Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 120.9 Billion |

| 2030 Forecast | USD 187.3 Billion |

| Growth Rate(CAGR) | 7.6% |

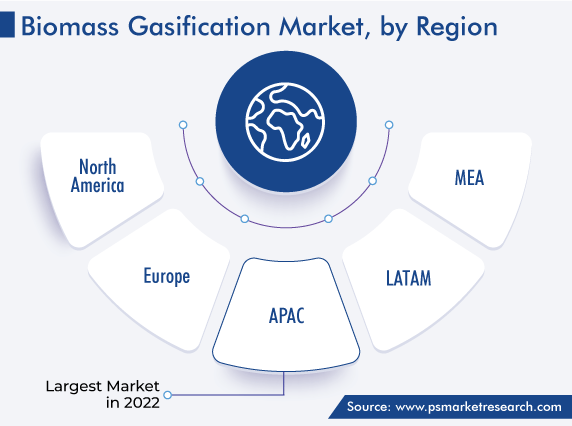

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Report Code: 12505

Get a Comprehensive Overview of the Biomass Gasification Market Report Prepared by P&S Intelligence, Segmented by Source (Agriculture, Forest, Animal, Municipal), Gasifier Technology (Fixed Bed, Fluidized Bed, Entrained Flow), Application (Power, Chemicals, Hydrogen, Transportation, Ethanol, Biochar), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 120.9 Billion |

| 2030 Forecast | USD 187.3 Billion |

| Growth Rate(CAGR) | 7.6% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

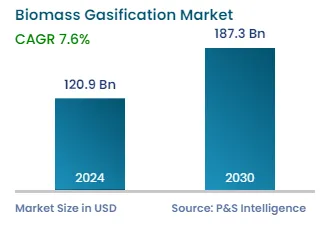

The biomass gasification market size stood at USD 120.9 billion in 2024, and it is expected to grow at a CAGR of 7.6% during 2024–2030, to reach USD 187.3 billion by 2030.

The growth can be primarily ascribed to the rising greenhouse gas emissions, growing adoption of environment-friendly energy sources, and increasing environmental concerns among the population.

The growing consumption of syngas in gas engines, to produce hydrogen and methanol and convert them to synthetic fuels, is propelling the advance of the domain. In the process, clean gas is produced via the refining of corrosive ash elements, including chlorides and potassium, which can lead to various problems in the feedstock. Moreover, the usefulness of gasifying fossil fuels for producing electrical power at the residential and industrial levels is increasing its popularity.

The growing awareness of sustainability and increasing adoption of environment-friendly strategies are fueling the adoption of the gasification process for generating clean energy. The rampant industrialization, rising demand for power, and advancing technologies are leading to the installation of gasifiers in various manufacturing units. The usage of this technique is also rising rapidly among municipal corporations for waste disposal and recycling complex compost.

In addition, gasifiers are an efficient, flexible, and reliable system for different heat-related applications, owing to their ability to be easily retrofitted into existing gas-fueled systems, including boilers and furnaces, where they replace fossil fuels with syngas. Moreover, the process is used for the generation of electricity from biomass (such as forestry waste), ammonia, and liquid fuels.

The usage of biomass as the feedstock is expected to grow significantly during the forecast period because it can be used as a clean alternative to coal-based power generation. Alarmed at the rising greenhouse gas emissions, industries and governments are turning their focus to environment-friendly energy sources, including paper, animal manure, cotton, agricultural waste, wood residue, and food waste. In this regard, the implementation of various policies and regulations by governments aimed at sustainability and the huge availability of biomass are the key factors boosting the growth of the market.

Furthermore, the governments of various nations are persuading adaptable gasifier-based power plants to generate power using locally available biomass resources, such as wood chips, rice husk, and cotton stalks. In India, around 150-MW biomass gasifiers have been set up for on-grid and off-grid projects. Additionally, over the years, many rice mills have replaced their steam engines/boilers with biomass gasifiers and 100% producer gas engines, for power generation, along with making provisions to meet as much of their thermal requirements as possible through waste heat recovery.

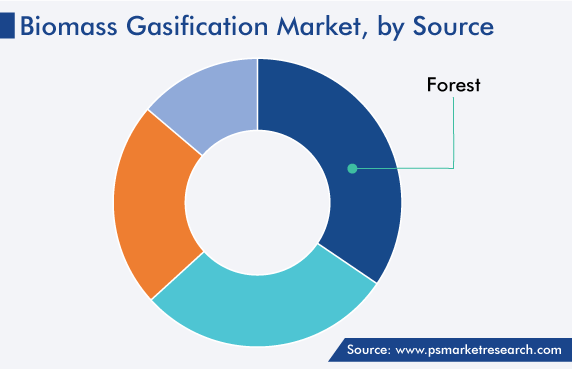

Forest waste holds the major share, of more than 30%, and it is expected to continue the same way during the forecast period. This is attributed to the rising number of projects for combined heat and power that use forest waste as the feedstock, because it has a huge amount of macromolecules, organic matter, and cellulose, which aid in heat generation.

The fixed-bed gasifier category is expected to grow at a CAGR of more than 8%, owing to the simplicity, high carbon conversion rate, solid retention time, and low ash carry of this variant. Moreover, the rising demand for electricity is propelling the growth of the market in this category. Fixed-bed gasifiers possess the flexibility to utilize a variety of biomass as the feedstock, ensure mass and heat transfer through oxidation, and deal with small particles.

Based on application, the chemical category holds the largest share, ascribed to the rising popularity of the gasification technology for the production of ethanol and other useful commodities. Its low operating cost, need for waste and feedstock of low value, and high-power efficiency are boosting the adoption of the gasification process for the production of chemicals of high value. Furthermore, the availability of a huge amount of feedstock will enable the growth of the market.

Drive strategic growth with comprehensive market analysis

Based on Source

Based on Gasifier Technology

Based on Application

Regional Analysis

The market for biomass gasification solutions valued USD 120.9 billion in 2024.

The biomass gasification industry is driven by the unsustainability of fossil fuels and the growing environmental concerns.

Forest waste is utilized the most extensively in the market for biomass gasification solutions.

Chemical is the largest application category in the biomass gasification industry.

APAC, led by China and India, is the largest market for biomass gasification solutions.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages