Report Code: 10025 | Available Format: PDF

Alcoholic Drinks Market Research Report: Size, Share, Key Trends, Growth Drivers, Regional Outlook, Revenue Estimation and Forecast, 2024-2030

- Report Code: 10025

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

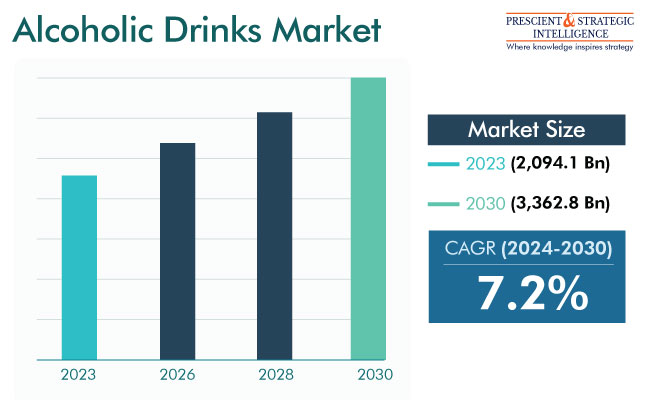

The global alcoholic drinks market is set to generate revenue of USD 2,094.1 billion by the end of 2023 and advance at a CAGR of 7.2% during the forecast period of 2024 to 2030, to reach USD 3,362.8 billion by 2030. This can be ascribed to the rising demand for premium products, youths’ shifting inclination toward flavored alcoholic drinks, and surging consumption of alcoholic drinks at social gatherings.

In many nations, it generates substantial amounts of cash and employment, as the consumption of alcoholic drinks worldwide has been beyond 270 billion liters per year.

In emerging markets, such as India, China, Indonesia, and Singapore, the demand for alcoholic beverages is rising more quickly than in developed countries. This is a result of the efforts made by alcoholic beverage producers to improve distribution methods and broaden their sales channels, such as online stores and convenience stores. The local production of branded alcoholic beverages and the introduction of new products are also fostering this expansion.

Fusion of Creativity and Alcohol in the Form of Cocktails

The cocktail scene is evolving as a result of new trends and demands and technological developments. Moreover, on social media, novice mixologists have created and heavily promoted original and delectable drinks, such as Jodatini and Fat Man.

Cocktail bars are going even more innovative after the pandemic, as a result of a shift in consumption behaviors and the rise in disposable incomes. Therefore, alcoholic drink manufacturers are increasingly providing ready-to-mix hybrid beverages, to cater to the changing consumer tastes and preferences. For instance, in October 2020, Diageo launched ready-to-drink canned cocktails under its popular Smirnoff and Gordon’s Martinis brands in response to the growing demand for pre-mix cocktails.

Such alcoholic concoctions, known as hybrid drinks, contain components from numerous distinct beverage categories. They are manufactured using odd flavor pairings, ingredients, and manufacturing techniques that are associated with other drinks. Another major trend is cannabis-infused alcoholic drinks, which has picked up after the legalization of recreational marijuana in many countries.

Microbrewery Is a Booming Trend in Emerging Economies

The phrase ‘microbrewery’ refers to the scale of a brewery. In order to obtain their grains, microbreweries typically work with nearby farmers, which not only helps the local economy but also has a lower impact on the environment. Additionally, due to the comparatively small size of their operations, they are simpler to run on alternate energy sources.

On account of the increasing demand for freshly brewed, handcrafted beer, the microbrewery industry in many emerging economies is rapidly expanding. For instance, in India, such establishments, which often feature engaging games, live music, and delectable food as well, are already popular in Bengaluru. Following the suit, Gurugram and Delhi have also started permitting microbreweries to operate. Among the top players in the microbrewery sector of India are White Rhino Brewing Co., Simba Craft Beer, The Biere Club, and Byg Brewski Brewing Company.

| Report Attribute | Details |

Market Size in 2023 |

USD 2,094.1 Billion |

Revenue Forecast in 2030 |

USD 3,362.8 Billion |

Growth Rate |

7.2% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Evolution in Consumer Tastes and Production Technologies

For generations, nightlife and alcohol have gone hand in hand, but there is a new trend on the rise: the sober nightlife experience. More businesses are providing sober or low-alcohol environments to cater to non-drinkers or anyone looking for alternatives to conventional night-time activities. This is in response to people becoming more aware of their health and wellbeing. Further, even the way alcoholic drinks are made, sold, and consumed has changed significantly as a result of technological improvements, and it will alter how customers think about drinks.

For instance, a new product, the Glyph 85H whiskey by Endless West, is not aged and never stored in any wood, but still meant to have the same flavor as if it had been. The company claims to make their product from the molecule up, relying on molecular chemistry to achieve the flavor profile of wood-aged whiskey, without the use of either wood or aging. The firm blends flavored esters obtained from fruits and flowers with a neutral grain spirit.

AI-generated gins and bioengineered whiskies are two of the newest trends in alcoholic drinks. Such innovative technology enables players to react swiftly to market demands and make necessary adjustments. For instance, manufacturers can keep an eye on temperature and quality during the brewing and fermentation processes with smart sensors. Additionally, companies are using the video conferencing technology to offer distinctive and interactive experiences, such as virtual tastings, in which the drinks to be tasted are delivered to consumers.

Rising Engagement of Alcohol Companies in Sponsorships

Many big players of this industry are investing significant amounts in sports, athletes, and the global entertainment industry. In an effort to attract their primary target group, beer and whisky brands, in particular, have started to link themselves with sports. This not only helps companies reach a larger number of people but also creates a better image, i.e., as a part of celebration and enjoyment rather than association with unhealthy lifestyles.

Football has the biggest fanbase and, therefore, the highest number of active sponsorship deals with alcohol brands, followed by cricket. For instance, Royal Stag and Jacob’s Creek are among the direct partners of the ICC World Cup 2023. Bira91, an Indian beer brand based in Gurugram, is another among the major sponsors of the event, as it was for the 2019 edition.

Beer Generates Highest Revenue

Beer has been the preferred drink till date as it contains lower alcohol level, which means more of it can be drunk at a time. Additionally, diners and pubs with a casual chic ambiance often have a selection of beers to choose from. Moreover, this popular drink is also served at most music concerts and sports events. Another reason beer is so popular is that it is cheaper than wines and distilled spirits.

Further, beer contains vitamin B and minerals such as selenium, potassium, and magnesium. Research has shown that many types of beers also contain antioxidants. If consumed to the level of a glass or two on a daily basis, beer can prevent heart disease and stroke. Additionally, it could be used to treat cancer, diabetes, anxiety, and a host of other illnesses.

The ready-to-drink (RTD) category is rapidly expanding in the market. Customers are becoming increasingly enticed by these spirit-based cocktails due to the convenience and diversity they offer. Taste is the main factor that influences consumers’ choice of RTDs, along with packaging characteristics, such as transportability and single-serve sizing. The RTD sector is well-established and as competitive as ever. Therefore, brand owners continue to place a high priority on innovative products, brand extensions, and collaborations to expand distribution and brand recognition.

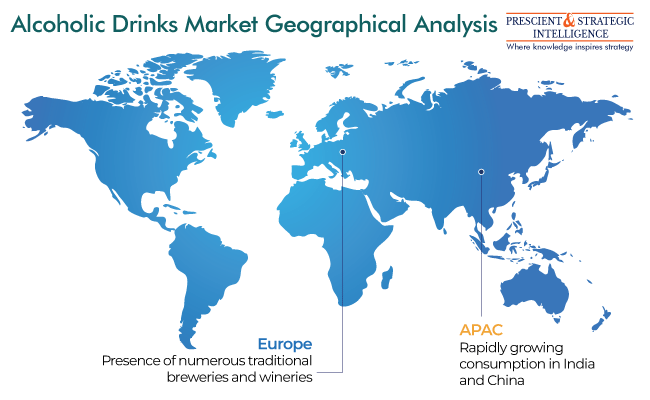

Rapidly Growing Consumption of Alcohol in Asian-Pacific

In the coming years, the APAC region is expected to register the fastest growth in the market. Asia is now the world's largest consumer of Scotch whiskey, overtaking the European Union. Sales curves in well-established markets, such as the U.S. and Europe, have somewhat flattened of late. Moreover, to educate and entice Asian consumers to purchase premium spirits, major whiskey makers, including Pernod Ricard and Diageo, spend heftily on marketing and promotional activities.

In India, the rate of alcohol use has increased during the past three decades. The quick recovery in alcohol consumption after a brief slowdown during the epidemic demonstrates the enormous domestic market. Due to India's rapid population growth, millions reach the legal drinking age each year. Among these, a huge number will eventually consume alcohol, indicating a significant rise in the country's overall consumption rate.

Additionally, China is the leader of the worldwide alcohol production sector. The country has dominated the market for over a decade, producing nearly 46.5438 million kiloliters annually.

Hypermarkets/Supermarkets Are Preferred

During the forecast period, the share of the hypermarkets/supermarkets category will continue to be the largest. Currently, the majority of the sales is made through offline channels. Just like other products, these retail channels offer a vast choice of alcoholic beverages on long shelves. Shoppers can pick up multiple products and compare them to see which one they want the most.

In the coming years, the online category is expected to witness rampant growth. In many developed countries, home deliveries of alcoholic beverages are already allowed, and during the pandemic, many emerging economies also permitted them. The decisions were made considering the high demand for such beverages and the fact that they represent a significant chunk of excise revenue for governments.

Major Breweries, Wineries, and Distilleries around the World Are:

- Anheuser-Busch InBev

- Bacardi Limited

- Diageo PLC

- United Breweries Holdings Limited

- LVMH Moët Hennessy Louis Vuitton

- Pernod Ricard SA

- Heineken

- Guinness & Co. Brewery

- Asahi Group Holdings Ltd.

- Brown–Forman Corporation

- Carlsberg A/S

- B9 Beverages Pvt. Ltd.

- Suntory Holdings Limited

- Molson Coors Brewing Co.

- Constellation Brands Inc.

- Rémy Cointreau

- Tsingtao Brewery Company Limited

- Beijing Yanjing Brewery Co. Ltd.

- Kirin Holdings Company Limited

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws