Market Statistics

| Study Period | 2019 - 2032 |

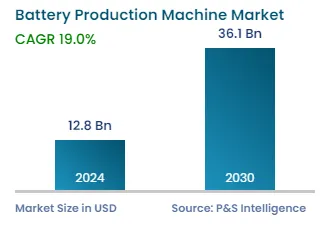

| 2024 Market Size | USD 12.8 billion |

| 2025 Market Size | USD 15.1 billion |

| 2032 Forecast | USD 51 billion |

| Growth Rate(CAGR) | 19% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

Report Code: 12503

This Report Provides In-Depth Analysis of the Battery Production Machine Market Report Prepared by P&S Intelligence, Segmented by Machine Type (Mixing, Coating & Drying, Calendaring, Slitting, Electrode Stacking, Assembly & Handling, Formation & Testing Machine), Battery Type (Nickel Cobalt Aluminum, Nickel Manganese Cobalt, Lithium Iron Phosphate), Application (Automotive, Renewable Energy, Industrial), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 12.8 billion |

| 2025 Market Size | USD 15.1 billion |

| 2032 Forecast | USD 51 billion |

| Growth Rate(CAGR) | 19% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The battery production machine market achieved USD 12.8 billion in value during 2024 while analysts project it will reach USD 51 billion by 2032 with an estimated CAGR of 19% throughout 2025–2032.

The market expansion results from rising lithium-ion gigafactory numbers, increasing electric vehicle sales, and growing environmental problem understanding among the public. The transportation industry has a pathway to shift from fossil fuels by adopting electric vehicles (EVs). Two major incentives for transportation sector electrification consist of enhanced energy efficiency and reduced localized pollution. Industrial players continue to develop automotive technology at a greater speed through their development of electric vehicles and connected, autonomous, and shared mobility systems.

All of this funding is aimed at businesses and start-ups developing autonomous driving, connected vehicles, and electrified mobility. These technological developments will help establish electric shared mobility as a viable substitute for automobile ownership and EV cost reduction.

Furthermore, consumers are spending on electric cars, e-bikes, and electronic products, which is driving the investment in cell manufacturing machinery. The worldwide registration of new electric cars reached 14 million units during 2023 thus bringing the total number of electric cars on roads to 40 million. as programs that encourage both the supply and demand sides of buying EVs and cell production, which is viewed as a crucial area for the future. Additionally, cutting-edge mobility ideas, such as autonomous driving, frequently rely on CO2-neutral technologies with cell-powered drive trains.

The formation and testing category held the larger market share, of 30%, in 2024. The formation and testing stage remains the most important and demanding process that consumes significant manufacturing time for battery products. The testing procedure uses cycles of charge and discharge to evaluate battery quality while performing safety inspections and performance tests. Manufacturers remain actively committed to developing advanced formation and testing equipment because they aim to reduce defects while meeting rigorous regulatory specifications for high-energy-density lithium-ion batteries.

The market's largest segment exists due to rising demands from EV manufacturers who need batteries that satisfy strict performance requirements thus driving the demand for automated and AI-driven formation and testing solutions.

Machine types studied in the report:

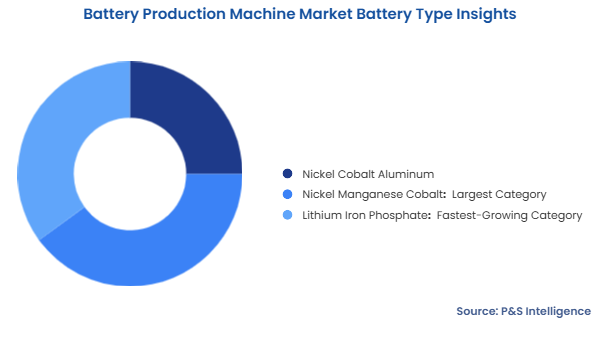

The NMC category held the larger market share, of 40%, in 2024, it is frequently used in several applications, including energy systems and EVs. Nickel and manganese combine their finest qualities in NMC. Moreover, manganese can develop a spinel structure to obtain low internal resistance and low specific energy, while nickel has high specific energy but poor stability. The metals’ combined strengths are increased by joining them.

Also, the main advantages of NMCs are that they provide a longer life cycle and higher energy density, as well as NMC cathodes, containing the most energy amount by weight and volume.

Battery types studied in the report:

The automotive category will grow at the higher CAGR, of 19.5%, during the forecast period. Automobile manufacturers operate in the biggest industry worldwide. World oil consumption reaches approximately 50% because of the annual production of 60 million vehicles. The strong demand will derive from the rising middle-class wealth and a sizable young population. Although EVs are not a particularly new trend, they are swiftly rising to the top of the automotive sector worldwide. The global sales of EVs hit new records during 2021, while the U.S. aims to achieve a 50% EV market share by 2030. The marketplace for electric and hybrid vehicles is growing because of worldwide sustainability targets that need immediate fulfillment, thus driving the demand for batteries around the world.

Applications considered:

Drive strategic growth with comprehensive market analysis

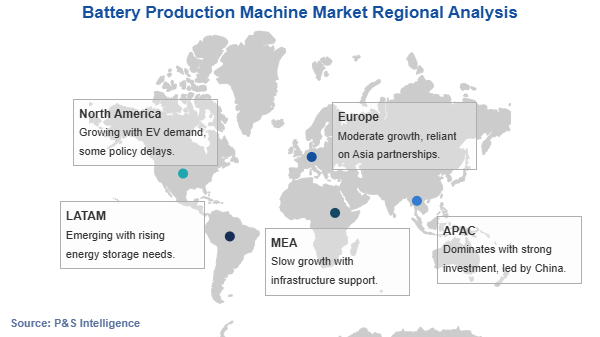

The APAC battery production machine market held the larger market share, of 40%, in 2024. Due to the technical advantages they offer and the falling cost of lithium-ion batteries, the use of integrated energy storage solutions utilizing lithium-ion batteries is predicted to increase. As a result, there will likely be a lot of chances for Li-ion cell makers shortly.

The Chinese automotive sector continues to expand quickly while showing substantial international involvement in automotive operations. China has consistently held the title of largest Li-ion battery purchaser worldwide since 2016. The battery production sector remains dominated by China through Contemporary Amperex Technology Co. (CATL), which operates as the top battery manufacturer in China and held a 35% share of global Li-ion battery sales during Q1 of 2022.

The lithium-ion industry in China has expanded by double digits for several years. The entire output of Li-ion batteries increased by 106% from the previous year to a record high of 324 GWh in 2021.

Moreover, India has had phenomenal growth, which is expected to last over the next several years. In terms of volume growth, India is currently the largest market worldwide, owing to the global growth of light automobiles. The Indian government expects investments in the automotive industry to reach USD 8–10 billion through domestic and foreign sources by 2023. India has the potential to become an industry-leading force in shared mobility by 2030, thus creating opportunities for electric and autonomous vehicle markets.

Moreover, the Japanese market for battery production machines is also rapidly growing. The country requires immediate action for renewable energy adoption and sector convergence with a transformed carbon pricing methodology toward achieving net-zero targets by 2050. Japan prioritizes the rapid advancement of renewable energy systems to replace the energy production lost after the Fukushima nuclear power plant disaster.

Japan announced through its Sixth Strategic Energy Plan in October 2021 that the country would increase its renewable energy generation target from 22% to 24% to 36% to 38% by 2030. The current renewable energy trends indicate that the generation mix will reach 34.6% in 2030 and match the target projection. South Korea aims to increase its renewable energy capacity while nuclear power will supply the projected power deficit.

Regions covered in the report:

The Battery Production Machine Market shows a high level of fragmentation because multiple business entities take part in various battery manufacturing phases. The manufacturing process requires multiple distinct technologies because electrodes need coating, while cells require stacking followed by assembly before testing can begin. The Battery Production Machine Market includes global industrial automation giants Hitachi Ltd. and Dürr AG, plus specialized providers such as Wuxi Lead Intelligent Equipment Co Ltd., which operate in different market segments. The market fragmentation intensifies due to regional companies that modify products to suit local requirements, including price-efficiency needs and scale-up needs for battery manufacturing facilities across various regions.

Market fragmentation in the battery technology sector increases because of the continuous advancements in lithium-ion and solid-state and flow battery technologies. The battery industry requires different chemical composition types alongside escalating markets for vehicle electric systems, energy storage solutions, and mobile devices which generates manufacturing equipment diversity requirements. Companies must keep adapting their operations to technological improvements since the battery production machine market exists as a competitive and fragmented industry.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages