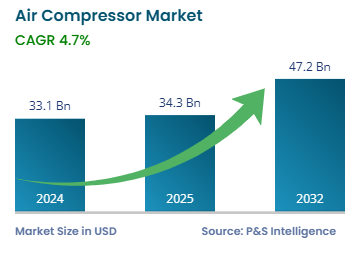

Air Compressor Market Overview

The global air compressor market size stands at 33.1 billion in 2024, which is expected to reach 47.2 billion by 2032, advancing at a CAGR of 4.7% during 2025–2032. This will prominently be due to the rising demand for environment-friendly air compressors all over the world, presence of advanced manufacturing facilities, rapid industrialization, and technological advancements.

Industrial air compressors are used in a variety of sectors, including metals & mining, construction, oil & gas, healthcare & pharmaceuticals, automotive & transportation, packaging, and power & energy. Moreover, compressed air systems are used by 70% of all manufacturers, to power conveyors, pneumatic tools, packaging machines, and paint sprayers.

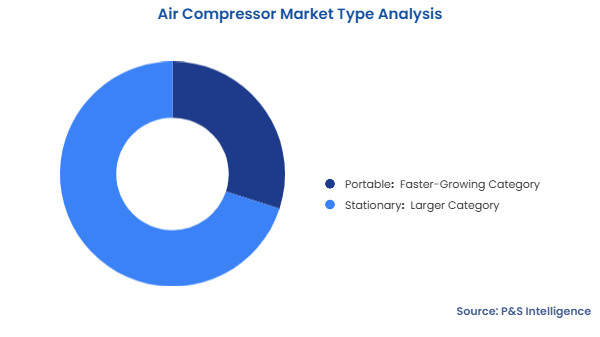

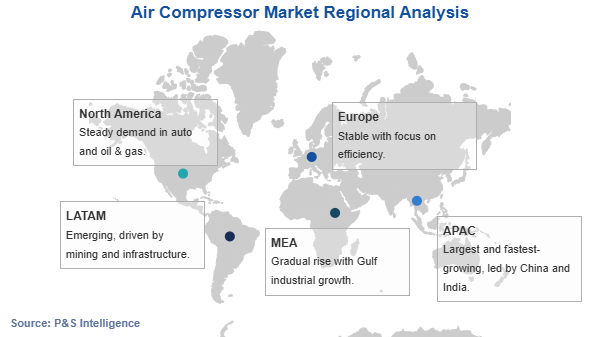

Due to the rising investments and capacity expansions, which are driving the industrialization rate and the manufacturing output, the portable air compressor category has an enormous potential to grow. Several growing economies, including those in APAC and Africa, have accelerated their industrial and economic development. The demand for industrial air compressors is also being driven by the government programs to support industrial automation, for the best possible resource utilization.