Ammonium Sulfate Market Overview

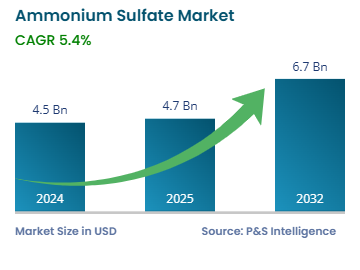

The ammonium sulfate market size in 2024 is estimated at USD 4.5 billion, and it is projected to advance at a CAGR of 5.4% during the forecast period (2025–2032), to reach USD 6.7 billion by 2032. The industry is very dynamic and constantly evolving, with various enterprises working in the global ecosystem to improve overall market intensity.

Technological advances in end-use sectors such as process innovations, geographical expansions of companies, and increase in manufacturing capabilities to cater to a larger marketspace, are also expected to fuel the market growth in the future years, worldwide. The growing reliance of the global farming community on various agricultural inputs such as fertilizers and pesticides has paved the way for advanced ammonium sulfate for use as a nitrogenous fertilizer.

In terms of its use in agricultural fertilizers, ammonium sulfate has no significant substitutes on the global market. However, its application has so far been limited to specific crops such as soybean and maize, and so the threat of substitution is seen as minor. Further, supplier bargaining strength in the market is regarded as moderate since the industry represents forward integrated operations of the majority of feedstock suppliers, including sulfuric acid and ammonia suppliers, creating a solid presence in the global agriculture sector.

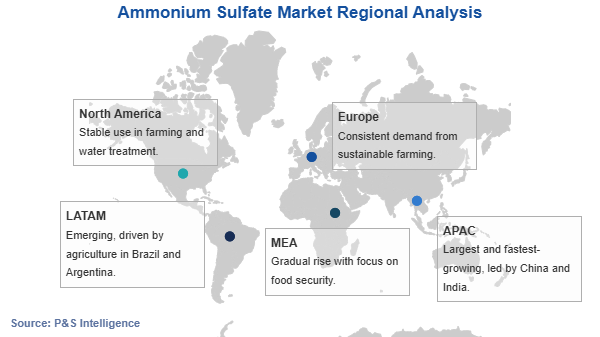

Europe, APAC, and North America, is expected to pave the way for increased consumption of ammonium sulfate, which will be supported by the increased medicinal research conducted by key pharmaceutical companies in these regions.

In addition, feed-grade ammonium sulfate is gaining popularity around the world, due to its acceptance as a safe non-nitrogen source for cattle and other ruminants. Ammonium sulfate is widely used in the production of enzymes for feed and the removal of potassium from vinasse, resulting in high-quality feed for cattle.

The cheap availability of raw materials like sulfuric acid and ammonia across the important agrarian economies of APAC, MEA, and LATAM is a key benefit for ammonium sulfate producers. With the high market potential in these regions, corporations are investing extensively in improving their manufacturing and production capacities, either through partnerships or as a separate company, in order to achieve a larger market share.