Augmented Analytics Market Trends & Growth Drivers

Continuous Advancements in Software Are Key Trends

An augmented analytic approach uses emerging technologies, including advanced statistics, (NLP), and machine learning (ML), to develop sophisticated and actionable insights from data. The software also helps analyze trends, makes future projections, and solves problems. It can evaluate organizational analytics by utilizing cutting-edge statistical and modeling tools. These realizations can be used to map out or alter the course of companies.

For instance, BI tools like Power BIQlikView, QlikSense, MicroStrategy, and SAP offer metrics, forecasting, dashboard, measure, scorecard, budgeting, planning, and visualization technologies, including advanced charts and graphs. These help in building reports with the use of statistical methods to project future forecasts.

As per the analysis, the value created by ML in analytics has the potential to spread across over 300 enterprise use cases and will be a major contributor to the market revenue in the forecast period. Moreover, businesses adopting ML as an analytic tool can contribute an average of 15% return on investment.

Digital Transformation and Automation of Industries Drive Market

From consumers’ daily lives to manufacturing and medical diagnosis, everything around the world is witnessing digital transformation and automation. These changes not only augment productivity across all processes but also enhance the convenience for users. Moreover, they are considered the cornerstone approaches to achieve sustainability, which is why they are being vehemently pursued by governments and business alike.

This is because any connected device, be it an individual’s smartphone, a computer owned by an enterprise, an integrated production line at a factory, or an at a hospital, generates huge amounts of data. As per estimates, compared to 41 Zettabytes in 2019, 97 Zettabytes of data were generated in 2022. Properly analyzing this information can not only help improve the productivity and efficiency of operations, but also assess the functioning of the device itself.

For instance, by tracking people’s locations and online activities from the data generated by their smartphones, companies are able to offer personalized recommendations spanning better, shorter routes, nearest ATM, relevant products on an e-commerce website, and everything in between. Similarly, studying the real-time data generated by an CT scanner can not only help clinicians in better disease diagnosis but also aid technicians in maintaining safe radiation doses and assessing the scanner’s electricity consumption.

Augmented analytics enhance the efficiency of data analysis, thus enabling business to make better decisions to not only impact customers’ lives more positively but also remain as profitable as possible. For instance, building automation systems generate constant data on the functioning of HVAC, lighting, fire & safety, and other appliances, and analyzing it is crucial to maintain high energy efficiency. The insights gained from this digital information also helps in predicting system failures, which ultimately allows for maintenance before a complete breakdown.

Data Concerns and Technical Challenges Hamper Market Growth

The challenges for the augmented analytics market are similar to those associated with most advanced digital technologies. The most significant among those is data privacy, because a range of data is analyzed by and companies for analysis. This includes people’s personal details, financial information, information about medical conditions and prescriptions. If the data analysis software is not backed up with adequate measures, hackers can easily steal it, and use it for their benefit.

The biggest risks of data breaches are ransomware, social engineering, identity fraud, phishing, malware, and DDoS. Such incidences cause companies financial and reputation losses, which can be in the millions of dollars. As per IBM, the average cost of a data breach is USD 4.88 million in 2024, 10% higher than last year. Moreover, 1 in 3 data breaches involve shadow data, which is digital information that is ignored or unintentionally left behind at vulnerable places in cyberspace. It is just not the immediate financial losses but also the repercussions of failure with the government regulations for data privacy that businesses have to deal with.

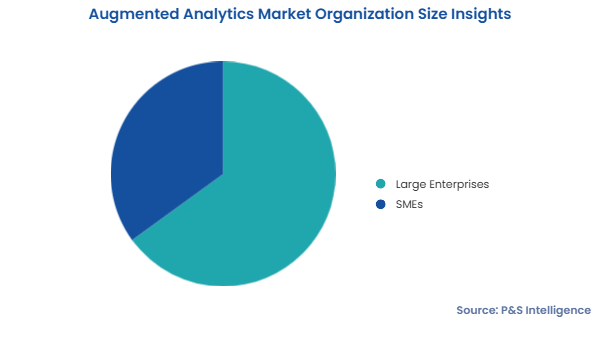

The other major challenge with augmented analysis software is its high costs, which are particularly crippling for small and medium-sized organizations and startups. The software could also itself be technically challenging, requiring extensive training and even an upgradation of legacy systems, thereby further raising expenses.

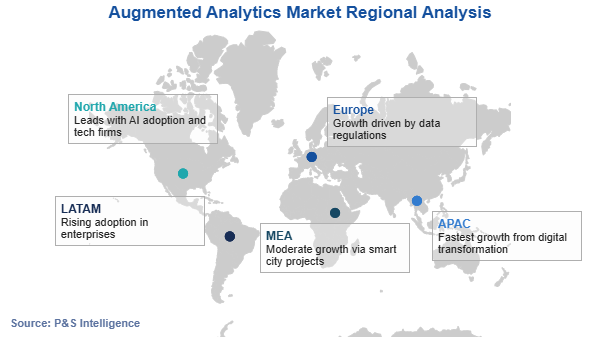

Regional Analysis

North America held the largest market share, of 40%, in 2024. This is due to a large number of research and development activities as well as the presence of significant industry players who are constantly updating their product offerings for the research. Moreover, the analytic software facilitates finding the pattern of data and ensures getting data insights, which make it possible for better business productivity.

For instance, in October 2021, IBM and Deloitte together announced an AI-enabled analytic solution, DAPPER. Through this, Deloitte and IBM can assist data scientists and business users in creating, organizing, and managing insight assets to help advance reliable internal reporting and AI solutions, so that businesses can concentrate on their core competencies.

As per the analysis, the U.S held a larger share in the IT services and cloud computing industry in 2021, generating almost USD 400 billion revenue, in North America. This is due to the surging adoption of augmented analytic solutions that have the ability to transform big data into a smaller usable dataset, which helps in getting useful business insights at a broader level and provides a centralized data platform.

The APAC market is expected to experience the fastest growth in the coming years, with 30.0% CAGR, due to the presence of major industry players in the region. Moreover, in terms of the rising adoption of artificial intelligence (AI)-based technologies in business intelligence (BI), the Indian market is expected to advance significantly. This can be attributed to the rising need to integrate and manage unstructured data by Indian enterprises and data scientists' experiments with real-time streaming data.

In APAC countries like India, Japan, and China, organizations have started to shift from conventional enterprise reporting tools to augmented analytic tools, in order to boost data preparation and cleansing.

In major IT cities in India (Bangalore, Hyderabad, Mumbai, Chennai), companies are increasingly investing in the automation of data processing. For instance, Subex Ltd. launched HyperSense, an end-to-end augmented analytic platform. This platform helps in turning data into insights by building, interpreting, and tuning AI models, and helps in delivering actionable insights from the data.

The following is the regional breakdown of the market:

- North America (Largest Regional Market)

- U.S. (Larger Country Market)

- Canada (Faster-Growing Country Market)

- Europe

- Germany (Largest Country Market)

- France

- U.K. (Fastest-Growing Country Market)

- Italy

- Spain

- Rest of Europe

- Asia-Pacific (APAC) (Fastest-Growing Regional Market)

- China (Largest Country Market)

- Japan

- India (Fastest-Growing Country Market)

- Australia

- South Korea

- Rest of APAC

- Latin America (LATAM)

- Brazil (Largest Country Market)

- Mexico (Fastest-Growing Country Market)

- Rest of LATAM

- Middle East and Africa (MEA)

- Saudi Arabia (Fastest-Growing Country Market)

- South Africa (Largest Country Market)

- Rest of MEA