Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 78.3 billion |

| 2025 Market Size | USD 82.9 billion |

| 2032 Forecast | USD 132 billion |

| Growth Rate(CAGR) | 6.9% |

| Largest Country | China |

| Fastest Growing Country | India |

| Nature of the Market | Fragmented |

Report Code: 11482

This Report Provides In-Depth Analysis of the APAC Paints and Coatings Market Report Prepared by P&S Intelligence, Segmented by Technology (Water-Borne, Solvent-Borne, High Solids, Powder Coatings, Ultraviolet), Formulations (Acrylic, Polyester, Polyurethane, Epoxy), Application (Architectural Coatings, Industrial Coatings, Special Coatings), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 78.3 billion |

| 2025 Market Size | USD 82.9 billion |

| 2032 Forecast | USD 132 billion |

| Growth Rate(CAGR) | 6.9% |

| Largest Country | China |

| Fastest Growing Country | India |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

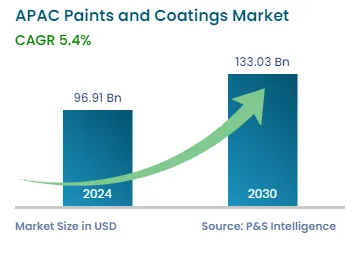

The APAC paints and coatings market size stood at USD 78.3 billion in 2024, and it is expected to grow at a CAGR of 6.9% during 2025–2032, to reach USD 193.2 billion by 2032. This is primarily ascribed to the growing construction industry, increasing demand for automobiles, surging need for paints and coatings from the oil and gas industry, and rising consumer spending in the region.

Moreover, the industry is expected to grow significantly during the forecast period, owing to the increasing demand for such products for the renovation and repair of commercial and residential buildings, and the rising government and foreign investments in the construction and automotive sectors. Also, the demand for automobiles in the region is increasing, on account of rapid urbanization, rising disposable income, and changing lifestyle, which is driving the need for paint & coatings, as these are widely used in automobile applications.

Through nanotechnology, the process of making paints and coatings experienced a fundamental revolution that resulted in intelligent high-performance products. The main breakthrough in paint manufacturing involved developing low or zero-VOC volatile organic compound formulations that provide increased safety for human users and environmental protection.

According to research companies used nanotechnology to develop innovative nano paints and coatings that demonstrate superior functions including water repellence, dirt resistance, anti-microbial effects, and scratch protection. Manufacturers accomplish these properties by adding ceramics and metals to paint formulations which results in stronger coatings compared to traditional paint.

The most advanced nano-coatings feature additional properties because they now include electrical conductivity and both UV protection and automatic repair capabilities. The application of these coatings leads to extended service life because they provide protection against scratch marks and corrosion along with stain stains. These advanced paints enable significant industrial impacts by finding applications across residential properties and automobiles as well as industrial machinery.

The ongoing development of nanotechnology in paints and coatings provides major business opportunities to companies that want to deliver sustainable high-performance products with extended durability.

The water-borne is the largest category, with a market share of 70% in 2024 because these coatings are popular for use in all types of structures. Water-borne coatings gain preference instead of solvent-based ones because they contain minimal VOCs that protect both people and Earth. More countries including China and Japan now require industries to use water-based paints because of government controls on VOC emissions. The expansion of the construction and automotive industries across APAC demands water-borne coatings because of their lasting performance and environmental benefits. This segment controls the most market share due to its success.

The powder coating category will grow at a highest CAGR, during the forecast period. Water-borne coatings lead in the market because they withstand longer use than other coatings while producing excellent results and emitting zero pollution. Manufacturers in automotive and metal industries use powder coatings because these coatings better defend their products against damage from corrosion and chemicals. New powder coating methods enable users to protect plastics and wood items without causing damage from heat. The Asia-Pacific powder coatings market will expand by more than 7% annually because of industrial development and environmental rules that require eco-friendly coatings.

Here are the technologies studied in this report:

the acrylic is the largest category, with a market share of 60% in 2024. Acrylic coatings gain success because they work well for decorative and industrial use at affordable costs with tough construction. These coatings find heavy use in construction sites and auto plants because they stand up well against weather impacts plus ultraviolet light and water. As countries across the Asia Pacific expand their infrastructure and urban development projects acrylic coatings have become more popular because people choose water-based and low-VOC paints. These coatings lead the market because they work well and become strong without taking much time to dry.

The polyurethane category will grow at a highest CAGR, during the forecast period. because it delivers better strength performance resistance to chemicals and can flex without breaking. Manufacturers apply polyurethane coatings to different surfaces because these coatings provide excellent protection from automotive wear and industrial damage. The automotive and industrial companies in APAC are growing quickly, which increases the demand for PU coatings at an accelerated rate. Scientists now create environmentally friendly water-based polyurethane that industries across the board are adopting for their applications. Polyurethane coatings in APAC will grow by more than 8% annually because customers need durable high-performance coatings for tough application areas.

Here are formulations analyzed in the report:

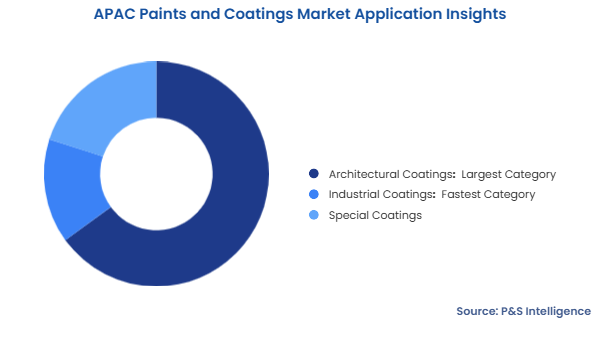

The architectural coating is the largest category, with a market share of 65% in 2024. Rapid urbanization drives growth in all major economies of Asia-Pacific through expanding construction projects. People want more buildings for homes and work plus they need building protection which creates a strong demand for paint products. The government supports building sustainable architecture through programs that enhance affordable homes while favoring water-use coatings with low VOC emissions. Due to the building activity surge architectural coatings remain the leading segment in this region.

The industrial coating category will grow at a highest CAGR, during the forecast period, because industries keep developing especially in automotive plants and manufacturing facilities. A steady rise in automobile production and aerospace company operations across India China and South Korea demands strong protective coatings for these industries and their heavy machinery needs. The oil and gas sector along with shipbuilding and electronics push market expansion because companies now need coatings that resist corrosion and heat. Nanotechnology and eco-friendly coatings drive industrial coatings demand at high rates in APAC markets currently.

Here are applications analyzed in the report:

Drive strategic growth with comprehensive market analysis

The China is the largest region, with a market share of 45% in 2024 because its construction boom and industrial growth fuel strong demand across all sectors. As China's second-biggest economy grows it needs more infrastructure construction and housing development which creates strong market demand for protective and decorative coatings. More urban residents need homes and businesses which drive up demand for water-based eco-friendly coating products. The Chinese government supports eco-friendly building practices which prompt builders to use low-VOC high-performance coatings to strengthen their market position.

China leads both automotive and manufacturing industries worldwide which need advanced coating materials. China's extensive manufacturing sector in shipbuilding electronics and machinery needs top-quality protective and specialty coatings to work and stay strong.

The rapid growth of automotive factories across China especially as the world's top car maker leads to higher demand for coatings that protect vehicles and improve their appearance. Major international and Chinese paints companies keep expanding their research and manufacturing operations in China which lets the nation stay strong as the top market for paints and coatings in Asia Pacific.

The India in the APAC will grow at a highest CAGR, during the forecast period, due to quick urbanization trends and growing infrastructure plus increasing household money available for spending. The Indian government invests heavily in smart communities with new homes plus building networks to make decorative and protective coatings more needed. Millions of people need environmentally safe building materials for their new homes and business structures at a rapid rate. Since customers want advanced coating choices the industry now makes low-VOC water-based weather-resistant formulations for various markets.

The automotive and industrial industries in India grow quickly which creates more demand for high-performance coatings. India stands as a major automotive manufacturing center worldwide, so it needs advanced coatings to make vehicles last longer and look better while resisting environmental damage.

Different types of protective coatings shield machines and structures in factories plus bridges and industrial sites against rust and outerwear. The paints and coatings market in India will expand at a fast-paced thanks to steady economic growth and rising foreign investment along with an increasing middle class.

The regions and countries analyzed for this report include:

The APAC paints and coatings market is fragmented in nature because many global and local companies try to gain market share across the APAC paints and coatings sector which remains divided among its participants. Major international companies including AkzoNobel, PPG Industries, Sherwin-Williams, and Nippon Paint lead the market, but many local and regional producers serve specific areas. The markets in APAC countries remain split because buyers want different products and governments have unique rules while local economic conditions stay distinct. Several small cost-effective producers located in India China and Indonesia work together to split the market into smaller pieces.

Large businesses now buy regional brands to enhance their market presence throughout various regions. Several international companies form partnerships through mergers and acquisitions to reach the fast-growing markets found in emerging nations. The market stays highly competitive even after these efforts because buyers pay close attention to prices and new products plus environmental concerns define this sector. Regional businesses compete strongly with international companies throughout the APAC paints and coatings market which makes the market structure more diverse than unified at present.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages