U.S. Manufacturing Analytics Market to Generate Revenue Worth $14.1 Billion by 2030

- Published: March 2020

The U.S. manufacturing analytics market generated the revenue of $2.5 billion in 2019 and is expected to reach $14.1 billion by 2030, advancing at a CAGR of 17.6% during the forecast period (2020–2030). The service category under the solution segment is expected to witness faster growth in the market during the forecast period. This can be attributed to the high adoption of analytics software by manufacturers for quality management, asset management, inventory management, and predictive maintenance to reduce equipment downtime and increase operational efficiency.

Implementation of virtualization Is a Key Trend Observed in the Market

For gaining a competitive advantage and improving business operations, manufacturers in the U.S. manufacturing analytics market are increasingly adopting virtualization software, which separates the applications from the physical hardware they run on. Switching to virtualization allows a number of virtual workloads to be handled simultaneously, on the same piece of machinery, which further improve manufacturing processes. The technology supports an easy initial setup and reduces the expenditure on physical hardware. Additionally, the ability of the virtualization software to address lifecycle management issues also increases the need of virtualization in the industry.

Increasing Focus on Simplifying Supply Chain Management Is Escalating the Market Growth

An increasing focus on improving supply chain management is of significance in the U.S. manufacturing ecosystem. This is a result of the rising awareness about supply chain management, for reduction in operational costs, improvements in customer satisfaction, and increase in the visibility and control over the inventory. Supply chain management solutions address manufacturing needs in a variety of areas, such as manufacturing and logistics optimization, sales and operations planning, product lifecycle management, business intelligence, network and inventory optimization, radio-frequency identification (RFID) of assets, and raw material procurement. Analytics tools are powering intelligent and autonomous systems that can be leveraged to streamline the processes in any stage of a supply chain. The ubiquitous connectivity offered by analytics further enables manufacturing organizations in the U.S. to improve the communication across the supply chains. Thereby, focus on improving supply chain management is driving the growth of the U.S. manufacturing analytics market.

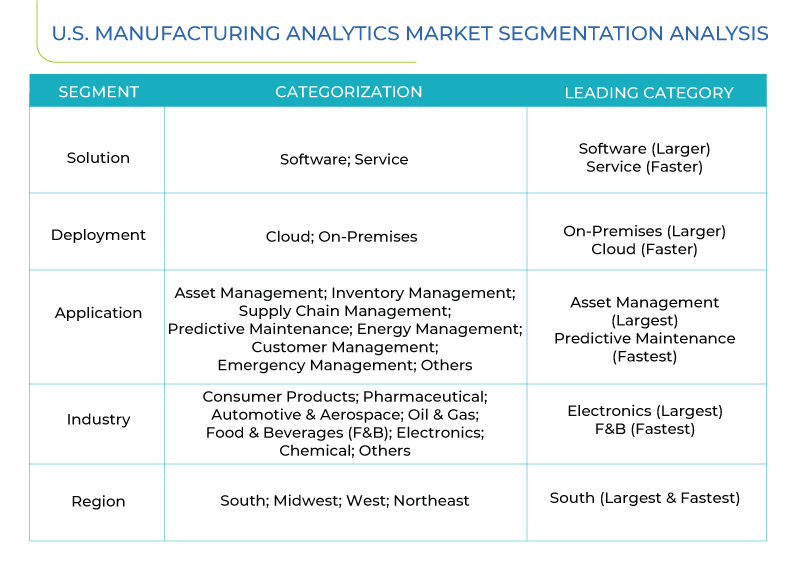

Segmentation Analysis of U.S. Manufacturing Analytics Market

- The on-premises category under the deployment segment held the larger share in the U.S. manufacturing analytics market in 2019. This is attributed to its higher adoption due to greater control and security of data and processes.

- The predictive maintenance category under the application segment is anticipated to witness fastest growth in the U.S. manufacturing analytics market during the forecast period. Using manufacturing analytics solutions, businesses can access information on equipment health, performance, and faults in real time to forecast downtime and schedule maintenance or updation before the fault occurs, thus ensuring no or least disruption in operations.

Regional Analysis of U.S. Manufacturing Analytics Market

The South region is expected to hold over 30% share in the U.S. manufacturing analytics market in 2030. This can primarily be attributed to the presence of a large number of manufacturing companies in the region. The availability of abundant land for manufacturing and highly skilled workforce to support operations, complemented by improved infrastructure and pro-business laws, supports the growth of the manufacturing industry in the region.

Competitive Landscape of U.S. Manufacturing Analytics Market

The U.S. manufacturing analytics market is highly competitive in nature due to the presence of a large number of players operating within. Some of the key players are SAP SE, SAS Institute Inc., Salesforce.com Inc., Oracle Corporation, IBM Corporation, TIBCO Software Inc., Alteryx Inc., Sisense Inc., DXC Technology Company, and General Electric Company.

Browse report overview with detailed TOC on "U.S. Manufacturing Analytics Market Research Report: By Solution (Software, Service), Deployment (On-Premises, Cloud), Application (Asset Management, Inventory Management, Supply Chain Management, Predictive Maintenance, Energy Management, Customer Management, Emergency Management), Industry (Consumer Products, Food & Beverages {F&B}, Electronics, Chemical, Automotive & Aerospace, Oil & Gas, Pharmaceutical) – Industry Size, Share, Trends and Demand Forecast to 2030" at:https://www.psmarketresearch.com/market-analysis/us-manufacturing-analytics-market

In recent years, major players in the U.S. manufacturing analytics market have taken several strategic measures to strengthen their market positions. For instance, in August 2019, Salesforce.com Inc. announced the acquisition of Tableau software, for $15.7 billion. With this acquisition, the company aims to strengthen its analytic capabilities, offering customers with data visualization capabilities and enabling them to take data-driven decisions.

Furthermore, in February 2019, IBM Corporation announced the launch of AI-supported Maximo Asset Performance Management (APM) solutions, which collect real-time data from physical assets, including elevators, mining equipment, turbine, and robots; and offer insights on operating conditions, predict potential issues, and provide repair recommendations.