Market Statistics

| Study Period | 2019 - 2030 |

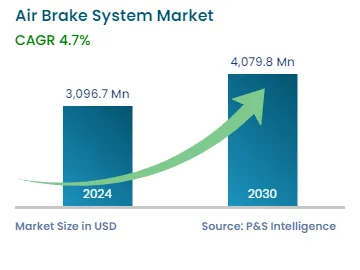

| 2024 Market Size | USD 3,096.7 Million |

| 2030 Forecast | USD 4,079.8 Million |

| Growth Rate(CAGR) | 4.7% |

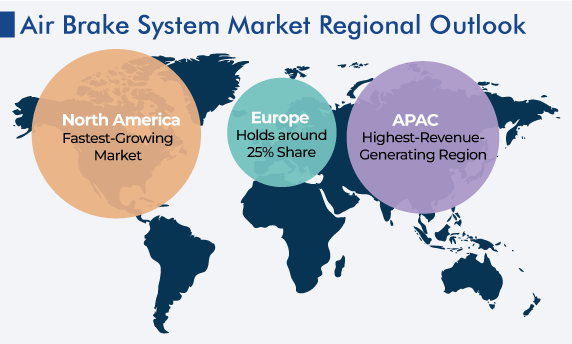

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Report Code: 12682

Get a Comprehensive Overview of the Air Brake System Market Report Prepared by P&S Intelligence, Segmented by Vehicle Type (Trucks, Semi-Trailer Tractors, Buses), Type (Drum, Disc), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 3,096.7 Million |

| 2030 Forecast | USD 4,079.8 Million |

| Growth Rate(CAGR) | 4.7% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global air brake system market revenue is USD 3,096.7 million in 2024, which is expected to reach USD 4,079.8 million by 2030, growing at a CAGR of 4.7% between 2024 and 2030.

This is due to the extensive usage of these components in heavy commercial vehicles because they provide a reliable performance, powerful and simultaneous braking, independence from engine power, and many other advantages. The rapid urbanization and industrialization, combined with a rising population, are leading to the initiation of building & construction activities on a mass scale. This, in turn, creates a high demand for the transportation of raw material by trucks, trailers, and semi-trailer tractors, all of which employ this braking technology.

Air brake systems are used to slow down or stop vehicles efficiently and safely. They are designed for precise control and use compressed air, which mitigates the chances of brake fade and enables the simultaneous application of the brakes across multiple wheels. This way the technology improves stability and control during the process.

They are preferred in heavy-duty vehicles due to their reliability, capacity to handle heavy loads, and consistent performance under challenging situations. This is itself a response to the high road traffic accident incidence, which continues to increase. The WHO says that the number of road traffic deaths every year is 1.34 million, mostly people aged 5–29 years. Thus, governments globally are implementing rules and regulations regarding the safety of people and the driver. Many countries have placed an utmost importance on the maximum load-carrying capacities and mandated the installation of air brakes in heavy-duty vehicles.

They are used in pieces of machinery other than automobiles as well. Construction and mining activities are surging around the world due to the increasing population. Several kinds of equipment used in both these sectors use air brakes because they are effective even in dusty or muddy conditions and can handle the high braking loads common in these applications.

They also find usage in large agricultural equipment, such as tractors and combines. Food is crucial for humans; thus, agricultural activities continue rising in scale, in turn, leading to an increase in the demand for air brakes for a range of farming machines.

The drum category accounts for the largest market share, of 70%, and it is expected to advance with a significant CAGR, of 4%, till 2030. This is due to the lower cost of drum brakes than the disc variants.

Further, the former are easy to manufacture and maintain, which is why they are especially preferred in price-sensitive markets. Additionally, they have been used for a long time in a variety of vehicles, including passenger cars, trucks, and trailers. Their versatility and familiarity essentially drive their usage in diverse applications. They also have a simple design and are durable and reliable, thus making them a perfect fit for off-road and heavy-duty applications. This is why they are widely used in Asia-Pacific and North America, with 85–90% of the heavy-duty vehicles in these regions integrated with these systems.

Further, there are many regulations and standards related to the usage of drum brakes in specific vehicle classes, which contributes to their prominence and adds to the market growth. Essentially, the surge in their usage is due to the growing focus on safety and increasing demand for high-load-carrying trucks in developed countries.

Moreover, Europe is a growing market for air disc brakes owing to its prominence as a major automobile manufacturing hub and the stringent regulations on the maximum vehicle stopping distance. Automakers in North America and Asia-Pacific are also working to deploy these systems in heavy-duty vehicles for safety and regulatory compliance. Road safety improves with these components as they have a higher braking power, shorter stopping distances, and better heat dissipation.

They also help in reducing weight and fuel efficiency, which is why fleet operators prefer them to reduce costs and comply with the strict safety and environmental regulations. Air disc brakes are becoming increasingly common in new commercial vehicle models as a result of the focus of OEMs on advanced technologies to strengthen their position. Thus, the development of advanced braking systems and increasing stringency of road safety regulations will benefit the market growth of air brake systems.

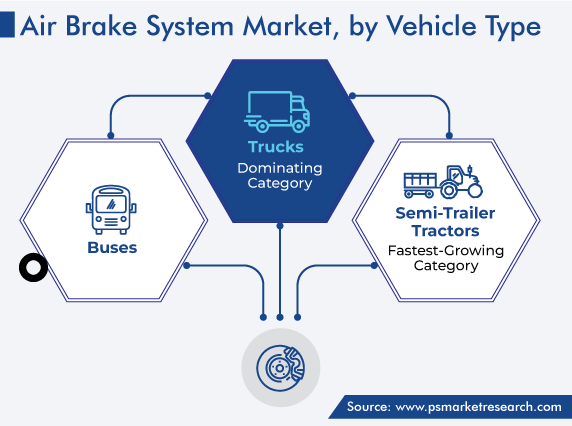

The trucks category accounts for the largest share, of 75%, and it is expected to grow at a significant CAGR during the forecast period.

This is due to the extensive usage of air brakes in rigid-body and heavy-duty trucks. These vehicles are widely used to transport goods across long distances, which is why they require robust and reliable braking systems. Due to the wide variety of goods trucks can carry, they have to travel everywhere, whether it is highways, state highways, city roads, or mountains, with a lot of cargo. Owing to this much weight, they require high braking efficiency in order to prevent road accidents and ensure the safety of other vehicles, pedestrians, and drivers. Air brakes are good at handling such needs and, in turn, reducing the risk of the loss of life and valuable cargo due to accidents.

Additionally, trucks are frequently used to tow trailers and other heavy loads. Air brake systems are perfectly designed for trailer applications as they provide synchronized braking across the entire vehicle combination, thus ensuring stable and optimum braking performance.

The buses category also holds a significant share in the market, due to the growing popularity of long-distance and intercity buses. The surging awareness of environmental conservation globally has led to more people using public transportation. Buses consume high volumes of fuel and operate on state highways and city roads, thus leading to a requirement for air brakes, as they are more efficient than hydraulic systems. Asia-Pacific is the largest market for air brakes in buses due to its large population and surging urbanization rate.

Drive strategic growth with comprehensive market analysis

The APAC region dominates the market with a revenue share of 50%, and it is set to showcase a growth rate of 5%.

This is because it is home to some of the world’s largest automotive manufacturers, such as Tata Motors, Ashok Leyland, Zheng Zou Yutong, Toyota, and Xiamen Kinglong. This has made China, India, and Japan three of the most-prominent automotive markets in the world. Further, Asia-Pacific accounts for over 60% of the global commercial vehicle production. China produced a record 3.17 million commercial vehicles in 2022, while Japan, the second on the list, produced 1.27 million units.

The rapid industrialization and infrastructure development have resulted in the expansion of the logistics & transportation sector, which requires commercial vehicles to a wide extent in order to meet the surging demand for goods supply.

Moreover, India is expected to be the fastest-growing market in Asia-Pacific due to the rampant infrastructure development as a result of the fast urbanization. Manufacturers are investing heavily in advanced air brake systems to ease driving on difficult terrain and help overcome the tough braking circumstances drivers are subject too. This will also help large fleet owners in complying with the safety regulations implemented by governments to save lives, by decreasing the number of road accidents.

Based on Vehicle Type

Based on Type

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages