Report Code: 11306 | Available Format: PDF | Pages: 298

Biobanking Market Research Report: By Offering (Consumables, Equipment, Services, Software), Sample Type (Blood Products and Genetic Material, Human Tissues, Cell Lines, Biological Fluids, Human Waste Products), Storage Type (Manual, Automated), Application (Clinical Research, Life Science and Medical Research, Regenerative Medicine), Utility (Research, Routine, Epidemiology), Regional Insight (U.S., Canada, Germany, France, U.K., Italy, Spain, Japan, China, India, Brazil, Mexico, Saudi Arabia, South Africa, U.A.E.) - Industry Analysis and Forecast to 2024

- Report Code: 11306

- Available Format: PDF

- Pages: 298

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

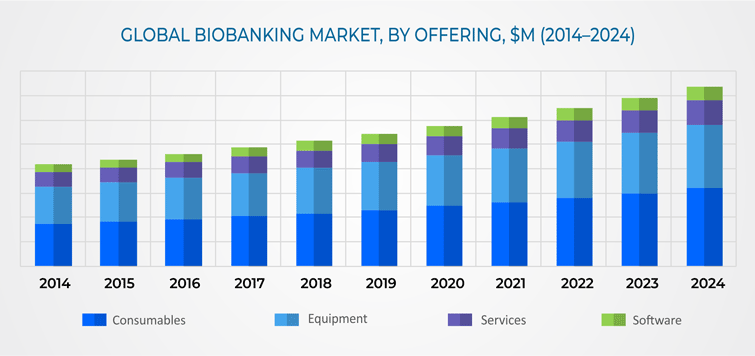

The biobanking market size was $25.8 billion in 2018, and it is expected to grow at a CAGR of 6.2% during 2019–2024 owing to the rising incidence of chronic diseases and increasing number of genomic research activities for studying them.

The consumables category, under the offering segment, is expected to dominate the biobanking industry, in terms of revenue, in 2024, with an over 40.0% share. Consumables are purchased repeatedly, whereas equipment and software are one-time purchases in biobanks.

The automated category, within the storage type segment, will display the faster growth, at a CAGR of 7.0%, during 2019–2024. This can be owed to the surging technological advancements and soaring demand for contamination-free samples.

The clinical research category accounted for the largest share, of 49.2%, in 2018, within the application segment. This was due to the increasing clinical research activities for determining the efficacy and safety of medicines and diagnostic devices.

The surging awareness regarding the importance of storing stem cells and cord blood will lead to the generation of considerable revenue by the routine category of the utility segment in the coming years. Routine biobanking includes the storage and maintenance of specimens.

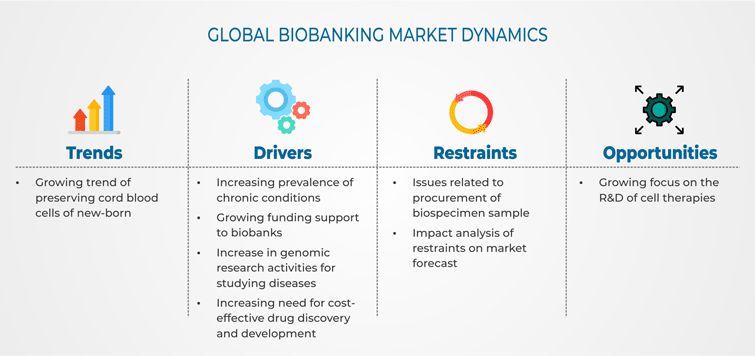

Biobanking Market Dynamics

The rising culture of preserving cord blood cells of newborns is a key biobanking market trend. Cord blood aids in curing any illness that can affect the child at any age, as it is a prominent source of hematopoietic stem cells. These stem cells have self-renewal properties, and they can differentiate into the lymphoid and myeloid cell lineages. Owing to these characteristics, stem cells are used in the treatment of wounds, trauma, and diseases. Moreover, the escalating awareness regarding the benefits of storing the umbilical cord has led to the fast establishment of biobanks that store these cells.

In addition, the growing cases of chronic diseases, such as diabetes, Parkinson’s disease, and Alzheimer’s disease, will fuel the demand for cord blood and stem cells in the coming years, as these biologics can aid in tissue grafting, drug testing, regenerative medicine, and organ transplantation. Due to these advantages of cord blood and stem cell therapies, the demand for biobanks has surged notably.

Moreover, the growth of the market for biobanks is driven by the growing research activities that focus on the unmet need for the treatment of several chronic ailments, such as cancer, respiratory disorders, diabetes, and ischemic heart diseases. Due to the increasing burden of such conditions, government agencies are providing hefty funds for biobanks to collect, preserve, transport, and analyze samples. For example, in May 2017, 11 biobanks in Germany attained $16 million from the German Federal Ministry of Education and Research (BMBF).

Competitive Landscape

In the recent years, major players in the biobanking market have taken several strategic measures, such as product launches, collaborations, acquisitions, and product approvals to sustain and improve their position in the industry. For instance, in April 2019, Thermo Fisher Scientific Inc. expanded its analytical instruments portfolio by introducing Thermo Scientific Vanquish MD High Performance Liquid Chromatography (HPLC) system, the Thermo Scientific TSQ Altis MD Series mass spectrometer, and the Thermo Scientific Quantis MD Series mass spectrometer. These instruments have a wide application in processing of cells and tissues obtained from biobanks.

In March 2019, Becton, Dickinson and Company launched automated flow cytometry sample preparation instrument with CE-IVD certification known as, BD FACSDuet. This instrument helps in understanding the characteristics of cell as well as counting.

Furthermore, in February 2019, Promega Corporation launched Maxwell RSC miRNA plasma and serum kits, which help in the purification of nucleic acids for researchers in the field of oncology. These kits can be specifically utilized in processing samples and specimens obtained from biobanks.

Thermo Fisher Scientific Inc.; Merck KGaA; Promega Corporation; Becton, Dickinson and Company; Hamilton Company; Avantor Inc.; Tecan Group Ltd.; QIAGEN N.V.; PHC Holdings Corporation; Brooks Automation Inc.; AutoGen Inc.; BioCision; and BioLife Solutions Inc. are the leading product manufacturers in the biobanking market. Other than these players, AlphaCord LLC, Cells4Life Group LLP, BioKryo GmbH, and LGC Biosearch Technologies are some eminent service providers in this market.

The value of the biobanking market would surge from $25.8 billion to $36.8 billion from 2018 to 2024.

The biobanking industry will grow at a CAGR of 6.2% between 2019 and 2024.

Equipment, consumables, software, and services are the main categories in the offering segment of the biobanking market.

The preservation of neonatal cord blood cells is the biobanking industry trend as these cells help in the treatment of diseases diagnosed during any stage of life.

The software offering category in the biobanking market will advance at a CAGR of 5.4% in the forthcoming years.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws