Report Code: 10948 | Available Format: PDF

Active Implantable Medical Devices Market Size and Share Analysis - Global Growth & Development Forecast to 2030

- Report Code: 10948

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Active Implantable Medical Devices Market Size

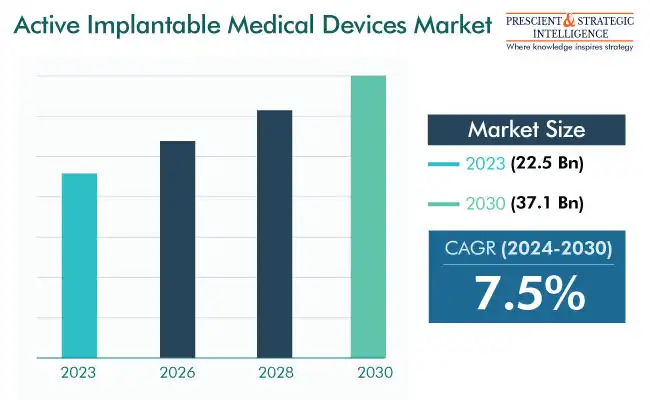

The active implantable medical devices market size has been estimated at USD 22.5 billion in 2023, and it will reach USD 37.1 billion by 2030, advancing at a 7.5% compound annual growth rate between 2024 and 2030.

The incidence of chronic ailments is rising, the populace is quickly aging, neurological and cardiovascular disorders are becoming more prevalent, and the implantable medical device technology is enhancing. Apart from these factors, the market advance is assisted by the growing funding to develop technologically enhanced products, rising acceptance of neurostimulators, and increasing developments in and consciousness regarding medical implants.

Growing Aging Population Boosts Market Advance

The surging elderly populace is one of the major factors behind the progress of this industry. As per the World Health Organization, 1 in 6 individuals globally will be 60 years old or over by 2030. By this time, the number of the number of people who are 60 years and over will touch 1.4 billion from 1 billion in 2020. Moreover, the count of individuals who are 80 years or older will triple in 2020–2050 and reach 426 million.

Additionally, about 92% of the older people have at least one long-term health problem, and 77% have two or more. Therefore, these people require extensive care, preferably in the comfort of their homes. In the years to come, the progress of this industry will likely be assisted by novel devices as well as ease of access to surgeries. Further, the supportive medical device R&D guidelines and the favorable insurance reimbursement policies will play a key role in this regard.

The surging count of heart issues and the growing need for active implantable devices, particularly in developed nations, are two more factors that boost the industry’s expansion. Similarly, as more individuals are becoming sick, there is an enormous demand for novel and enhanced technologies that are easy to utilize.

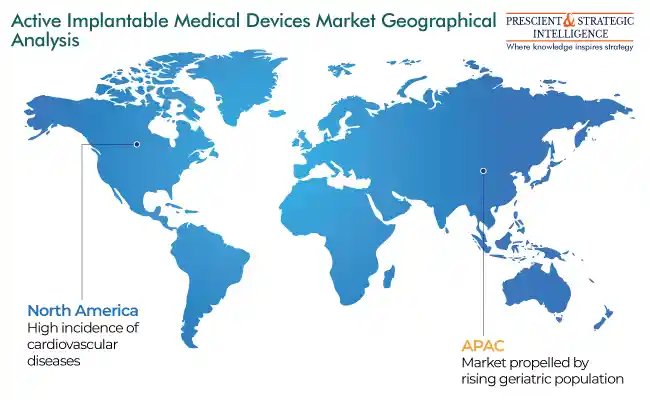

North America Leads Market

North America was the largest contributor to the industry in 2023. The surging occurrence of cardiovascular diseases, advantageous reimbursement policies, and high rates of obesity are the key factors that are boosting the growth of this market in the region. In addition, the major industry players in this continent are developing new products that are easier to implant, safer for patients, smaller and economical, and, above all, more effective.

Additionally, according to the Centers for Disease Control and Prevention (CDC), over 3 million individuals in the U.S. suffer from atrial fibrillation, which is the most-prevalent abnormal heart rhythm type. Moreover, the count is likely to quadruple by 2050 because of the aging of the populace. The growing problem of cardiovascular diseases is likely to drive the need for implantable cardioverter defibrillators, implantable loop recorders, and pacemakers in this nation in the coming years.

The market in APAC is likely to advance at the highest compound annual growth rate in the years to come. The increasing healthcare expenses as well as the associated infrastructure expansion are the key factors boosting the regional industry. Further, India and China have an enormous elderly populace, and the healthcare systems in these nations are advancing. Additionally, the less-stringent rules attract medical device businesses to invest in India and China.

LATAM is another lucrative region for those willing to invest in the active implantable medical device business. This is majorly ascribed to the initiatives taken by regional countries to advance the standard of care, especially for critical and life-threatening diseases and those with a significant emotional and financial burden. For example, Mexico joined the HEARTS initiative in February 2020 to enhance primary healthcare for patients with CVDs. Encouraged by the Pan American Health Organization, the initiative focuses on improving the prevention as well as control of hypertension at the primary care level.

Hospitals Category Is Dominating Industry

The hospitals category, on the basis of end user, led the industry in 2023. With a large elderly populace and the increasing incidence of chronic sickness, the need for healthcare services is rising. Hospitals have to deal with a larger number of patients as a result, which boosts the requirement for medical equipment to monitor, treat, and diagnose patients. In addition, hospitals generally offer specialized operations as well as treatments that require specific equipment.

For example, implants, specialized surgical equipment, and robotic systems may be required during surgical procedures. A better supply of associated medical instruments is essential because of the growing need for these treatments. Further, implantation procedures, however minute, carry some risk, which is why patients generally prefer to receive them at a full-fledged hospital rather than an ambulatory surgery center.

| Report Attribute | Details |

Market Size in 2023 |

USD 22.5 Billion |

Revenue Forecast in 2030 |

USD 37.1 Billion |

Growth Rate |

7.5% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Implantable Cardioverter Defibrillator Is Most-Used Product

In 2023, the implantable cardioverter defibrillators category, on the basis of product, was the largest contributor to the industry. This can be ascribed to the increasing number of people with cardiovascular diseases globally, the rising need for such life-saving apparatus in emerging economies, and the arrival of technological innovations in these devices.

Implantable cardioverter defibrillators offer different choices for varying patient requirements. These include single-chamber, double-chamber, and bi-ventricular options, each designed to solve different cardiac rhythm problems. Furthermore, the improvements in technology have made ICDs better with more features and increased their importance in the medical world. The growing need for these machines in emerging economies shows a big change in how people get cardiac care.

Moreover, neurostimulators are likely to advance at the highest CAGR over the forecast period. Neurostimulation devices are vital for people suffering from movement disorders, paralysis, and chronic pain. As per estimates, 10–20% of the people on earth suffer from long-lasting pain as a result of cancer, injuries, amputation, psychological trauma, or spinal cord diseases.

Top Companies Producing Active Implantable Medical Devices:

- Boston Scientific Corporation

- Demant A/S

- Sonova Holding AG

- BIOTRONIK SE & Co. KG

- Hangzhou Nurotron Biotechnology Co. Ltd.

- Medtronic plc

- MED-EL

- Abbott Laboratories

- Danaher Corporation

- Cochlear Ltd.

- LivaNova PLC

- Zimmer Biomet Holdings Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws