Building and Construction Plastics Market Future Prospects

The global building and construction plastics market size in 2024 is USD 109.3 billion, and it is expected to advance at a CAGR of 8.2% during 2025-2030, to reach USD 175.5 billion by 2030.

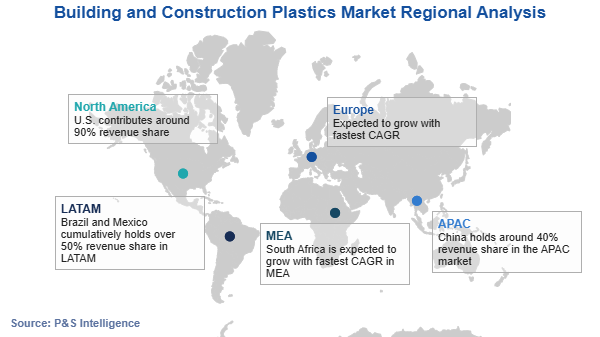

The expansion of the worldwide construction industry is a major element driving the demand for these plastics. Countries such as the U.S., the U.K., Indonesia, China, India, the U.A.E, and Saudi Arabia are contributing to the expansion of the construction industry. Increased industrialization, which has been attributed to increased population, has led many governments in other countries to increase spending on construction to develop infrastructures further. Thus, the rising construction expenditure around the world is expected to drive the sales of construction and building polymers in the coming years.

The construction business is also expanding as a result of the rising demand for green and energy-efficient buildings, due to their related advantages, such as improved indoor environmental quality and a lower overall load on metal structures compared to conventional settings. Consequently, it is expected to drive the demand for building and construction plastics.

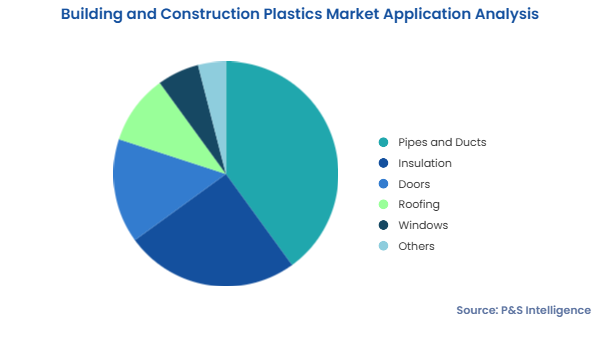

The demand for building and construction plastics in roofing applications is projected to be further driven by their characteristics, such as high strength, weather resistance, excellent transportation efficiency, simple to install, high rigidity, and low weight. The growing public awareness of plastics' potential to replace conventional roofing materials is another factor propelling the market.