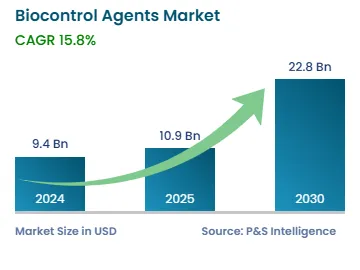

The biocontrol agents market size stands at USD 9.4 billion in 2024.

What will be the growth rate of the biocontrol agents market during the forecast period?+

During 2025–2030, the growth rate of the biocontrol agents market will be 15.8%.

Cereals & grains are the largest crop type in the biocontrol agents market.

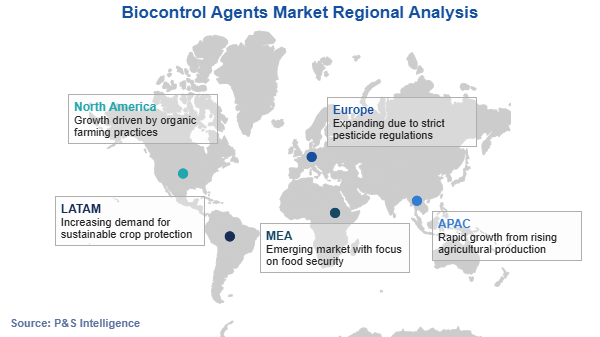

The major drivers of the biocontrol agents industry include the rising demand for organic farming globally, stringent regulations against chemical fertilizers, and surging consumer preference for biocontrol agents.

Biocontrol agents market is fragmented in nature.