Report Code: 10438 | Available Format: PDF | Pages: 217

Automated Dispensing Machines Market Research Report: By Type (Centralized, Decentralized), Application (In-Patient, Out-Patient), End User (Hospitals, Pharmacies) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 10438

- Available Format: PDF

- Pages: 217

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

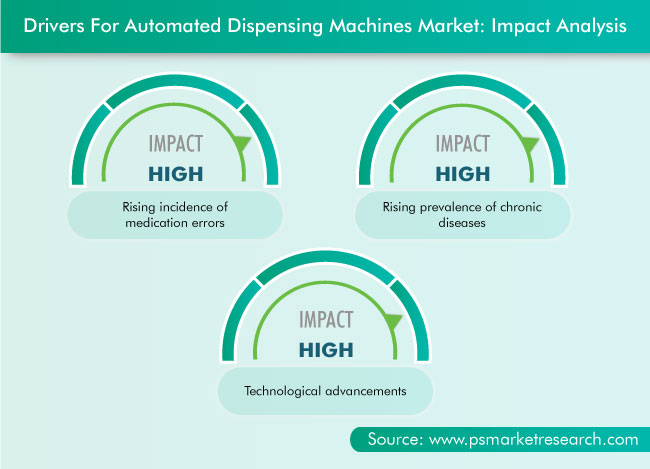

The global automated dispensing machines market generated $1,673.0 million revenue in 2020, and it is expected to grow at a CAGR of 9.1% during the forecast period (2021–2030). The key factors responsible for the growth of the market include the rising incidence of medication errors, technological innovations, growing geriatric population, rising prevalence of chronic diseases, government initiatives to integrate automated machines in healthcare settings, and increasing number of patent approvals.

The process of COVID-19 lockdown lifting has been initiated in phases, and in some countries, it has been completed. This has proved to be a good sign for the recovery of the economy and growth in the employment sector, which, in turn, has created a demand for services and goods. In 2021, the major players in the automated dispensing machines market have focused on the digitalization of the systems, which, in turn, will increase the sale of the machines in the foreseeable future. Further, this is leading to a rise in the manufacturing of the machines and their installation in healthcare settings across the world.

In-Patient Category Holds Larger Share in Market due to Increase in Prevalence of Chronic Diseases

The in-patient category held the larger share in 2020 in the automated dispensing machines market, based on application. This is majorly attributed to the increase in the prevalence of chronic diseases, which is why the demand for automated dispensing machines for in-patients has risen considerably.

Decentralized Category To Witness Faster Growth due to Increasing Cases Of Hospitalization

The decentralized category is expected to witness the faster growth in the automated dispensing machines market during the forecast period, based on type. This will be primarily due to the increasing cases of hospitalization, rising number of hospitals, and surging demand for decentralized systems in healthcare settings.

Due to Largest Patient Pool, Hospitals Category Accounts for Larger Revenue Share

Hospitals have emerged as the higher-revenue-generating category amongst the end users in the automated dispensing machines market owing to the growing patient population, increasing healthcare expenditure, and rising prevalence of chronic diseases.

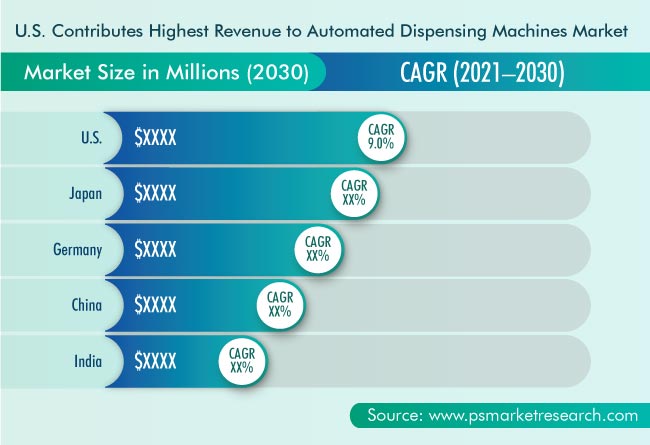

North America To Lead Market due to High Healthcare Spending

Geographically, North America is expected to lead the automated dispensing machines market throughout the forecast period. This can be mainly attributed to the improving healthcare infrastructure, presence of established players, and rising geriatric population.

Market To Grow Fastest in APAC owing to Improving Healthcare Infrastructure

Asia-Pacific (APAC) is expected to witness the fastest growth in the automated dispensing machines industry during the forecast period owing to the improving healthcare infrastructure and increasing focus of market players on developing countries, such as China and India, for business expansion.

Technological Advancements Are Key Growth Driver for Market

Advancements in artificial intelligence (AI), machine learning, and robotics have led to a drastic increase in the demand for automated dispensing machines to improve patient safety, optimize workflow, and reduce healthcare costs. For instance, in November 2020, Omnicell Inc., a provider of medication management solutions and adherence tools for health systems and pharmacies, announced new capabilities in its portfolio of medication management solutions that are designed to expand the medication inventory and supply chain management abilities, thus supporting improved clinical, operational, and financial goals. This is playing pivotal role in the growth of automated dispensing machines market.

Growing Geriatric Population also Propelling Product Demand

The booming geriatric population is another major factor driving the growth of the automated dispensing machines market. According to the World Population Ageing 2020 report by the United Nations (UN), there were 727 million persons aged 65 or above in 2020, and they are set to number over 1.5 billion by 2050. Moreover, globally, the share of the elderly population is expected to increase from 9.3% in 2020 to around 16.0% by 2050. With age, people become more susceptible to chronic diseases, majorly cardiovascular disorders (CVDs), neurological disorders, and gastroenterological diseases. According to the World Health Organization (WHO), 17.9 million people die each year from CVDs, which represents an estimated 31.0% of all deaths worldwide.

Rising Incidence of Medication Errors Is Driving Market Growth

The rising incidence of medication errors is playing a pivotal role in the growth of the automated dispensing machines market. According to the National Center for Biotechnology Information (NCBI), 7,000–9,000 people die every year in the U.S. as a result of medication errors. The lack of healthcare medication administration training and poor communication between healthcare professionals and patients increase the chances of medication errors. Seeing the increasing number of deaths caused by medication errors, government agencies across the globe have started encouraging hospitals and pharmacies to implement advanced technologies for dispensing accurate doses of medicines, to manage medical conditions more effectively.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$1,673.0 Million |

Market Size Forecast in 2030 |

$3,941.9 Million |

Forecast Period CAGR |

9.1% |

Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Country Breakdown; Impact of COVID-19; Companies’ Strategic Developments; Company Profiling |

Market Size by Segments |

By Type; By Application; By End User; By Region |

Market Size of Geographies |

U.S; Canada; Germany; France; U.K.; Italy; Spain; Japan; China; India; Brazil; Mexico; Saudi Arabia; South Africa |

Secondary Sources and References (Partial List) |

TouchPoint Medical; ArxIUM; Tosho Inc.; Takazono Corporation; McKesson Corporation; Pearson Medical Technologies LLC; Accu- Chart Plus Healthcare Systems Inc.; Capsa Healthcare; Swisslog Holding AG; Willach pharmacy solutions |

Explore more about this report - Request free sample

Market Players Involved in Product Launches to Gain Significant Position

The global automated dispensing machines market is fragmented in nature with the presence of several key players, including Becton, Dickinson and Company, Baxter International Inc., Omnicell Inc., ScriptPro LLC, Talyst LLC, TouchPoint Medical, Tosho Inc., AlixaRx, Takazono Corporation, McKesson Corporation, Pearson Medical Technologies LLC, Capsa Healthcare, Swisslog Holding AG, Willach Pharmacy Solutions, Newlcon Oy, and Accu-Chart Plus Healthcare Systems Inc.

In recent years, players in the automated dispensing machines market have been involved in product launches in order to attain a significant position. For instance:

- In April 2021, Omnicell Inc. unveiled its latest robotic dispensing system, named Medimat, to the Middle Eastern pharmaceutical industry, at this year’s DUPHAT Conference and Exhibition (April 5–7, 2021) held at the Dubai World Trade Centre. Medimat is a next-generation technology for central pharmacy workflows that helps improve all the aspects of the dispensing process.

- In January 2020, TouchPoint Medical Inc. launched the next-generation medDispense series, which has expanded its automated medication dispensing line. The new medDispense product line delivers many dispensing options and security across one software platform. Moreover, it supports single-dose dispensing, single-line item control, and bulk item storage, while using one software platform medLogicTM.

Key Players in Automated Dispensing Machines Market Include:

-

Becton, Dickinson and Company

-

Baxter International Inc.

-

ScriptPro LLC

-

Talyst LLC

-

TouchPoint Medical

-

Tosho Inc.

-

Takazono Corporation

-

McKesson Corporation

-

Pearson Medical Technologies LLC

-

B. Braun Melsungen AG

-

Capsa Healthcare

-

Swisslog Holding AG

-

Willach Pharmacy Solutions

-

Newlcon Oy

-

ArxIUM

-

Accu-Chart Plus Healthcare Systems Inc.

Market Size Breakdown by Segment

The global automated dispensing machines market report offers comprehensive market segmentation analysis along with market estimation for the period 2015–2030.

Based on Type

- Centralized

- Decentralized

Based on Application

- In-Patient

- Out-Patient

Based on End User

- Hospitals

- Pharmacies

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific (APAC)

- Japan

- China

- India

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East and Africa (MEA)

- Saudi Arabia

- South Africa

The global automated dispensing machines market will attain value of $3,941.9 million by 2030.

The automated dispensing machines industry will progress at a CAGR of 9.1% from 2021 to 2030.

North America will hold the largest share in the automated dispensing machines industry during 2021–2030 because of the surging geriatric population in the region.

Asia-Pacific will be the fastest growing region in the market for automated dispensing machines during 2021–2030.

The growing prevalence of medication errors is driving the expansion of the market for automated dispensing machines.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws