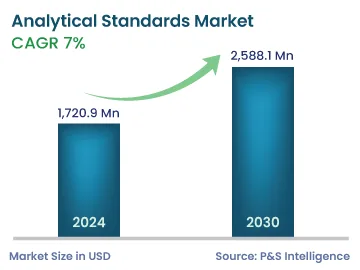

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 1,720.9 Million |

| 2030 Forecast | 2,588.1 Million |

| Growth Rate(CAGR) | 7% |

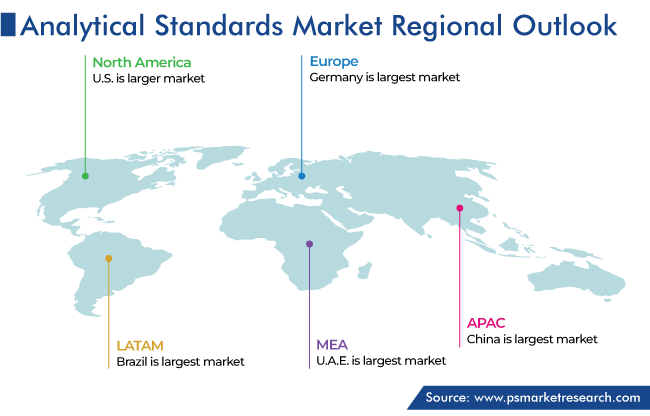

| Largest Region | North America |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Report Code: 12813

Get a Comprehensive Overview of the Analytical Standards Market Report Prepared by P&S Intelligence, Segmented by Technique (Spectroscopy, Chromatography, Titrimetry, Physical Property Testing), Application (Pharmaceutical & Life Sciences, Food & Beverage, Forensics, Veterinary Sciences, Petrochemistry, Environmental Sciences), Methodology (Raw Material Testing, Bioanalytical Testing, Stability Testing, Dissolution Testing), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 1,720.9 Million |

| 2030 Forecast | 2,588.1 Million |

| Growth Rate(CAGR) | 7% |

| Largest Region | North America |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The analytical standards market size stood at USD 1720.9 million in 2024, and it is expected to grow at a CAGR of 7.0% during 2024–2030, to reach USD 2,588.1 million by 2030.

Analytical standards are certain parameters that a raw material or chemical should pass, for further processing. These compounds are also termed ‘reference materials’, and they are critical in analytical testing and quality assurance testing.

These high-purity compounds of standard concentrations are used to increase the accuracy of quantitative analysis, detect the presence of certain components in a mixture, calibrate analyzers, and for various other purposes. Electrophoresis, chromatography, titration, and spectroscopy are a few of the processes wherein such compounds are used for quantitative and trace analysis.

The global market is expanding due to the growing application of the associated products in pharmaceutical, biotechnology, food safety and quality assurance, environmental analysis, forensics, and many other applications. Moreover, their rising application in the clinical study of complete proteins and metabolites in a cell or organism, with the rising concern to control or monitor pollution, drives the industry.

Additionally, the rising concern for food safety and quality and product expiry analysis, driven by the stringent government rules in this regard, is propelling the usage of analytical standards. Such quality control guidelines are even stricter for pharmaceutical companies, which forces them to use these techniques to ensure an optimum quality for their products.

The demand for analytical compounds is especially high in the pharmaceuticals and life sciences sector, owing to the rising count of clinical research and trial activities, wherein they are used to study the chemical and physical stability of drugs. Hence, as the growing prevalence of various diseases propels drug R&D, the pharmaceutical and life sciences category is expected to witness a CAGR of 7.3% during the forecast period.

Additionally, the biopharmaceutical sector is one of the fastest-growing markets for analytical standards globally. For the development of various biomarkers and discovery of biologic drugs, analytical standard compounds find extensive application in assays, analytical testing, trace material identification, and purity assessment. In the context of the biopharmaceutical sector, the stringent regulations regarding the safety and efficacy of drugs and the validation of the manufacturing process drive the product demand.

Moreover, in order to get any chemical approved by a regulatory body, its suitability must be validated, which creates the requirement for evaluation with a reference chemical that is pure. All the data obtained during the analytical testing of the materials is considered at the micro level to ensure that the substance is suitable for its intended use. The analysis of the substance depends upon the criticality of the application, which also governs the selection of the reference material to be employed.

Due to the COVID-19 pandemic, the pharmaceutical industry witnessed an unprecedented demand for production at a large scale. Improved quality control was imperative for achieving ambitious goals at each step of drug development. Therefore, the use of analytical reference compounds increased, particularly among companies offering biopharmaceuticals and nutraceuticals. Their main objective was to elevate product yield and quality, minimize the wastage of raw materials, and better control the pharmaceutical manufacturing processes.

Moreover, the development of biopharmaceutical products is complex owing to the requirement for various types of laboratory tests and the caution that needs to be observed while working with living organisms. Analytical standard compounds taken as reference materials create a framework intended to facilitate the regulatory implementation in pharmaceutical development, manufacturing, and quality assurance.

The market experienced vast growth during the pandemic owing to the extensive use of analytical standard techniques during the manufacturing of vaccines. As part of the efforts to develop therapies against the virus, analytical techniques played a vital role in drug research and discovery. In this regard, the stringent quality standards implemented to ensure the production of effective and safe drugs for an increasing population afflicted by the infection drove the market.

In order to achieve robust quality control, certain attributes and parameters need to be met, which, in turn, is expected to boost the demand for analytical standards in the coming years.

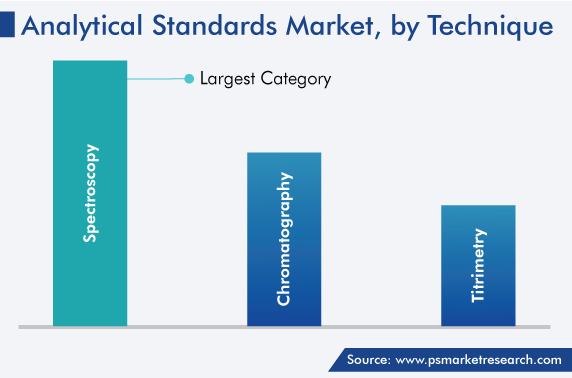

The chromatography category held significant market share, of 25%, in 2023, and it is projected to attain significant growth during the forecast period. This is attributed to the increasing pharmaceutical and biopharmaceutical R&D activities and technological advancements. Chromatography helps in detecting the constituents of a chemical mixture and separating them, monitoring dissolved contents in freshwater and marine ecosystems, studying the emission lines of distant galaxies, altering drug structures to improve effectiveness, and characterizing proteins. The advance of the category is, thus, attributed to the rising population impacted by chronic illnesses, which drives the demand for medication.

There are various types of chromatography, including gas chromatography and liquid chromatography, the demand for which has grown as a result of the easy availability of reference materials, accuracy of the results, and their high separation capacity. Moreover, in the last few years, chromatography procedures have experienced a vast growth in usage in the fields of food sciences for the quantitative analysis of legal or illegal additives and other adulterants.

In addition, molecular spectroscopy is a widely used spectroscopy technique. The category is also expected to experience considerable growth during the forecast period, due to the increasing application of this technique in the pharmaceutical and biopharmaceutical industries.

North America is the leading market for analytical standards, and it is expected to grow at a CAGR of 7.2% during the forecast period, maintaining its position till 2030. The presence of the majority of the global manufacturers and regulatory authorities, who have stipulated strict quality standards to comply with for pharmaceutical companies; the growing biotechnology industry and consequently increasing use of analytical technologies and standards; and high R&D expenditure by pharmaceutical companies in the region are driving the regional market.

The presence of major manufacturers has led to the high sale of reference or standards compounds to the pharmaceutical and chemical industries in the region. Further, there has been high penetration of analytical technologies and methods among laboratories for environmental pollution monitoring, drug testing, forensics, food testing, and other purposes. Moreover, the high per capita income and supportive government regulations to make healthcare accessible in the U.S. and Canada are driving the growth of the market.

One of the key global concerns related to health is food contamination. Adulterated raw material, contaminated food, and unsafe food distribution are the major causes of food-borne infections, allergies, and poisoning.

For instance, every year, more than 600 million people, or around 1 in 10 people, get sick with a food-borne illness, and around 420,000 people die of them, resulting in 33 million healthy life years lost. Moreover, data shows that around USD 95 billion in total productivity loss is associated with food-borne diseases in low- and middle-income countries, while around USD 15 billion is spent on treating these illnesses each year globally.

The major factor propelling the focus on food quality testing is the implementation of strict safety laws and regulations on food adulteration, contamination, and food safety. The most-commonly used analytical testing and quality control methods in the food and beverage industry are chromatography and spectroscopy.

Based on Technique

Based on Application

Based on Methodology

Geographical Analysis

Players in the analytical standards industry are majorly targeting the pharmaceutical & life sciences, environmental conservation, and food & beverage sectors.

COVID-19 impacted the market for analytical standards positively.

Chromatography dominates the analytical standards industry.

The highest revenue in the market for analytical standards comes from North America.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages