Report Code: 12263 | Available Format: PDF | Pages: 317

AI in Fintech Market Research Report: By Component (Solutions, Services), Deployment (Cloud, On-Premises), Application (Credit Scoring, Fraud Detection, Chatbots, Quantitative and Asset Management) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 12263

- Available Format: PDF

- Pages: 317

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

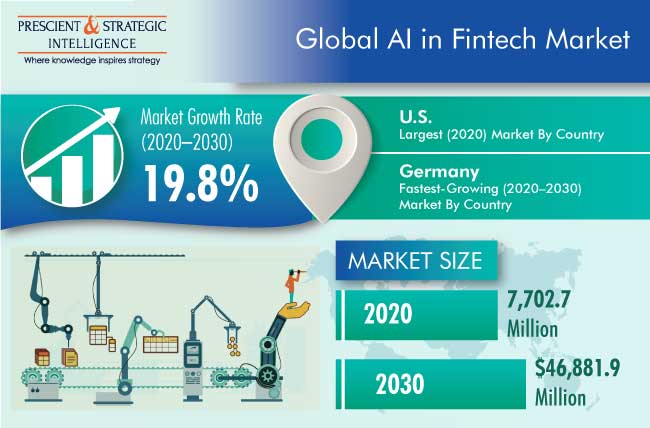

The global AI in fintech market generated revenue of $7,702.7 million in 2020, and it is expected to advance at a CAGR of 19.8% during 2020–2030. The key factors supporting the growth of the market include companies focusing on cost-cutting and efficiency improvement; surging adoption of internet of things (IoT), artificial intelligence (AI), and machine learning (ML) technologies across financial institutions; increasing penetration of 5G technology; growing fintech adaption; and rising demand for cloud services.

The COVID-19 pandemic had negatively impacted the market in the first two quarters of 2020. However, post lockdown, it has been witnessed that financial institutions are adopting AI solutions to reach maximum potential customers and streamline their operational activities, with a focus on optimizing operational cost and time and integrating their workflow with new COVID norms. The interest of banks and other financial institutions in adopting ML and data science has continued and increased throughout the COVID-19 crisis.

The pandemic has also increased the importance of ML and data science for the future. For instance, the initial wave of the epidemic resulted in an increase of 10–20% in online and mobile banking across Europe. Also, AI solutions assist banks in increasing revenue, lowering costs, and uncovering previously unknown opportunities. Thus, due to the above-mentioned factors, the market for AI in Fintech has been witnessing recovery.

Cloud Category Held Larger Share During Historical Period

On the basis of deployment, the cloud category dominated the AI in fintech market in 2020. This is mainly ascribed to the fact that, in a cloud environment, AI learns from historical data, detects current norms, and makes suggestions. Also, AI and cloud together can deliver greater efficiency, productivity, and digital security, both in terms of information handled and accuracy, and this automated technique avoids human errors during data analysis.

The solutions category held the larger share in the market for AI in fintech in 2020, and is expected to witness the fastest growth during the forecast period, based on component. This is because of the increasing demand for AI solutions for overall system enhancement. Moreover, the AI technology helps in natural language processing (NLP), question and answer (Q&A) processing, facial recognition, natural language generation, video and image analytics, and speech recognition, which save operating costs of financial institutions. Also, these solutions in fintech use predictive analytics for real-time anomalous data detection in bank transactions, credit card transactions, insurance claims, home mortgage, and loan applications.

In terms of application, the quantitative and asset management category generated highest revenue in the AI in fintech market in 2020. This is mainly because AI is changing the asset management sector by allowing fundamental analysts to conduct a large number of researches and extract more information quickly, allowing them to discover accurate investing ideas. Moreover, the financial institutions have invested a significant proportion of amount in AI solutions and services for quantitative and asset management, to optimize data management in a better way.

Asia-Pacific (APAC) Region to Witness Fastest Growth in The Market

Geographically, APAC region is expected to witness the fastest growth during the forecast period, due to the growing economy, increasing investments in IT infrastructure, rising adoption of new technologies, and surging government initiatives toward the development and deployment of IoT and AI technologies in companies operating across several verticals in the region. Moreover, major players, as a part of their business strategy, are investing in the untapped markets of the region, which, in turn, is contributing to the regional market growth.

Moreover, North America held the largest share in the global AI in fintech market in 2020. This is mainly attributed to the developed IT infrastructure, high investment, penetration of 5G technology, and high fintech adaption rate in the region. For instance, the investment in the regional fintech market was around $64,200 million in 2019.

Mobile Payment Innovations Is a Key Market Trend

High adoption and integration of innovative mobile payment solutions is a key trend in AI in fintech market. As global consumers become more reliant on digital payment than traditional wallets. Many players in the market offer payment platforms and are constantly adding new capabilities such as biometric access control including fingerprint recognition, and facial recognition. For instance, Alipay, a third-party online and mobile payment company owned by Alibaba, is now the world's largest mobile payment platform. Thus, AI solutions made the process easier, safer, and convenient for financial institutions as well as consumers.

Automated Financial Processes, With Improvements in AI Boosted the Market Growth

AI solutions are enabling businesses to reduce costs, automate processes, and decrease the likelihood of errors. For instance, companies use AI chatbots as customer assistants for a variety of tasks such as sales, customer care executive (over the phone), and online chat executive. Being able to answer frequently asked questions about a company or a product/service, it provides improved customer experience because users get the answer to their query right away, while also saving the company’s time and money. Thus, this factor drives the AI in fintech market growth.

Financial institutions are under intense pressure to improve efficiency, reduce costs, and boost productivity. Process automation is set to play a pivotal role in task execution within financial institutions in the coming years. The primary aim of automation in the banking industry is to assist in processing repetitive banking works. Some of the key benefits of automation include cost savings, time savings (frees up time for employees to work on more complex tasks), a reduction or even elimination of human errors, and scalability. Thus, the increasing demand for process automation among financial organizations is boosting the growth of the market for AI in fintech.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$7,702.7 Million |

Market Size Forecast in 2030 |

$46,881.9 Million |

Forecast Period CAGR |

19.8% |

Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Country Breakdown; Impact of COVID-19; Companies’ Strategic Developments; Company Profiling |

Market Size by Segments |

By Component; By Deployment; By Application; By Region |

Market Size of Geographies |

U.S; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; South Korea; Australia; India; Brazil; Mexico; Israel; U.A.E.; South Africa |

Secondary Sources and References (Partial List) |

Association for Advancing Automation; Association for Financial Technology; Automation Industry Association; Control System Integrators Association; European FinTech Association; Financial Data and Technology Association; FinTech Professionals Association; International Monetary Fund; International Society of Automation; Marketplace Lending Association; Measurement, Control and Automation Association; Organization for Machine Automation and Control; Singapore Fintech Association; World Bank Group |

Explore more about this report - Request free sample

Market Players Involved in Collaborations and Partnerships to Gain Significant Position

The global AI in fintech industry is competitive with the presence of several key players offering solutions with minimal differentiation. In recent years, the market players have been involved in the collaborations and partnerships in order to attain a significant position. For instance:

- In April 2020, Fenergo, a leading provider of digital transformation, customer journey, and client lifecycle management (CLM) solutions for financial institutions, and IBM Corporation announced the signing of an original equipment manufacturing agreement that would allow them to collaborate on solutions that help clients address a wide range of financial risks they face. IBM and Fenergo would be able to create solutions that combine Fenergo's CLM offering with IBM's RegTech portfolio of anti-money laundering (AML) and KYC solutions, as a result of the agreement.

- In April 2020, Verient System INC, Next IT Corporation's parent company, reached an agreement with one of the world's largest banking organizations to provide its new standard solution for fraud and corporate security investigations. The Variant Systems Al platform assists the bank in detecting fraud, as well as in meeting cybersecurity and deployment management requirements.

Key Players in Global AI in Fintech Market Include:

- Amazon Web Services Inc.

- Intel Corporation

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- Alphabet Inc.

- HCL Technologies Limited

- Salesforce.com

- SAS Institute Inc.

- Cognizant Technology Solutions Corporation

- Capgemini SE

- IPsoft Incorporated

Market Size Breakdown by Segments

The global AI in fintech market report offers comprehensive market segmentation analysis along with market estimation for the period 2015-2030.

Based on Component

- Solutions

- Software tools

- Platforms

- Services

- Managed

- Professional

Based on Deployment

- Cloud

- On-Premises

Based on Application

- Credit Scoring

- Fraud Detection

- Chatbots

- Quantitative and Asset Management

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific (APAC)

- Japan

- China

- India

- Australia

- South Korea

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East and Africa (MEA) By component

- Israel

- U.A.E.

- South Africa

In 2030, the value of the AI in fintech market will be $46,881.9 million.

Solutions are the larger category under the component segment of the AI in fintech industry.

The major AI in fintech market drivers are companies focusing on cost-cutting and efficiency improvements and increasing demand for process automation among financial organizations.

North America is the largest and APAC is the fastest-growing AI in fintech market.

Most AI in fintech market players are adopting collaborations and partnerships strategy to sustain their business growth.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws