Report Code: 10693 | Available Format: PDF

Automotive Elastomers Market Size & Share Report - Global Demand and Development Forecast to 2030

- Report Code: 10693

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Automotive Elastomers Market Size & Share

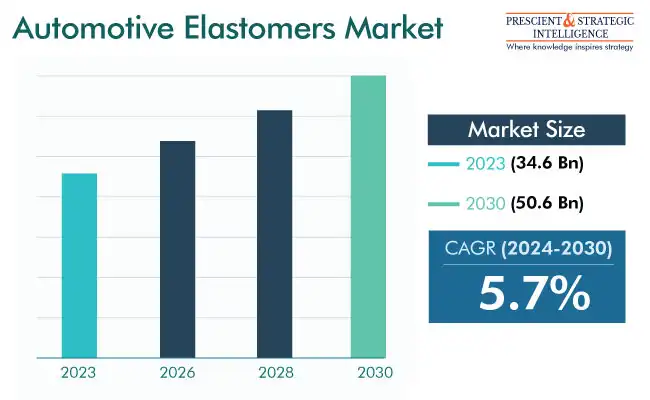

The global automotive elastomers market was valued at USD 34.6 billion in 2023, and it will grow at a rate of 5.7% between 2024 and 2030, to reach USD 50.6 billion in 2030.

The industry is propelled by the surging need for new cars and increasing per-capita income. Furthermore, governments’ severe standards and guidelines to lessen pollution, surge vehicle mileage, and guarantee passenger safety have resulted in the widespread use of automotive elastomers. The rising awareness of the many advantages of these materials, such as emission and noise lessening, performance boost, and safety enhancement, is projected to fuel the demand for them.

Continuous Development of Automotive Sector

The worldwide automotive elastomer industry is primarily propelled by the augmenting automotive demand in both developing and advanced economies. As per the International Organization of Motor Vehicle Manufacturers, automotive sales numbered 81,628,533 units in 2022, compared to 78,787,566 units in 2020.

The market growth is also driven by the continuous research and technological advancements in the industry, mainly aimed at reducing vehicles’ weight and, as a consequence, their fuel consumption and emissions. Thus, the growing demand for materials that are lightweight, durable, and flexible, possess high abrasion resistance, and exhibit superior low-temperature performance is a key factor fueling the market advance.

The manufacturing cost of automotive elastomers is influenced by the fluctuation in crude oil prices and the availability of alternative substitutes in the market, impacting costs directly or indirectly. Thus, if oil prices rises, the players might look at bio-based elastomers to reduce production costs and enable the drive toward sustainability.

Moreover, the huge capital investment in automotive elastomer plants prompts businesses to outsource production to nations with lower labor and raw material prices, such as China and India. Furthermore, the significant domestic vehicle customer base presence in Asia-Pacific and the Middle East poses a competitive problem for key international firms because of the availability of low-cost technology, cheap raw materials, and inexpensive labor, thus resulting in a price difference globally.

Therefore, in April 2022, Motherson finalized the acquisition of Marelli, a manufacturer of automotive components, to become a major vehicle component producer in India and rank among the top 10 globally.

Thermoset Elastomers Lead Market, Fueled by Growing Automotive Demand

On the basis of type, the industry has been divided into thermoset and thermoplastic elastomers. Of these, the thermoset elastomers category is dominating the market, and the category is also projected to lead the industry during the projection period. This growth can be credited to the rising need for natural and synthetic rubber in the vehicle sector. Furthermore, tires are made using natural and synthetic elastomers, which offer sturdiness and flexibility on the road, thus further boosting the growth of the category.

The thermoplastic elastomers category is projected to advance at a significant CAGR during the projection period. This can be credited to the high tear resistance, compression resistance, tensile strength, thermoplastic processability, shock absorption, and slip resistance of these materials. Even otherwise, the automotive sector is one of the major customers of TPEs, credited to their potential to resist abrasion, high temperatures, and chemicals.

| Report Attribute | Details |

Market Size in 2023 |

USD 34.6 Billion |

Revenue Forecast in 2030 |

USD 50.6 Billion |

Growth Rate |

5.7% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Passenger Cars Category Holds Largest Revenue Share

The passenger cars category holds the largest revenue share, and it is also projected to continue with the dominance during the projection period. This can be credited to the growing utilization of automotive elastomers in passenger cars because of the materials’ ability to replace numerous metals utilized in vehicles.

The light commercial vehicles (LCV) category is projected to advance at a significant CAGR during the projection period. This can be credited to the growing use of elastomeric materials in LCVs because they comprise cross-linking compounds, which advance cyclic loading resistance. Moreover, the demand for these automobiles is rising for last-mile deliveries, especially with the burgeoning size of the e-commerce industries.

On the Basis of Application, Tire Category Is Leading Market

The tire category is leading the market, and the category is also expected to keep leading the application segment during the projection period. This would be mainly because of the utilization of elastomers in tire making to advance overall performance significantly. This is mainly because the addition of intermediates benefits the chemical structure of rubber by offering dependable seals, flexibility, and toughness.

The interior category is expected to witness a considerable CAGR, in terms of revenue, during the forecast period. The usage of elastomers in vehicle interiors is boosted by their low weight, flexibility, artistic appeal, cost-efficiency, agility, low emissions, and moldability. Therefore, chemical companies are launching new variants for usage in vehicle interiors. For instance, in June 2022, Continental AG introduced Benova Eco Protect, a novel surface material made to advance the sustainability, toughness, and look of vehicle interiors.

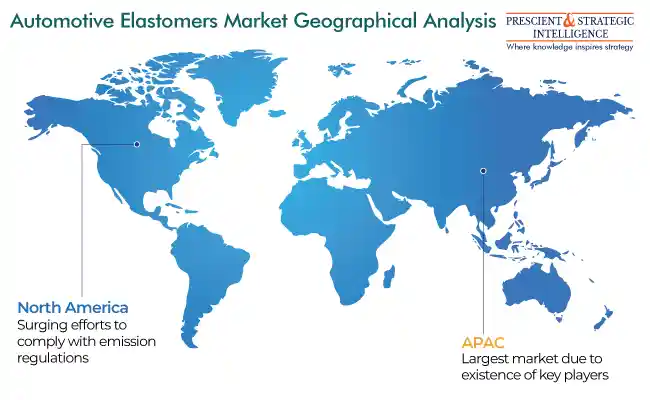

Asia-Pacific Market Is Highest Income Generator

The Asia-Pacific market holds the largest revenue share, and the region is also projected to hold on to its position during the forecast period. The existence of key market players, the obtainability of raw materials and labor at low costs, and the high acceptance of progressive technologies are propelling the industry in the region. South Korea, India, Japan, and China are not just the largest automotive manufacturers in APAC, but the entire world.

Moreover, these countries are highly polluted, which is why stringent mileage and emission norms have been implemented on automobiles here. Since reducing the weight of vehicles, by substituting metals with lighter materials, can bring about a significant decrease in emissions, automakers are rapidly adopting elastomers, fiberglass, polymers, and other alternative materials.

The North American region is also projected to witness a significant compound annual growth rate, in terms of revenue, over this decade. The region's industry growth can be attributed to the improvements in technology, significant per-capita incomes, strong demand for new cars, and obligation to comply with the severe ecological guidelines. Additionally, the region is home to many renowned automakers as well as large chemical and polymer corporations, including all of the Big Oil.

Key Companies Offering Automotive Elastomers

- Dow Inc.

- LANXESS AG

- DuPont de Nemours Inc.

- ExxonMobil Corporation

- BASF SE

- SABIC

- Huntsman International LLC

- Continental AG

- INEOS Group Limited

- Mitsui Chemicals Inc.

- Teknor Apex

- LG Chem Ltd.

- China Petrochemical Corporation

- 3M Company

- Kuraray Co. Ltd.

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co. Ltd.

- Solvay S.A.

- The Lubrizol Corporation

- Mitsui Chemicals Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws