Market Statistics

| Study Period | 2019 - 2030 |

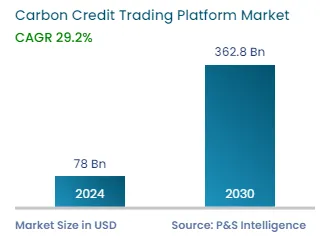

| 2019 Market Size | USD 78 Billion |

| 2030 Forecast | USD 362.8 Billion |

| Growth Rate(CAGR) | 29.2% |

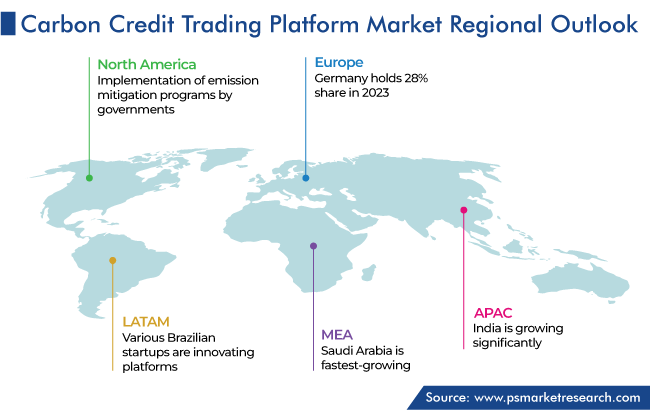

| Largest Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Report Code: 12528

Get a Comprehensive Overview of the Carbon Credit Trading Platform Market Report Prepared by P&S Intelligence, Segmented by Type (Voluntary, Regulated), System Type (Cap and Trade, Baseline and Credit), End Use (Industrial, Utilities, Energy, Petrochemical, Aviation), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2019 Market Size | USD 78 Billion |

| 2030 Forecast | USD 362.8 Billion |

| Growth Rate(CAGR) | 29.2% |

| Largest Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The global carbon credit trading platform market accounted for a size of USD 78 billion in 2024, and it is set to touch USD 362.8 billion by 2030, advancing at a compound annual growth rate of 29.2% during 2024–2030. The market is driven by the burgeoning GHG emissions, growing number of companies announcing net-zero commitments, and augmenting number of carbon offset programs.

To meets the Paris Agreement's goal of limiting global warming to 1.5 °C, emissions must be lowered by 45% by 2030 and completely eliminated by 2050. The growing number of smart cities, companies, and other institutions have made commitments to achieve net-zero emissions. More than 70 nations have established a net-zero target, which accounts for nearly 76% of global emissions and includes the three greatest polluters: China, the U.S., and the European Union.

With the help of the Science Based Targets initiative, more than 3,000 companies and financial institutions are reducing their emissions in accordance with climate science. In addition, more than 400 financial organizations, over 1000 educational institutions, and over 1000 towns have signed on to the Race to Zero, promising to take strict and immediate action to cut global emissions in half by 2030.

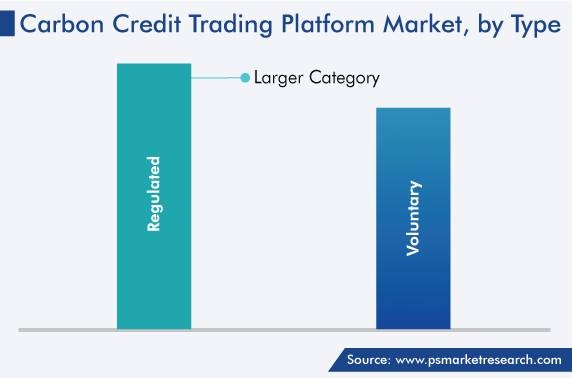

The cap and trade category held the larger share of more than 66% in 2023. It is a system that establishes a "cap" on maximum emissions to reduce aggregate emissions from a group of emitters. Moreover, it is referred to be a market-based approach to lower total pollutant emissions and promote corporate investment in fossil fuel substitutes and energy efficiency.

A typical program starts by setting a "cap" on the total amount of pollutants that can be released. The government then grants the authority to emit pollutants through emissions permits by establishing a maximum limit on emissions. An emissions allowance is a permit to emit pollutants; the cap places a limitation on the overall number of allowances. These allowances become a price signal for the cost of emitting when corporations buy and sell them because they are tradable, bankable, and rare.

Moreover, cap-and-trade has helped cut emissions on a global scale. Several UN member nations adopted a cap-and-trade system under the Kyoto Protocol to reduce greenhouse gas emissions. To decrease ozone-depleting pollutants, the Montreal Protocol successfully developed a cap-and-trade system. Moreover, Europe's cap-and-trade scheme resulted in a reduction in greenhouse gas emissions. Furthermore, emissions have decreased by 29% in 2018 since the Emissions Trading System of the European Union began in 2005, capping emissions from fixed structures.

The voluntary category is expected to grow faster with a CAGR of more than 30.3% during the forecast period. The voluntary carbon market is expanding and becoming more significant in terms of controlling global warming. A market that could support businesses' efforts to reduce their own emissions is emerging, as corporate leaders make ever-more ambitious commitments to reduce global greenhouse gas (GHG) emissions. This is the market for voluntary carbon credits.

Using voluntary carbon credits, the private funding is directed to climate change projects that would not otherwise be able to start. Moreover, other advantages of such initiatives are enhancements to public health, reduction of pollution, preservation of biodiversity, and the development of jobs. Moreover, carbon credits also encourage spending on the innovation needed to bring down the price of new climate technologies. The mobilization of finance to the Global South, where there is the greatest potential for financially viable nature-based emissions-reduction projects, would also be facilitated by scaled-up voluntary carbon markets.

The industrial sector held the largest share, of around 38%, in 2023. While producing goods essential to the contemporary way of life, heavy industry also contributes to almost 40% of the world's carbon dioxide emissions. The top three carbon-emitting industries are steel, cement, and chemicals, which are also among the hardest to decarbonize due to both technical and economic factors. Technical factors include the requirement for process emissions of CO2, as well as long asset lives, capital intensity, low-profit margins, and trade exposure. The need for carbon credit trading platforms is being driven by businesses' concentration on implementing decarbonization initiatives to combat climate change.

Moreover, the utilities category held a significant share in the carbon credit trading platform market in 2023. Moreover, power companies are focusing on innovative methods to reduce carbon emissions. Furthermore, fossil fuels are burned to produce the heat required to power steam turbines, which results in the production of CO2, the main heat-trapping greenhouse gas that causes global warming, and accounts for around 40% of all CO2 emissions worldwide. Thus, companies are adopting smart electric grid technologies that may be able to cut CO2 emissions.

The three main sectors of the electric grid are generating, transmission and distribution, and consumption. Moreover, renewable energy sources are used in smart generation. Similarly, smart transmission and distribution depend on maximizing the overhead transmission lines, underground cables, transformers, and substations that are already in place so that future generating capacities are kept to a minimum. Furthermore, utilizing more efficient tools, such as energy-saving lighting fixtures, will enable smart houses and hybrid plug-in electric vehicle technologies, which, in turn, will depend on smart consumption.

The world may need to remove billions of tons of carbon dioxide from the atmosphere annually by the middle of the century, in addition, to making rapid cuts to emissions to keep warming to 2 °C or bring the climate back into a more stable range.

Planting trees, creating carbon-sucking machinery, and dispersing carbon-absorbing minerals are examples of current technological and natural solutions. As they create and implement new scalable carbon capture technologies, such as oxyfuel combustion capture, that will enable them to stop the flow and remove the historical carbon dioxide previously emitted. The amount of money invested globally in carbon capture, utilization, and storage increased more than fourfold last year to USD 1.44 billion, up from less than 0.5% of the total amount invested in sustainable energy through 2020. Moreover, startups in carbon removal are anticipated to reach USD 1 trillion by 2050.

However, many solutions require investment to increase their commercial viability and enable their widespread deployment. Moreover, governments, major corporations, large tech, and venture capital firms are all responding with commitments and investments in a market that wasn't even there a few years ago. Similarly, Alphabet, Microsoft, and Salesforce, three major heavyweights in the IT industry, pledged to invest USD 500 million in innovative climate technology that will remove carbon dioxide from the environment. Salesforce has pledged to invest USD 100 million in carbon removal credits as part of its bigger pledge, while Microsoft has already committed to removing more carbon dioxide from the atmosphere than it emits by 2030.

Drive strategic growth with comprehensive market analysis

The European region held the largest share, of 34%, in 2023. The EU Emissions Trading System (ETS) is a pillar of the EU's climate change strategy and its primary strategy for lowering greenhouse gas emissions in an efficient and cost-effective manner. It was the first significant carbon market in the world and continues to be the largest.

The two most important economic entities in addressing the climate catastrophe are governments and businesses. Moreover, startups are innovating in this area to make it easier for people to adopt greener practices. In the EU, one such action is being done through carbon credits and increased oversight over carbon use. The EU ETS, which internalizes the costs of CO2 and utilizes a price signal to stimulate the transformation to a climate-neutral business, has been in effect for energy-intensive industries since 2005.

Following news that EU legislators were considering significant adjustments in the carbon market and increasing energy generation from non-polluting sources, EU carbon permits traded at a record EUR 98.5 in February of this year. If businesses emit more CO2 than their emission allowances have allowed for, they risk a fine. These permits will be put up for auction after 2027, and whether or not a price corridor is still required will be decided in 2025. Additionally, fewer allowances are being granted each year. Another choice available for businesses is to purchase credits from initiatives that reduce emissions and help with carbon offsetting.

Moreover, the APAC market is predicted to grow fastest during the forecast period, due to pledges made by nations at the most recent United Nations Climate Change Conference (COP26), including APAC, which also committed to a variety of net-zero targets. As part of its attempts to achieve its net-zero emissions targets by or around 2050, Singapore stated in February that it intends to raise its carbon prices in 2024. In addition, the government declared that companies could offset up to 5% of their taxable emissions using high-quality foreign carbon credits.

Furthermore, China's carbon market, established in 2021 and presently restricted to the power generation industry, may expand more quickly than planned to eight additional industries, including steel, nonferrous metals, chemicals, building materials, and refining and petrochemicals. The relative growth and success of China's market, driven by enhanced regulatory focus, could establish a favorable trend for the rest of the region.

Although there are many other projects that can produce carbon credits, their increasing importance as the main market-based approach to stop deforestation will increase investments in natural resource management in the region. In the future years, forestry and land-use projects, the most popular form of offset offered on carbon credit trading, will get a large portion of the funding obtained in Asia's developing carbon market.

To aid in the post-pandemic recovery, governments in recipient nations across Asia, the region are eager to take advantage of expanding financing options, including carbon credit. For instance, it is predicted that by 2030, Southeast Asia Market will generate USD 10 billion in yearly economic prospects.

This report offers deep insights into the carbon credit trading platform industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Type

Based on System Type

Based on End Use

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages