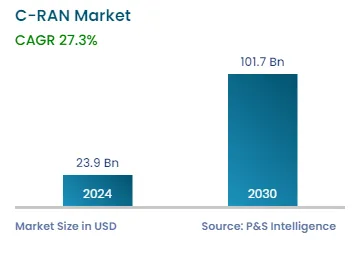

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 23.9 Billion |

| 2030 Forecast | USD 101.7 Billion |

| Growth Rate(CAGR) | 27.3% |

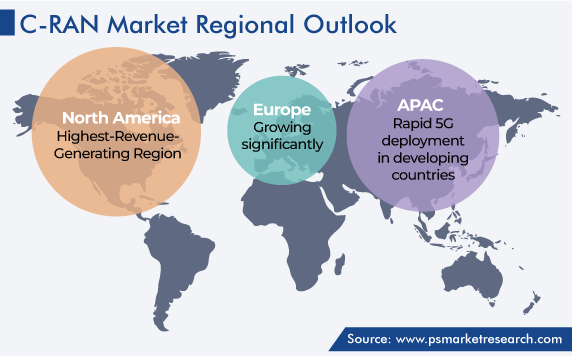

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 11773

Get a Comprehensive Overview of the C-RAN Market Report Prepared by P&S Intelligence, Segmented by Deployment (Indoor, Outdoor), Component (Infrastructure, Solution, Services), Type (3G, LTE & 5G), Application (Large Public Venues, Targeted Outdoor Urban Areas, High-Density Urban Areas, Suburban & Rural Areas), Architecture (Virtualized/Cloud, Centralized), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 23.9 Billion |

| 2030 Forecast | USD 101.7 Billion |

| Growth Rate(CAGR) | 27.3% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The cloud/centralized radio access network (C-RAN) market is estimated to have generated a revenue of USD 23.9 billion in 2024, and it is expected to grow at a CAGR of 27.3% during the forecasted period, to reach USD 101.7 billion by 2030. This is ascribed to the prompting requirement for long-term evolution (LTE) services, the increasing penetration of the 5G network, the surging emphasis on automation, the growing digitalization rate, the escalating demand for internet of things (loT) solutions, and the burgeoning smartphone adoption.

Moreover, C-RAN offers several advantages for service providers such as improved flexibility and scalability, higher spectrum efficiency and energy efficiency, enhanced security, hardware pooling, simplified upgrades and maintenance, lower costs with dark fiber, site simplification, and future-proof capabilities.

However, the standard RAN technology is only ideal for small workplaces because its deployment in huge areas, such as event spaces, malls, amusement parks, and stadiums, affects user experience, due to the escalated network density. Thus, C-RAN is used in large public spaces, as the software-based architecture simplifies diminished inter-cell interference, has excessive storage capacity, and intensifies user experience. Also, it assists in visualizing networks. Virtual networks are tailored to address the distinct needs of applications, services, devices, customers, and operators. Further, C-RAN guides network operators by supplying exclusive virtual networks with functionalities related to customer needs, over ordinary network infrastructure.

Furthermore, the expanding diffusion of 5G technology is one of the central factors holding up the market growth. Telecom operators are displaced toward new technologies to boost their network capabilities. Providers of services across the world are concentrating on the modification of RAN to meet the thriving requirement for 5G solutions and services from businesses. Many companies are executing 5G services to increase their service capabilities, as several regions are projected to swiftly adopt 5G services in the forthcoming years. Thus, the current race to become superior in 5G delivery is expected to heighten C-RAN investments.

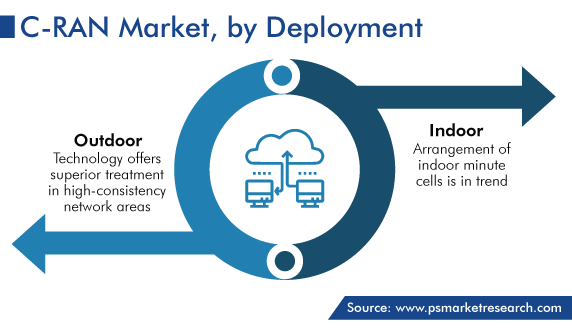

Based on deployment, the outdoor category leads the C-RAN market, accounting for a larger revenue share, of 70%, in 2023, and it is also expected to observe notable growth in the forthcoming years. This is because this technology offers superior treatment in high-consistency network areas, such as parking lots, stadiums, and malls. Further, it provides notable advantages in diminishing energy costs, prominent network resilience, and vigorous allocation of network resources with time.

Whereas, the indoor category is projected to grow at a higher CAGR over the expected period. This can be because the arrangement of indoor minute cells that are mini-base stations for C-RAN architecture is in trend, as they offer superior services to end consumers in high-density and high-value locations such as independent places, offices, homes, and other embedded locations. Also, indoor arrangements are applied typically in several embassies, court buildings, and government offices that deal, handle, and exchange sensitive data. Hence, the trend of data reliability in indoor formation is expected to certainly influence the market.

Based on component, the infrastructure category holds the largest revenue share in the industry. This is on account of the high investments by telecom operators in 5G, 4G, and LTE technologies and the surging deployment of C-RAN for numerous radio protocol support. Moreover, the investment made in the infrastructure category is inclined to be expensive and resource-intensive, but it is very important to an area’s economic development and propensity.

Whereas, the service category is expected to witness a higher growth rate during the forecast period. This can be because the surging deployment of software-based C-RAN solutions has resulted in a high need for related professional services, such as consultancy, maintenance, design, and development.

Based on network type, the LTE & 5G category dominates the market, accounting for the largest share, of around 60%, in 2023. This is ascribed to the enormous progress in data traffic and remarkably high-power utilization by current network architecture. LTE & 5G networks are high-speed and low-latency networks, and they are more well-organized for C-RAN operations.

In addition, the increasing existence of 5G networks all over the world is further expected to be one of the crucial factors for the growth of the market in this category. However, the victorious execution of 5G is chiefly contingent on network densification, which is escalated through accessible network amplitude by adding on more cell sites, which include colossal sites, radio access networks, in-building wireless, and small cell deployments. Thus, the increase in deployments of 5G will pave the way for the increasing utilization of networking solutions, which, in turn, drive the demand for C-RAN solutions.

Based on application, the targeted outdoor urban areas category is projected to experience the highest growth rate in the coming years. This growth is supported by various key factors, such as C-RAN arrangement in targeted outdoor urban areas provides the possibilities for remarkably strengthened performance efficiency. For urban environments that are signalized by high data requirements, C-RAN technology can provide faster data speeds and reduction in latency, meeting the required expectations of users who rely on seamless connectivity.

Moreover, the arrangement of C-RAN in these urban areas makes possible the intensification of extant network infrastructure. This particularly means that telecom operators can enhance their ongoing setups, which makes them more robust and well-organized without the need for extensive physical changes. The ability to combine C-RAN arrangement harmoniously into urban environments is a notable advantage over traditional RAN disposition.

Based on architecture, the centralized category holds a larger share of the market. This is because in the centralized architecture, the processing of baseband is integrated into a central location (data center or data hub), and the remote radio units (RRUs) are affixed to a central site through a network that is carried by digitalized band base signals between the centralized site and the RRUs. Also, the well-structured resource allocation and less power consumption are all sanctioned by this architecture.

Moreover, the growth of the market in this category is ascribed to technological advancements, which are sanctioned for optical, wireless, and IT communication services. For instance, the centralized architecture utilizes the enhanced CPRI standard, mm-Wave, and dense wavelength division multiplexing to authorize the relay of baseband signal over various long ranges.

Whereas, the virtualized/cloud category is projected to witness a higher CAGR, of 28.2%, in the coming years. This can be ascribed to the surging adoption of software-defined networking and network function virtualization (NFV) technology in the wireless telecom industry. Also, the virtualization of the radio access network is expected to ease the devising of the carrier for 5G network support to increase the bandwidth requirements. For instance, a base station with 5G can practically escalate both the productivity and quality of a system by extricating it from a classification of baseband units.

Drive strategic growth with comprehensive market analysis

Based on region, the APAC C-RAN market is expected to witness the highest growth rate, of 28%, in the coming years. With the proper and perpetual leap-up in mobile data traffic, APAC is inclined to hold remarkable potential in terms of C-RAN arrangement, as the region is observing major spending in the industry and high adoption of NFV and SDN technologies. Moreover, with the surging focus on sifting from traditional RAN architectures to C-RAN architectures, there have been several large-scale investments in the industry of telecom, apparently widely spreading the scope of C-RAN. Also, major players in the market are making noteworthy investments across the region.

Furthermore, other factors such as the positive impact of government initiatives and policies and the rising development of C-RAN infrastructure as a foremost step toward the surging adoption of 5G in countries such as China, Japan, India, and South Korea are projected to drive the market. This can be in the debt to the existence of a wide base of customers, expanding investments in 5G technology, and the increasing number of small and medium enterprises (SMEs). Thus, these factors have led to the vast adoption of cloud-based technologies and the enlargement of the telecommunications industry in the region.

Whereas, North America accounts for the largest market share. This is attributed to the increasing requirement for high-speed connectivity, the rising adoption of 5G technology, the surging need for efficient network management, the mounting deployment of cloud-based arrangements, the presence of key industry players, and the existence of a regulatory environment that favors the arrangement of C-RAN architectures in the region.

Also, North America is projected to become one of the foremost regions for 5G arrangement, with an estimation of millions of 5G connections by 2030. For example, the U.S. Federal Communications Commission (FCC) has introduced several initiatives to accelerate the deployment of 5G networks. Thus, these factors are expected to drive the adoption of C-RAN architectures in the coming years.

This report offers deep insights into the C-RAN industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Deployment

Based on Component

Based on Network Type

Based on Application

Based on Architecture

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages