Report Code: 12486 | Available Format: PDF | Pages: 109

Australia E-Commerce in Automotive Aftermarket Research Report: by Component (Engine Parts, Drive Transmission and Steering Parts, Suspension and Braking Parts, Equipment, Electrical Parts), Channel (Third-Party Retailer, Direct to Consumer), Consumer (Garage Owners, Mechanics, Spare Parts Retailers, B2C) - Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12486

- Available Format: PDF

- Pages: 109

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

The Australia e-commerce in automotive aftermarket is estimated to generated $1,503.5 million in 2022, and the market size is predicted to reach $3,822.2 million by 2030, advancing at a 12.2% CAGR during 2022–2030. The market is driven by the convenience offered by online shopping channels, increasing number of DIY customers, and growing automotive aftermarket.

As a result of the pandemic, the e-commerce in automotive aftermarket has witnessed a slowdown, attributed to the temporary hindrances in the supply chain and a lower demand for replacement auto parts. Moreover, during the first wave, automakers and their suppliers struggled to carry out vehicle assembly owing to the restrictions on the transportation of non-essential goods. Furthermore, the impact of the COVID-19 outbreak was visible in the export/import of automobile parts from/to different countries, thus causing large-scale disruptions. This hampered the supply chain of the raw material and components of automobiles.

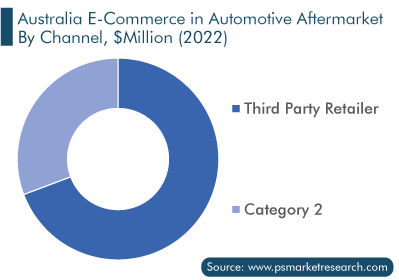

Third-Party Retailers Held Larger Share

Based on channel, the third-party retailer category, in 2022, held a 69.1% market share. The availability of a wide range of products and hassle-free transactions with timely delivery are resulting in a shift to the online purchasing of automotive replacement parts from getting them at the traditional brick-and-mortar stores. A large number of e-retailers, such as Alibaba Group Holding Ltd., Amazon.com Inc., and Wal-Mart Stores Inc., offer automotive components on their portals, thus making the access easy for consumers.

Moreover, garage owners held the largest share, of 45.6%, in 2022. This is mainly due to the convenience, easy availability, and affordability provided to vehicle owners by these entities.

Australia is the ninth-largest destination for U.S. auto parts exports. The Australian aftermarket is worth around $9.2 billion and split fairly evenly between local manufacturers and importers. Moreover, Australian companies, including Carparts2u, Car Mods Australia, Repco, and Pro Speed Racing provide a wide range of vehicle components via e-commerce platforms for replacement.

Click-and-Mortar Retailing Is Key Market Trend

Consumers’ feeling toward an all-online automotive aftermarket platform is not completely clear, click-and-mortar retailing is trending in the e-commerce in automotive aftermarket. This model comprises traditional retailers who have an online presence, thus allowing customers to place order for the parts and pay for them online and pick them up at the physical store. This operational model incorporates e-commerce into brick-and-mortar stores, thus mutually eliminating each other’s drawbacks.

E-commerce platforms allow retailers to establish an online presence and upload their inventory and product listings online, thereby making it easier for them to reach customers. This also makes the purchasing experience smooth and convenient for customers, since they do not have to physically look for certain products from store to store. They can simply look the product up online and reach the store to pick it up. This distribution method integrates the comfort offered by e-commerce, while eliminating the waiting and delivery times.

| Report Attribute | Details |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Market Size in 2022 |

$1,503.5 Million |

Revenue Forecast in 2030 |

$3,822.2 Million |

Growth Rate |

12.2% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Component; By Channel; By Consumer |

Explore more about this report - Request free sample

Growing Automotive Aftermarket

The growth of the overall automotive aftermarket has a direct impact on the advance of the e-commerce in the automotive aftermarket.

- As per the Macrotrends, the urban population in Australia in 2020 was over 22.1 million, a 1.43% increase from 2019, and 22.2 million in 2021, a 0.32% increase from 2020. This increasing urbanization, coupled with the increasing disposable income, is propelling the increase in vehicle ownership. Thus, VIO continues to rise, creating an ample demand for aftermarket components. according to the CEIC, the number of registered vehicles in the country was reported at 19,229,139 in December 2020. Additionally, as per the Australian Bureau of Statistics, as of January 31, 2021, there were 20.1 million registered motor vehicles, and the national fleet increased by 1.7% from 2020 to 2021. This was also a significant increase from the previous number of 18,924,450 units in December 2019.

- Moreover, with the increasing average age of vehicles, the automotive aftermarket would witness significant growth in Australia. The rise in the average age of the vehicles is mainly due to car loans, which stretch for up to 5–6 years, and better-quality vehicles, which themselves last longer. The country is expected to witness a further rise in the average age of vehicles during the forecast period, which will drive the market growth. Aftermarket component manufacturers will compete to gain new customers with varying methods, such as an e-commerce presence and wider product portfolios.

Moreover, in recent years, the players in the market have been involved in product launches in order to attain a significant position. For instance:

- In October 2022, Robert Bosch GmbH added several automotive aftermarket parts to its product portfolio. The new products cover the European and Asian markets for passenger and commercial vehicle parts, which include braking parts, fuel and water pumps, cooling fans, rotating machines, spark plugs, ESP units, ignition coils, fuel injectors, and sensors.

- In June 2022, Meritor Inc. announced the launch of its ProTec independent front suspension (IFS) for motorcoach applications.

Top E-Commerce Companies in Automotive Aftermarket of Australia:

- Alibaba Group Holding Ltd.

- Robert Bosch GmbH

- Amazon.com Inc.

- eBay Inc.

- Carparts2u

- Belipart

- HELLA GmbH & Co. KGaA

- Meritor Inc.

- Car Mods Australia Pty Ltd.

- Ubuy Co.

Market Size Breakdown by Segment

This report offers deep insights into the market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Component

- Engine Parts

- Piston and Piston Rings

- Engine Valves and Parts

- Fuel Injection Systems and Carburetors

- Powertrain Components and Others

- Drive Transmission and Steering Parts

- Gearboxes

- Wheels

- Steering Systems

- Axles

- Clutch Assembly System and Others

- Suspension and Braking Parts

- Brake Calipers

- Brake Pads

- Suspension Systems

- Other Parts

- Equipment

- Headlights and Lighting Components

- Wiper and Washer Systems

- Dashboard Instruments

- Other Equipment

- Electrical Parts

- Starter Motors

- Spark Plugs

- Electric Ignition Systems

- Battery and Others

- Miscellaneous

Based on Channel

- Third-Party Retailer

- Direct to Consumer

Based on Consumer

- Garage Owners

- Mechanics

- Spare Parts Retailers

- B2C

The e-commerce in automotive aftermarket of Australia valued $1,503.5 million in 2022.

Third-party retailers dominate the Australia e-commerce in automotive aftermarket.

The DIY and DIFM cultures and click-and-mortar retailing are trending in the e-commerce in automotive aftermarket of Australia.

The Australia e-commerce in automotive aftermarket is propelled by the growing auto sector.

The COVID-19 impact on the e-commerce in automotive aftermarket of Australia was negative initially and then somewhat positive from 2021 onwards.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws