Report Code: 11867 | Available Format: PDF | Pages: 163

BFSI Security Market Research Report: By Security Type (Physical Security, Information Security), Service (System Integration, Risk Assessment, Consulting, Training), End User (Banks, Insurance Companies) - Industry Share, Growth, Trends and Demand Forecast to 2030

- Report Code: 11867

- Available Format: PDF

- Pages: 163

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

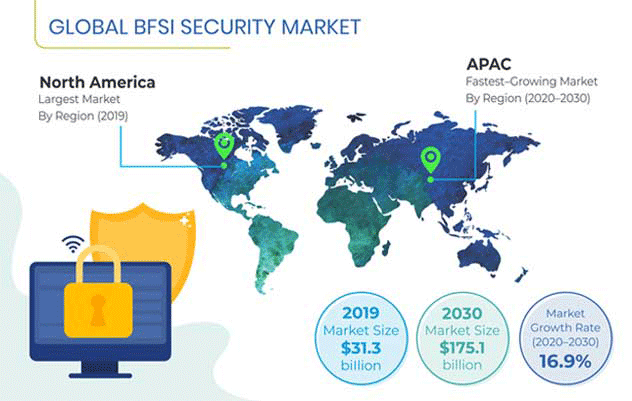

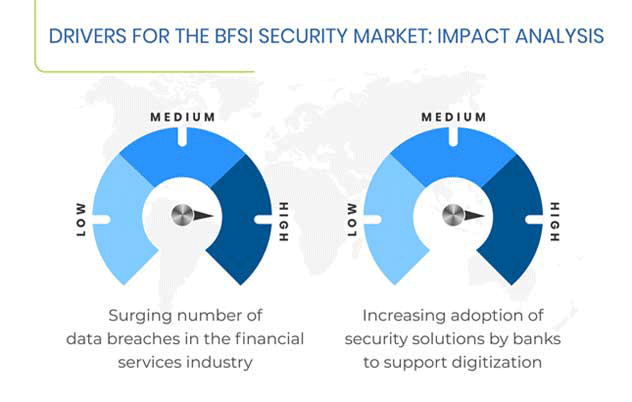

The banking, financial services, and insurance (BFSI) security market value was $31.3 billion in 2019, and it is predicted to grow to $175.1 billion by 2030. The market is also predicted to advance at a CAGR of 16.9% between 2020 and 2030. The growing incidence of data breaches in the financial services industry is one of the key factors driving the advance of the market.

Globally, the market for BFSI security solutions is predicted to demonstrate the highest growth rate in the Asia-Pacific (APAC) region in the coming years. This is credited to the development of cloud-based technologies, surging number of banks, increasing prevalence of cyberattacks, and enactment of cybersecurity mandates in several countries. For example, according to the China Banking Regulatory Commission Article 40, all commercial banks in the country are required to install appropriate risk monitoring and warning systems for mitigating business risks.

Fundamentals Governing BFSI Security Market

Financial institutions and banks are increasingly moving their core applications and operations to the cloud network, primarily due to the growing requirement for a personalized banking experience, demand for mitigating the risks associated with traditional technologies, surging requirement for real-time analysis of huge amounts of data, focus on reducing their capital expenditure, and the ability of the cloud to provide better operational control of the platforms.

This is a major BFSI security market growth driver on account of the fact that the adoption of cloud solutions augments the chances of cyberattacks, as the data is stored at remote locations. Thus, in order to control and manage security operations over the cloud network, cloud-based security solutions are increasingly being adopted by BFSI organizations around the world.

The financial services industry has always been one of the major target areas for cybercriminals due to the generation of huge volumes of unstructured data and involvement of various financial assets in the industry. Moreover, with the rapid technological advancements being carried out, such as the adoption of online banking and digitization of operations, the incidence of data breaches is rising, which is, in turn, causing huge losses to the companies operating in this industry. In 2019, the incidence of expensive data breaches was the highest in the U.S. These data breaches resulted in average losses of $8.19 million.

The internet of things (IoT) technology plays a major role in improving the security of banking and financial operations by assisting organizations in tracking the location of the crime, detecting and identifying the devices used for breaching the company database, and remotely monitoring surveillance systems in order to detect fraudulent activities early. Thus, the adoption of IoT is creating lucrative growth opportunities for the BFSI security market players.

It becomes necessary for banks and other financial institutions to adopt smart security solutions that provide centralized management, detect potential cyberattacks, proactively assess risks, and automate work operations. This way, the adoption of the IoT technology is creating huge opportunities that can be leveraged by the BFSI security industry players by developing intelligent security solutions for financial institutions and banks.

Segmentation Analysis of BFSI Security Market

The physical security category had the larger share in the market for BFSI security solutions in 2019, under the security type segment. The video surveillance sub-category of the physical security category contributed the highest revenue to the market in 2019. This is credited to the large-scale adoption of closed-circuit television (CCTV) cameras in banks for monitoring and tracking the activities of disgruntled employees or suspected individuals. Besides the aforementioned factor, the development of analytical solutions and advanced technologies for video surveillance is propelling the advancement of this category.

The system integration category is predicted to demonstrate the fastest growth in the forthcoming years, under the service segment.

Banks dominated the market in 2019, under segmentation by end user. Furthermore, this category is predicted to exhibit the fastest growth in the BFSI security market in the upcoming years on account of the rising prevalence of cyberattacks and growing requirement for complying with the stringent regulations being enacted for the banking industry. The adoption of optimal security solutions allows companies operating in the banking sector to monitor and eliminate the vulnerabilities that pose a major threat to their operations.

Geographical Analysis of BFSI Security Market

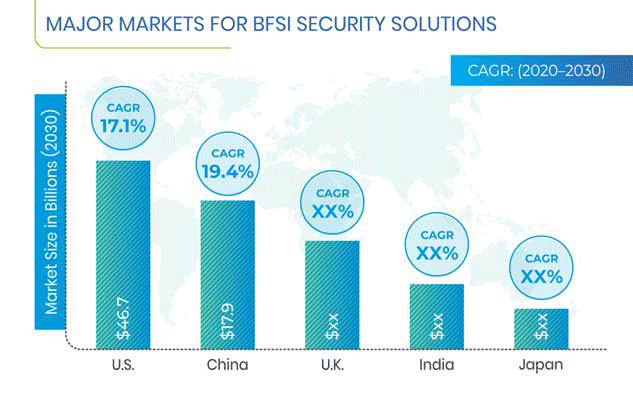

North America was the largest market in 2019, and the region is predicted to lead it in the coming years as well. The North American market was dominated by the U.S. in 2019, and this is another trend that will continue in the forthcoming years. This is ascribed to the fact that the banking and financial firms based in the U.S. are rapidly adopting vulnerability management solutions, making huge investments in upgrading their information and physical security infrastructure, and deploying cyberattack mitigation solutions.

Furthermore, according to a report published by the Internet Crime Complaint Center (IC3) of the Federal Bureau of Investigation (FBI), cybercrimes, frauds, and internet-based thefts caused losses worth $2.7 billion in the country in 2018, while the number of complaints was 351,936 that year.

In the future, the BFSI security market will demonstrate the fastest growth in the APAC region. This will be due to the huge IT investments being made in emerging economies, such as India and China, increasing prevalence of fraudulent activities, and adoption of advanced technologies by banks and other financial institutions.

China dominated the APAC market in 2019, as industry players are increasingly focusing on developing broader security systems, instead of only video surveillance systems, by providing access control systems, intruder alarm systems, and various other physical security information management (PSIM) systems to Chinese banking firms. Moreover, BFSI companies in the country are rapidly adopting big data services and video-centered intelligent IoT solutions for maximizing their profitability and security.

Recent Strategic Developments of Major Market Players

Major players in the global BFSI security market are focusing on product launches, merger & acquisitions, and partnerships, to sustain and improve their position in the industry. For instance, in September 2019, Honeywell International Inc. launched a cybersecurity platform, Honeywell Forge Cybersecurity Platform, which aims to improve cybersecurity performance across an enterprise. The platform supports in increasing the visibility of vulnerabilities and threats, mitigating risks, and improving the efficiency of cybersecurity management. Moreover, the platform also helps in transferring of data safely and utilizes operations data, in order to improve cybersecurity compliance.

Moreover, in August 2019, U.S.-based security provider, McAfee LLC announced the acquisition of NanoSec Co. for an undisclosed amount. Through this acquisition, McAfee aims to strengthen the container security capabilities of McAfee MVISION, which would enable customers to speed up the application delivery, along with enhancing security and compliance of hybrid and multi-cloud deployments.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Market Size by Segments |

Security Type, Service, End User |

Market Size of Geographies |

U.S., Canada, U.K., France, Germany, Russia, Switzerland, China, Japan, India, Australia, South Korea, Singapore, New Zealand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, U.A.E |

Explore more about this report - Request free sample

Competitive Landscape of BFSI Security Market

The BFSI security market is fragmented with the presence of numerous players. Some of the major companies include McAfee LLC, Honeywell International Inc., Accenture plc, Broadcom Inc., IBM Corporation, Cisco Systems Inc., Trend Micro Incorporated, DXC Technology Company, Booz Allen Hamilton Holding Corporation, and Dell Technologies Inc.

Market Size Breakdown by Segment

The BFSI security market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Security Type

- Physical Security

- Video surveillance

- Access control

- Intrusion and fire detection

- Physical security information management (PSIM)

- Information Security

- Antivirus

- Encryption

- Unified threat management

- Risk and compliance management

- Data loss prevention

- Identity and access management

Based on Service

- System Integration

- Risk Assessment

- Consulting

- Training

Based on End User

- Banks

- Insurance Companies

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Russia

- Switzerland

- Asia-Pacific (APAC)

- China

- Japan

- India

- Australia

- South Korea

- Singapore

- New Zealand

- Latin America (LATAM)

- Brazil

- Mexico

- Argentina

- Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- U.A.E.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws