Report Code: 11687 | Available Format: PDF | Pages: 87

U.S. Automotive Tire Market Research Report: By Vehicle (Two-Wheeler, Passenger Vehicle, Light Commercial Vehicle, Medium and Heavy Commercial Vehicles), Design (Radial, Bias), Type (Winter, Summer, All-Season), End-Use (OEM, Aftermarket) - Industry Size, Share Analysis and Growth Forecast to 2024

- Report Code: 11687

- Available Format: PDF

- Pages: 87

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

U.S. Automotive Tire Market Overview

The U.S. automotive tire market generated revenue of $57.9 billion in 2018 and is expected to grow at a CAGR of 5.4% during 2019–2024. The growth of the market can be attributed to the expanding automotive industry in the country and the high tire replacement rate due to increase in the average lifespan of vehicles.

On the basis of vehicle, the U.S. automotive tire market has been categorized into two-wheeler, passenger vehicle, light commercial vehicle, and medium and heavy commercial vehicles. Among these, passenger vehicles held the largest market share, of over 78%, in terms of sales volume in 2018. The increased sales of pickup trucks in recent years have been the major factor driving the market in the passenger vehicle category.

Based on design, the U.S. automotive tire market has been categorized into radial and bias tires. Between the two, radial tires held the larger share in the market in 2018. The category is expected to continue dominating the market in the forecast period as well. Radial tires are more durable than bias tires because of their sturdy construction, which comprises perpendicular polyester plies and crisscrossed steel belts. Additionally, these tires offer a smoother ride experience, which results in their high market demand.

On the basis of type, the U.S. automotive tire market has been categorized into winter tires, summer tires, and all-season tires. Under this segment, all-season tires held the largest market share in 2018. The market dominance of all-season tires can be mainly attributed to their wide application throughout the year, irrespective of any season. Also, with the advent of these tires, the need and demand for seasonal tires have substantially reduced in the country.

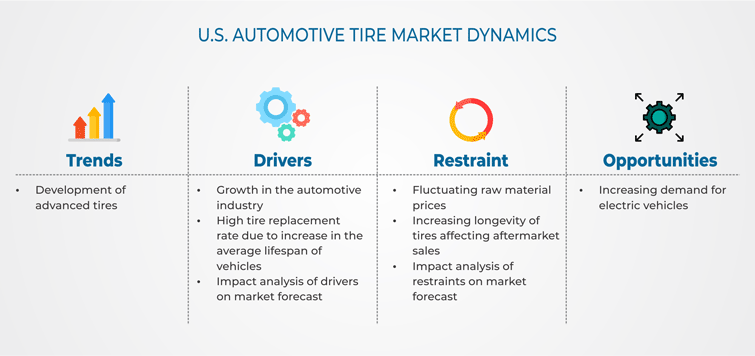

Driver

The U.S. is one of the largest automotive markets in the world and home to many global automobile and related component manufacturers. Furthermore, the automotive industry contributed 3.0% to the country’s gross domestic product (GDP) in 2018. Thus, the future of the U.S. automotive tire market in the country looks promising, especially with the reduction in tariff, arrival of technologically advanced vehicles such as autonomous and electric vehicles, changing preferences of young consumers, and increased compliance in product manufacturing.

The prosperity in the automotive industry is supporting the growth of the automotive tire market, with growth opportunities most prominent in the light commercial vehicle segment owning to the increased production of these vehicles to meet the consumer demand. Moreover, stringent government regulations, increasing operational life of vehicles, and growing demand for green tires are furthering the scope for the automotive tire industry in the country. Additionally, with the introduction of open investment policy, existence of a large consumer base, availability of skilled workforce, presence of a well-developed infrastructure, and provision of local and state government incentives for vehicle adoption, the country continues to grow as an automotive market, thus driving the growth of the U.S. automotive tire market.

Restraint

Automotive tire manufacturing is a complex process and requires a number of raw materials such as rubber (both natural and synthetic), carbon black, sulfur, and other chemicals. The prices of these raw materials are often seen to fluctuate, subject to various factors. For instance, between the first and the second quarter of 2018, the price of natural rubber in the U.S. declined by 5% and the price of carbon black jumped by 41%. Besides, The Goodyear Tire & Rubber Company, a leading tire manufacturer in the U.S., registered a 4% increase in its raw material prices in 2018, as against the 1% increase reported in 2017. Raw material prices are also subject to the availability of resources such as natural rubber. Since excessive cutting down of rubber trees is discouraged by the government in the country, the availability of natural rubber is usually erratic. This, in turn, results in fluctuations in the prices of the raw material, further limiting the growth of the U.S. automotive tire market.

Opportunity

The demand for electric vehicles is increasing in the U.S. owing to the eco-friendly nature of these vehicles. However, a major concern associated with the use of these vehicles is the range anxiety. Thus, OEMs are actively working toward enhancing the range of electric vehicles by making use of modified, lightweight tires especially designed for such vehicles. Besides, tire makers are utilizing advanced carbon-based material that offers advantages such as reduced carbon emissions, increased endurance, and low rolling resistance. Thus, the growing demand for electric vehicles in the country is expected to create lucrative opportunities for the players in the U.S. automotive tire market, as these application-specific tires help improve fuel efficiency and offer a smoother riding experience.

U.S. Automotive Tire Market Competitive Landscape

Some of the key players operating in the U.S. automotive tire market are The Goodyear Tire & Rubber Company, Michelin North America Inc., Cooper Tire & Rubber Company, Pirelli & C. S.p.A., Continental Tire the Americas LLC, Hankook Tire Company Limited, Bridgestone Americas Inc., Kumho Tire U.S.A. Inc., Yokohama Tire Corporation, and Toyo Tire Corporation.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws