8 Million |

| Growth Rate(CAGR) | 10.1% |

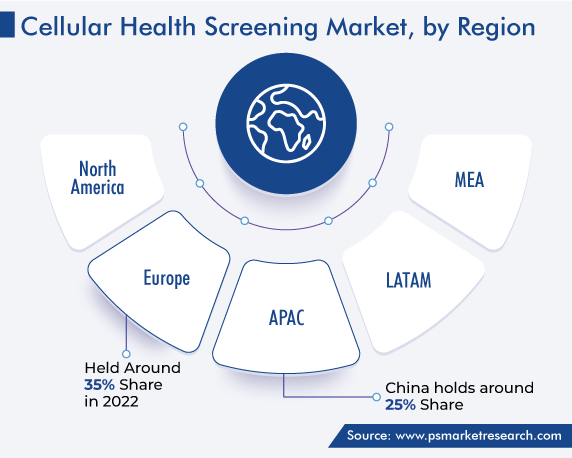

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12663

Get a Comprehensive Overview of the Cellular Health Screening Market Report Prepared by P&S Intelligence, Segmented by Test Type (Single Test Panels, Multi Test Panels), Sample Type (Blood, Urine), Collection Site (Home, Offices, Hospitals, Diagnostic Labs), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 3,091.9 Million |

| 2030 Forecast | USD 5,512.8 Million |

| Growth Rate(CAGR) | 10.1% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The cellular health screening market size stood at USD 3,091.9 million in 2024, and it is expected to advance at a compound annual growth rate of 10.1% during 2024–2030, to reach USD 5,512.8 million by 2030. This is primarily ascribed to the rising applications of cellular health screening in personalized medicine, detecting diseases at an early stage, helping preventive care, and identifying different health-related problems; the increasing number of awareness campaigns; the growing adoption of telomere performance programs; and the surging prevalence of chronic illnesses mainly cancer across the world.

For instance, according to government reports, chronic diseases are responsible for approximately 75% of deaths all over the world, and around 85% of premature deaths are reported in low- and middle-income countries.

According to various research papers, telomere length is correlated with cancer, and the shortening of telomere length means that an individual is at a higher risk of cancer. Moreover, the telomere length is affected by several factors, such as inflammation, infection, and stress, which cause oxidative stress that leads to telomere degradation. It also occurs due to aging, diseases that arise at an older age, lifestyle changes, and genetic and environmental disorders. Thus, the increasing prevalence of chronic diseases and cancer is projected to contribute to the growth of the market during the forecast period.

Moreover, the rising number of product launches by key players for testing and the surging trend of R&D investments in the life sciences industry are contributing to the market growth. For instance, in May 2022, Qiagen launched QIAstat-Dx Rise to expand its testing portfolio, and it received a CE marking to run new respiratory and gastrointestinal panels. The product can process around 56 tests with enhanced walk-away efficiency in an eight-hour shift.

The increasing prevalence of cancer across different regions is driving the market growth. It has been evaluated on the basis of government sites, in the U.S., approximately 1.9 million new cases of cancer were diagnosed in 2022 and around 609,360 deaths were reported. Cell analyzing helps in the detection of malignancies before it spreads all over the body so as to provide proper treatment on time. The identification of malignancy before the appearance of symptoms is possible with the help of cell health screening.

Moreover, smoking prevalence is higher among Alaskan and American women than men, and about a quarter of people suffer from such issues. Due to a large number of cancer cases, it become important to study the physiology and anatomy of a . In order to avoid the spreading of malignancies, it is necessary that they should be detected at an early stage.

The increasing demand for personalized medicine is driving the demand for cell health screening because it helps in providing more effective and accurate treatment coupled with customized disease-prevention strategies. Several times, medical professionals inaccurately diagnose diseases. The inaccurate diagnosis harms patients, which can further result in death or permanent disability. Due to such incidences, the demand for personalized medicine has increased and will continue with the same over the coming years.

The medicine is prescribed on the basis of individual characteristics of patients and these characteristics are evaluated from cell health screening. Personalized medicine also helps in minimizing trial and error prescribing of drugs and also avoidance of adverse drug reactions. Moreover, this medicine is responsible for the investigation of insights into diseases with the usage of advanced and innovative technology and it also helps in providing patients with the required treatment. In addition, biomarkers are used for determining responses and risks of treatments received by patients. Hence, the surging demand for personalized medicine is contributing to the growth of the market.

Based on test type, the single-test panel category account for a major share of the market. This is attributed to its cost-effectiveness, labor efficiency, and increased potential for automation. Among single-panel tests, the demand for telomere single-panel tests is expected to grow at the highest rate in the coming years. This can be because these offer accurate information, aid in measuring the length of telomere, and help in determining cell age.

Whereas, the multi-test panel category is expected to witness the fastest growth in the forecast period. This can be attributed to their higher efficiency, increased clinical diagnostic sensitivity and specificity, reduced cost, and high precision.

Based on sample type, the urine sample category is projected to record the fastest growth in the coming years. This can be because it is widely used for detecting and managing a large number of disorders, such as kidney diseases, urinary tract infections, and diabetes. Moreover, collecting urine is a convenient and non-invasive method and it can be done by patients and does not require any equipment or technician. In addition, a urine sample is also used for the identification of heavy metals and oxidative stress and cell health analysis.

Whereas, the blood sample category dominates the market, as it helps in providing highly accurate and faster results, and due to the rising number of launches of autonomous devices for the collection of blood samples. For instance, Vitestro announced the launch of an autonomous device for blood collection, in May 2022. The device links artificial intelligence and ultrasound-guided 3D reconstruction with robotic needle insertion in order to have an accurate quantity of blood.

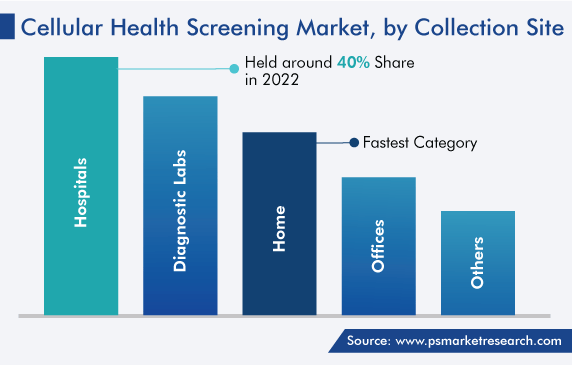

Based on collection site, the hospitals category holds the largest revenue share in the market. This is due to the increasing healthcare expenditure and the presence of a large number of hospitals all over the world, where diagnosis and treatments are provided simultaneously, and they have advanced diagnostic techniques and medical professionals for particular tests for the identification of diseases.

Moreover, in recent years, various public organizations have made huge investments to upgrade the infrastructure of hospitals and their services. For instance, in 2021, the U.S. spent $576.9 billion on overall healthcare expenditure, which was an increase of 7.7% from 2020. Moreover, India spends around 3% of GDP on healthcare expenditure. Similarly, according to the Asia-Pacific Observatory on Health Systems and Policies, China has improved its healthcare infrastructure in recent years with significant government investments, to increase the accessibility of health services.

Whereas, the home category is expected to show the fastest growth in the coming few years. This can be ascribed to the rising adoption of self-sampling and growing awareness about health. The self-sampling is rapidly adopted because it eliminates the need for visiting hospitals for tests and is a user-friendly method.

Drive strategic growth with comprehensive market analysis

North America has the leading position in the cellular health screening market, and it will hold the same position till 2030, with a value of USD 2.5 billion. This is attributed to the increasing government funding for preventive healthcare, the surging adoption of new technologies, the growing awareness about personalized medicine, and the rising prevalence of chronic and infectious diseases, in the region. In North America, the U.S. market holds the leading position, and it will grow at a CAGR of 10% during the forecast period. This is attributed to the robust healthcare infrastructure and the existence of a large number of key players in the country.

Furthermore, the European market is showing a significant growth rate. This is ascribed to the growing geriatric population, the increasing incidences of chronic diseases, and the surging adoption of advanced methods of screening for effective and preventive treatment of various diseases in the region.

This report offers deep insights into the cellular health screening industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

By Test Type

By Sample Type

By Collection Site

Regional Analysis

The cellular health screening market size stood at USD 3,091.9 million in 2024.

During 2024–2030, the growth rate of the cellular health screening market will be 10.1%.

Blood is the largest sample type in the cellular health screening market.

The major drivers of the cellular health screening market include the increasing focus on healthy life expectancy, the rising healthcare expenditure, the surging prevalence of diseases, and the growing geriatric population.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages