Report Code: 11109 | Available Format: Excel

Automotive Anti-Pinch Power Window System Market Report - Global Size, Share, Strategic Developments, and Growth Potential Estimation, 2024-2030

- Report Code: 11109

- Available Format: Excel

- Report Description

- Table of Contents

- Request Free Sample

Automotive Anti-Pinch Power Window System Market Overview

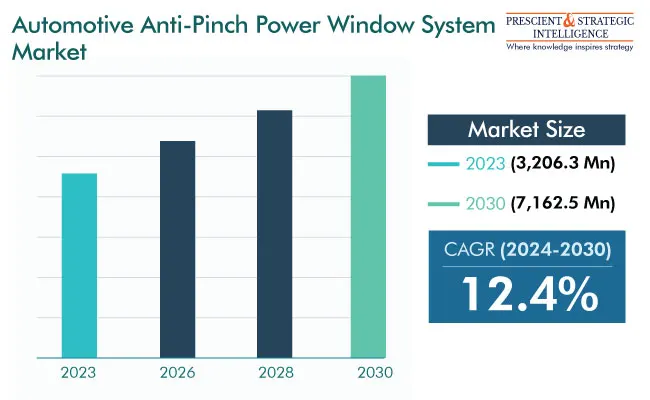

The automotive anti-pinch power window system market was USD 3,206.3 Million in 2023, which will rise to USD 7,162.5 Million by 2030, powering at a rate of 12.4% between 2024 and 2030.

This growth is mainly ascribed to the increase in safety systems in the automotive sector, the rising electrification of automobiles, and the shift of production to low-cost nations.

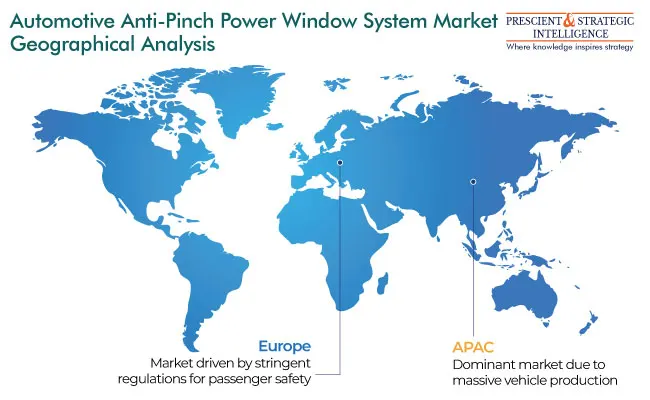

- The anti-pinch technology of power windows has to comply with standards set by the U.S. and EU.

- The allowed maximum force a power window is permitted to apply on any object should not exceed 100N.

The automotive anti-pinch power window system is an integral safety feature that is embedded into power windows present in modern automobiles. Its main purpose is to improve safety by protecting against injuries or damage that a barrier could cause while the powered window is being closed.

The system uses sensors or a specific mechanism fitted in the window frame that keeps track of the window’s movement during the closing operation. If an object is noticed, such as fingers, a hand, discs, or others; the system then automatically reverses the direction of the window. This essentially prevents the window from closing anymore, thereby reducing injury risk to occupants or harm to objects caught in the window.

The technology is intended to serve as an extra safety measure, particularly in cases where occupants might accidentally position his/her body parts or something on the window path. By stopping the movement of the window upon sensing a barrier, the system plays an important part in averting accidents and enhancing overall safety in the vehicle.

Driver

The rising safety systems in the automotive sector are a major driver in the growth of this industry. There is a growing penetration of developed automotive safety as well as security features across premium automobiles to mid-level automobiles. There is a surging requirement for electronic equipment in emerging markets and they are progressively added in entry-level automobiles.

In addition, major safety applications integrated into vehicles are anti-pinch windows, braking and stability systems, electronic steering, and driving assistance systems including cameras, communication devices, and radar. The anti-pinch feature in automotive power window systems is becoming more and more preferred among customers and manufacturers. In addition, more businesses are switching to anti-pinch power window systems owing to regulatory bodies’ regulations. Therefore, such reasons are likely to further assist the industry expansion in the coming years.

Trends

- Surging Need for Electric Vehicles

As electric vehicles become increasingly popular, so, too, is the need for unique features, such as greater safety designs including anti-pinch power windows. As electric vehicles become more mainstream, the need for such technologies will increase continuously.

- For instance, the sales of electric cars across the globe will increase to 45 million units in 2030 from 8.1 million units in 2022.

- Developments in Sensor Technologies

The introduction of more advanced sensor technologies has been powering the automotive anti-pinch power window systems. In many cases, these systems rely on sensors to notice obstacles in the way of the window and initiate an immediate reversal of the window movement to avoid damage or harm.

- Incorporation with Vehicle Connectivity Systems

Modern cars are becoming more connected and anti-pinch power window systems could be integrated with the overall connectivity of the vehicle. This integration would enable the users to regulate windows through smartphone applications as well as the central system of some vehicles.

Challenge

- Growing Cost Pressure for Original Equipment Manufacturers

- Increasing Competition Among Manufacturers

One of the major challenges that slow down the development of the industry is the increase in cost pressure for OEMs. On the other hand, anti-pinch power windows have deep penetration into luxury cars. However, there is a safety issue along with the increasing awareness about the need for safety equipment in vehicles, and the growing competition among the automotive manufacturers in terms of product differentiation.

- As per a study, 87% of car owners were conscious about safety ratings before buying their car.

This has enforced original equipment manufacturers to implement safety systems in entry-level and mid-range automobiles.

Furthermore, the increasing competition among automakers to increase competitiveness via product differentiation is driving them to add anti-pinch power window systems. Therefore, it significantly boosts the costs of procurement. As a result, such aspects are having a negative impact on the industry.

| Report Attribute | Details |

Market Size in 2023 |

USD 3,206.3 Million |

Revenue Forecast in 2030 |

USD 7,162.5 Million |

Growth Rate |

12.4% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Automatic Category Is Larger Contributor

Automatic category, based on type, is the larger contributor to the industry. This can be ascribed to the growing trend of automobile electrification, where vehicle manufacturer integrates electronic parts for greater efficiency. At the same time, an increased consciousness regarding advanced safety features has boosted the acceptance of automatic windows. The superiority as well as convenience provided by electrically driven windows are in line with the industry's pursuit of user-friendly inventions.

Passenger Cars Is Leading End Use

The passenger cars category, based on end use, is the largest contributor to the industry. This can be primarily because of the swiftly advancing automotive sector, particularly in China, India, South Africa, and Brazil. Moreover, the increasing export of vehicles is also likely to boost the expansion in the years to come.

For example, as per a news article, in 2023, India's car exports increase by 4% from 2022, reaching 671,384 units. Moreover, Skoda's exports climbed 431% (1,530 units), whereas, Volkswagen registered a growth of 29%, reaching 40,920 passenger vehicles, in 2023. Furthermore, Maruti Suzuki attained a new landmark by exporting 261,700 passenger automobiles, such as SUVs and cars.

APAC Is Significant Contributor

APAC is a significant contributor to the industry. Some major nations that are significantly assisting the regional industry expansion include Japan, Australia, and China. This can also be ascribed to the mounting car exports in these nations.

- For instance, in 2023 (for the first 11 months), China exports 4.76 million cars for the first 11 months of 2023.

- Whereas, Japan exports 3.99 million cars, during this same period.

Moreover, there is an increasing need in emerging nations, including Thailand, Indonesia, and India, which will further boost the growth of the industry. In addition, variables such as technology progression, rising product awareness, and the number of countries in the region that will include it in their safety standards are predicted to fuel industry expansion in the coming years.

Competitive Landscape

The automotive anti-pinch power window system market is very competitive with both recognized and new companies. These companies are consistently evolving and coming up with new technologies to make their anti-pinch power window systems perform better and safer. They are also broadening their global reach to open up new markets.

Key Players in the Market

- Brose Fahrzeugteile GmbH & Co. KG.

- INA-Holding Schaeffler GmbH and Co. KG

- Grupo Antolin Irausa S.A.

- Denso Corporation

- The Renco Group Inc

- Mabuchi Motor Co. Ltd.

- Leopold Kostal GmbH & Co. KG.

- Magna International Inc.

- Nidec Corporation

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- Mitsuba Corporation

- Panasonic Holdings Corp.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws