Market Statistics

| Study Period | 2019 - 2030 |

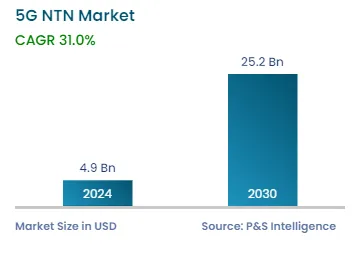

| 2024 Market Size | USD 4.9 Billion |

| 2030 Forecast | USD 25.2 Billion |

| Growth Rate(CAGR) | 31% |

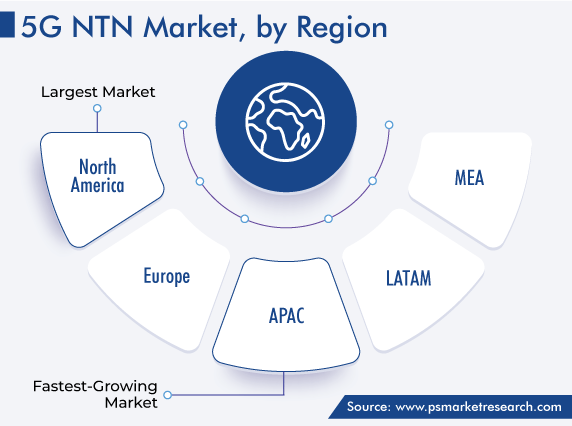

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12587

Get a Comprehensive Overview of the 5G NTN Market Report Prepared by P&S Intelligence, Segmented by Component (Hardware, Solutions, Services), Platform (UAS Platform, LEO Satellite, MEO Satellite, GEO Satellite), Application (EMBB, URLLC, MMTC), End-Use Industry (Maritime, Aerospace and Defense, Government, Mining), Location (Urban, Rural, Remote, Isolated), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 4.9 Billion |

| 2030 Forecast | USD 25.2 Billion |

| Growth Rate(CAGR) | 31% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global 5G non-terrestrial network (NTN) market size was USD 4.9 billion in 2024, and this number is expected to increase to USD 25.2 billion by 2030, advancing at a CAGR of 31.0% during 2024–2030. This can be attributed to the expanding 5G infrastructure, surging demand for high-speed, low-latency connectivity by the consumers in urban and suburban locations, increasing mobile data traffic, and growing government efforts for enhancing 5G’s reach to customers.

Furthermore, industry players have taken several strategic measures, including mergers and acquisitions, partnerships, and product launches, to strengthen their foothold.

The technology can offer cost-efficient broadband and wireless connectivity in the unconnected and remote areas across the globe. Employing the latest generation of networks and satellite technology, the defense, government, and commercial industries, as well as individuals, would be able to connect and communicate with remote parts of the globe where terrestrial networks do not operate.

Remote places that could be connected with this technology include the Arctic, Himalayas, and Amazon rainforest; the sea, for ships, oil rigs, and other pieces of marine equipment; the air, for commercial and defense aircraft; and the space, for spacecraft, satellites, space stations, and telescopes.

Additionally, several emerging economies also use NTNs to offer internet and communication services, specifically in rural areas with a lack of terrestrial infrastructure. These factors push telecom industry players to make investments in the field, to deliver reliable connectivity in far-flung areas.

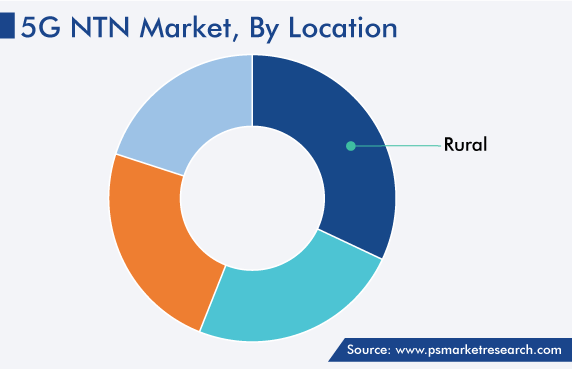

Remote areas held the major 5G non-terrestrial networks market revenue share in 2022, and they are further expected to maintain their dominance during the prediction period. This is due to the limited mobile broadband services in such areas, need for long-range coverage in order of tens to hundreds of kilometers, growing necessity to resolve the issues with multicasting and broadcasting, and rising concern for public safety in hard-to-reach areas, such as dense forests and deserts.

Moreover, the rural category will witness significant growth in the coming years, owing to the rising need for internet access, growing requirement for infrastructure to deliver effective connectivity solutions, and governments’ funding programs to establish smart cities and connect rural areas with urban agglomerations.

The growing pace of innovations and strategic measures by industry players will help the market grow with a significant pace in the coming years. For instance, in March 2022, Washington-D.C.-based global communications provider Omnispace LLC announced that it was teaming up with a U.K.-based technology and product development company named TTP plc to develop a 5G hybrid network that can integrate terrestrial and satellite networks into one seamless, connected experience. Moreover, both companies have developed prototype products and demonstrated their use on the 3GPP-compliant 5G NTN network, to authenticate several vendor platforms, applications, and devices.

Similarly, Keysight Technologies Inc., a U.S.-based technology company that provides cutting-edge design and validation solutions to connect and secure the globe, began collaborating in January 2023 with Qualcomm Technologies Inc. to launch an end-to-end 5G NTN connection. On the basis of this demonstration of call signaling and data transmission with the use of orbit trajectory imitation, both organizations aim to quicken the deployment of the 5G NTN technology to deliver cost-effective broadband in hard-to-reach areas.

LEO satellites will witness the highest growth rate in the coming years, due to the requirement for improved network coverage, high spending by government and tech giants, and mounting trend of 5G integration in satellite communications. Furthermore, the LEO component can also improve services, including container tracking, and advanced drone operations.

Furthermore, unmanned aircraft systems (UAS) contribute significant revenue as they can be used to offer continental, regional, as well as local coverage, with the radio beams typically remaining fixed with respect to the mobile or device. Moreover, UASs, such as drones, are increasingly being deployed to improve the operations of LEO satellites, along with their lower deployment cost.

The aerospace and defense category will register the fastest growth during the forecast period. This is due to the high government spending on the defense sector, mounting technological advancements for higher personnel safety and strike precision, and growing digitalization rate.

Moreover, the burgeoning demand for high-speed, reliable internet connectivity for passengers during flights and the rising requirement for stable communication for land and marine military operations further create opportunities for the market.

Furthermore, the maritime category is important in the market due to the fact that the industry is suffering from a lack of connectivity and path visibility. As ships ply on the ocean, they do not always have reliable connectivity, which results in an unstable supply chain of commodities, which further creates the need for seamless 5G connectivity. Additionally, the maritime satellite communication technology has been accepted to leverage advanced communication networks to connect with employees working at remote offshore locations.

Solutions accounted for the largest revenue share in 2022, and they are expected to maintain their position in the coming years. This can be ascribed to the increasing need of operators to deliver excellent connectivity, with the utilization of 5G-based technologies, along with lower operational expenses; and the growing count of players offering test solutions to inspect the affordability, dependability, and effectiveness of the system before launching it in space. Moreover, companies invest heavily to perform such tests, which further drives the demand for the associated solutions.

Drive strategic growth with comprehensive market analysis

North America accounted for the largest revenue share in 2022, and it is further expected to maintain its position in the prediction period. This is due to the presence of a huge number of players developing and delivering 5G communication solutions, and high 5G penetration in the region. Moreover,

APAC will witness the fastest growth with a CAGR of around 30% during the forecasted period, due to the rising internet penetration, mounting need for enhanced network connectivity, growing consumer base for high-speed internet, surging investment by international players and governments in the telecom sector, and increasing count of satellite lunches.

Furthermore,

This report offers deep insights into the 5G non-terrestrial network industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Component

Based on Platform

Based on Application

Based on End-Use Industry

Based on Location

Geographical Analysis

The 2024 size of the market for 5G NTN solutions was USD 4.9 billion.

LEO satellites dominate the 5G NTN industry.

North America will be the largest market for 5G NTN solutions.

The biggest 5G NTN industry drivers are deployment of the related infrastructure and rising demand for high-speed low-latency connectivity, especially in unconnected areas.

Rural areas are the key locations in the market for 5G NTN solutions.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages