Report Code: 12176 | Available Format: PDF | Pages: 180

Medical Cartridges Market Research Report: By Material Type (Glass, Plastic), Size (Less than 3 ml, 3 ml to 5 ml, 6 ml to 10 ml, More than 10 ml), End User (Pharmaceutical and Biotech Companies, Biomedical Research Organizations) - Global Industry Revenue Estimation to 2030

- Report Code: 12176

- Available Format: PDF

- Pages: 180

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

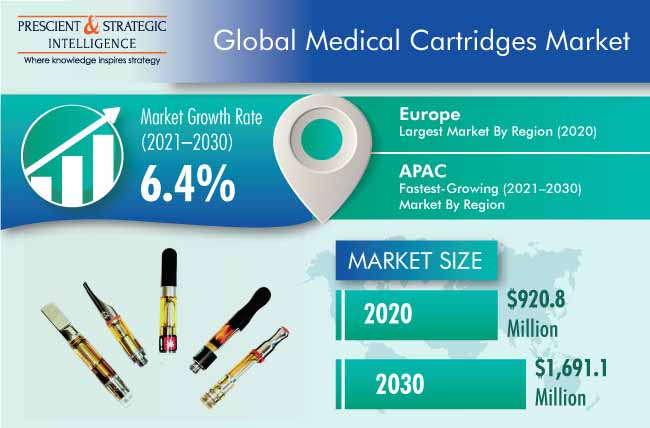

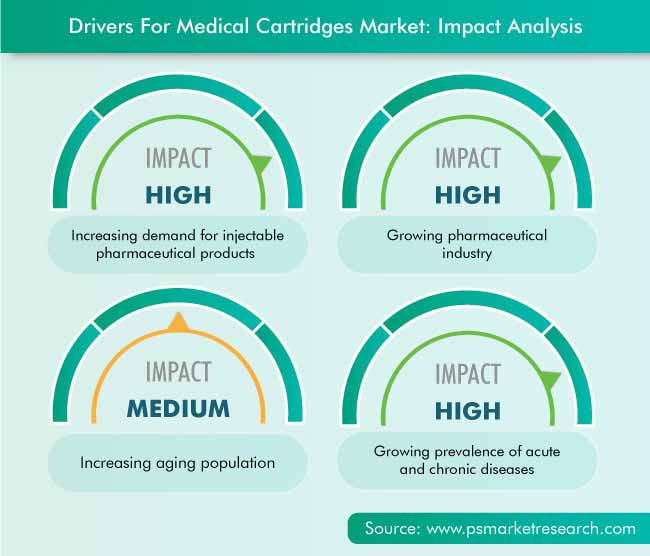

The global medical cartridges market generated revenue of $920.8 million in 2020, and it is expected to grow at a CAGR of 6.4% during the forecast period (2021–2030). Factors that are responsible for the growth of the market include growing pharmaceutical industry and increasing demand for injectable pharmaceutical products. Furthermore, surging aging population and rising prevalence of acute and chronic diseases are projected to boost the demand for medical cartridges.

The COVID-19 pandemic has made governments across the globe to take necessary measures in order to stop the spread of the virus. Several restrictions, such as social distancing, lockdowns, partial or full closure of factories, and temporary suspension of import and export activities, have been imposed in order to contain the virus. These restrictions have also affected the operations of hospitals and nursing homes, resulting in reduced number of hospital visits by non-COVID patients. Also, workflow of the manufacturing industry has been obstructed, which ultimately decreasing the productivity.

Due to Higher Adoption by Pharmaceutical Packaging, Glass Category Led the Market

Based on material type, the medical cartridges market is categorized into glass and plastic. The glass category held larger share in the industry in 2020. Furthermore, the category is also expected to witness higher CAGR during 2021–2030. The higher demand for glass cartridges is mainly due the inert qualities of glass that prevents any type of reaction between the drug and the cartridge. Furthermore, glass walls also prevent the contamination of pharmaceutical products stored within them, by not letting gases and other volatile substances to enter the chamber.

Higher Use of Cartridges in Drug Delivery Devices Supports the Growth of Pharmaceutical and Biotech Companies Category

On the basis of end user, the market for medical cartridges is classified into pharmaceutical and biotech companies, biomedical research organizations, and others. Among these, the pharmaceutical and biotech companies held the largest market share in 2020. Furthermore, the category is also expected to witness the same trend in the forecast period. The highest use of cartridges by these companies is mainly because of the technological advancements in parenteral drug delivery devices, including pen injectors and on-body injectors, and increase in adoption of such devices.

Due to Rising Prevalence of Diabetes, Less than 3 ml Category Led the Market

Based on size, the medical cartridges market is categorized into of less than 3 ml, 3 to 5 ml, 6 to 10 ml, and more than 10 ml. Out of these, the less than 3 ml category held the largest market share in 2020. This is majorly due to the rising cases for diabetes, increasing affordability of insulin devices, advancements in drug delivery systems, and growing awareness for the treatment of the disease.

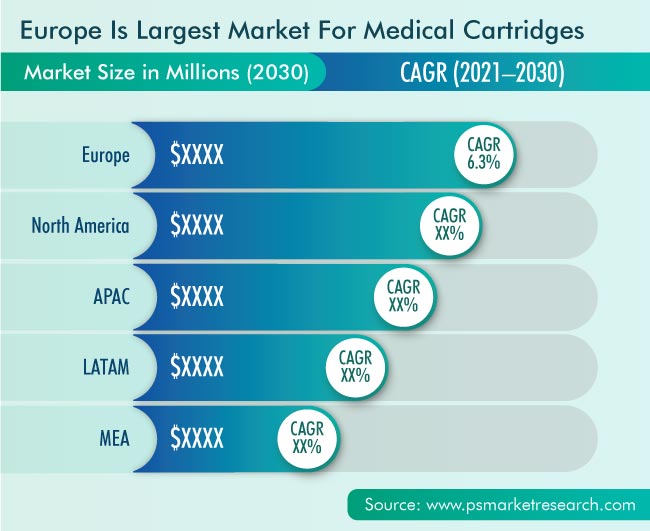

Europe Accounted for Largest Market Share due to Rising Healthcare Expenditure

Geographically, Europe was the largest market for medical cartridges in 2020. This is mainly attributed to the rising prevalence diabetes in the region. Furthermore, sedentary lifestyle of people in Europe is giving rise to obesity. For instance, according to the IDF Diabetes Atlas Ninth Edition, around 59 million adults aged 20–79 years had diabetes in 2019.

On the other hand, the Asia-Pacific (APAC) medical cartridges market is expected to witness the fastest growth during the forecast period, owing to the increasing geriatric population, growing prevalence of diabetes, and rising healthcare expenditure in the region.

Increasing Use of Cartridges for Diagnostic Applications Is a Key Market Trend

The demand for cartridges has increased, due to their rising usage in diagnostic applications, such as computed tomography (CT) scans and magnetic resonance imaging (MRI) tests. With the rise in cases of chronic diseases, such as cancer, volume of such diagnostic tests has increased. For instance, according to the World Health Organization (WHO), the number of new cancer cases registered in 2018 was 17,036,900, which increased to 19,292,789 in 2020. Thus, with the surging need for such tests, the demand for high-volume cartridges is increasing.

Growing Pharmaceutical Industry Leading to Rising Demand for Cartridges

The growing pharmaceutical industry plays a pivotal role in the growth of the market for medical cartridges. The industry produces biologics and biosimilar drugs for the management of various chronic diseases, such as cancer, diabetes, and rheumatoid arthritis. Some biopharmaceutical products are developed and manufactured in the form of injectable therapeutic agents, which are administered through vials, cartridges, and prefilled syringes.

| Report Attribute | Details |

Historical Years |

2014-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$920.8 Million |

Market Size Forecast in 2030 |

$1,691.1 Million |

Forecast Period CAGR |

6.4% |

Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Regional and Country Breakdown; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis; Company Profiling |

Market Size by Segments |

By Material Type; By End User; By Size, By Region |

Secondary Sources and References (Partial List) |

American Cancer Society; American Diabetes Association; Association of Diagnostics Manufacturers of India; Association of Indian Medical Device Industry; Association of Medical Diagnostics Manufacturers; Association of the Diagnostics Industry; British In Vitro Diagnostic Association; Canada Diabetes Association; Center for Medicare & Medicaid Services; Center for Disease Control and Prevention; China National Drug Administration |

Explore more about this report - Request free sample

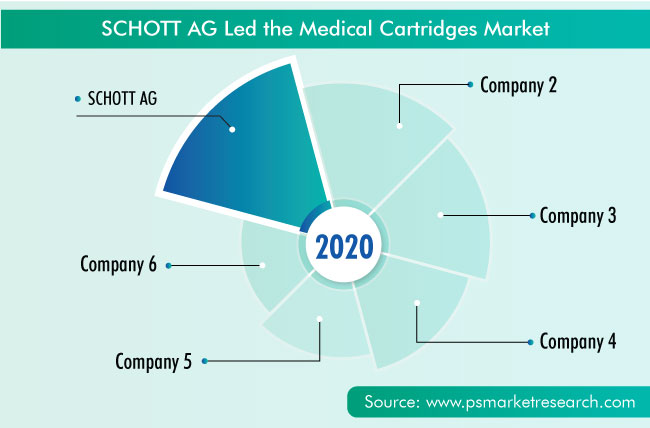

Players Are Actively Involved in Expansions to Improve Market Position

The global medical cartridges market is consolidated in nature, with the presence of few key players. Some of the major players in the industry include SCHOTT AG, Gerresheimer AG, Stevanato Group, Nipro Corporation, Baxter International Inc., and Thermo Fisher Scientific Inc.

In recent years, the players in the cartridge industry have been involved in expansions in order to improve their market position. For instance:

- In December 2020, SCHOTT AG established a new pharmaceutical tubing factory in Zhejiang Province, China, to manufacture FIOLAX borosilicate glass tubing for vials, cartridges, ampoules, and syringes. The factory is equipped with state-of-the-art production technology and an initial capacity of 20,000 tons of glass per year.

- In October 2019, Gerresheimer AG opened a new innovation center named Gx Glass Innovation and Technology Center in Vineland, New Jersey, the U.S., to support the development in pharmaceutical glass, primary glass packaging products, and related technologies and digitized processes.

Some of Key Players in Medical Cartridges Market Include:

-

Stevanato Group

-

SCHOTT AG

-

Gerresheimer AG

-

Nipro Corporation

-

Baxter International Inc.

-

Thermo Fisher Scientific Inc.

-

Merck KGaA

-

Transcoject GmbH

-

Pierrel S.p.A

-

AptarGroup Inc.

-

Novocol Pharma

Market Size Breakdown by Segment

The global medical cartridges market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Material Type

- Glass

- Plastic

Based on Size

- Less than 3 ml

- 3 ml to 5 ml

- 6 ml to 10 ml

- More than 10 ml

Based on End User

- Pharmaceutical and Biotech Companies

- Biomedical Research Organizations

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Netherlands

- APAC

- China

- Japan

- India

- Australia

- LATAM

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- South Africa

- U.A.E.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws