U.S. Electric Bus Charging Station Market to Generate Revenue Worth $184.5 Million by 2025

- Published: September 2019

The U.S. electric bus charging station market was at its nascent phase and registered $20.9 million revenue in 2018. Furthermore, the market is expected to surpass $184.5 million by 2025, witnessing a CAGR of 37.1% during the forecast period. Based on product, plug-in charging station held the largest share in the market in 2018.

The plug-in charging station witnessed an early adoption in the U.S. for personal transport vehicle. Additionally, for most drivers, it is a convenient option to charge their vehicles at fleet facilities, which increases its acceptance across the country.

Growing Development of Wireless Charging Systems is One of the Major Trends Observed in the Market

Wireless charging systems have gained popularity among vehicle manufacturers to restrict the weight of electric buses and also to reduce the charging time. With the use of these systems, power can be transmitted to the load from supply equipment through cordless technique. Furthermore, the systems notably improve electric vehicles’ performances in comparison with traditional plug-in chargers, and thus, improve driving experience in terms of range. Several companies across the world are working on faster development of wireless electric charging systems to decrease the effective bus charging time. These systems have shown countless potential to push forward the further development and popularization of electric vehicles, globally, without awaiting the breakthrough development in battery technologies.

Growing Demand for Electric Buses is Boosting the Market Growth

The U.S. electric bus charging station market is highly dependent on the government support. The electric buses in the government sector are used for public transport, transit services, military, and others purposes. Most of the decisions of purchasing electric buses are made at the federal or the state government level. The U.S. government has a strong commitment to increase the number of electric buses in its transportation system. For instance, the government in the country plans to replace diesel buses, which have exceeded useful life, with electric buses. Also, local governments in the country are integrating electric vehicles into their municipal or public transit fleets. Such procurement and replacement initiatives are expected to drive the demand for electric buses, which in turn, will boost the deployment of electric bus charging stations in the country.

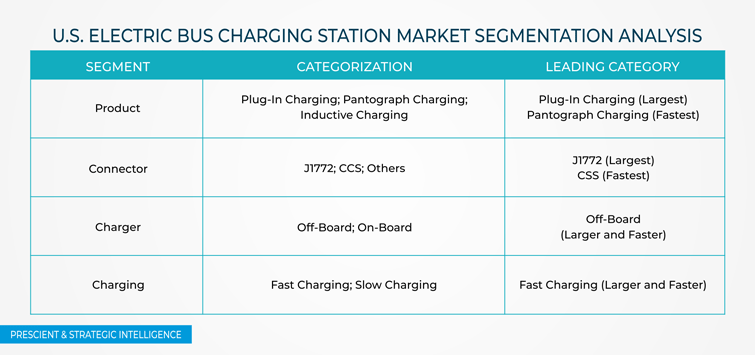

Segmentation Analysis of the U.S. Electric Bus Charging Station Market

- Plug-in charging station is the largest product category in the U.S. electric bus charging station market. Whereas, the market for pantograph charging stations is projected to grow at the fastest rate during the forecast period, due to their ability of fast charging.

- CSS connector is the fastest growing category in the U.S. electric bus charging station market, owing to its increasing acceptance as a global standard for charging electric vehicles. Electric bus manufacturers, such as BYD Auto Co. Ltd. and NFI Group Inc., have joined the Charging Interface Initiative (CharIN e.V. or CharIN) to standardize electric bus charging connectors in the country.

- Off-board charger is dominating the charger segment in the U.S. electric bus charging station market. Furthermore, despite its high overhead cost, the market for off-board charger is forecasted to grow at a significant rate. These chargers are preferred due to their vehicle-to-grid reactive power capability. Also, they enable electric bus manufacturers to reduce the vehicle weight and make it lighter, which allows fast charging at higher power level.

- Fast charging station is faster growing category in the U.S. electric bus charging station market. The duration of time it takes to recharge an electric bus is a key factor for its extensive implementation. The station can charge an electric bus with a high-voltage DC in approximately 30 minutes as compared to a slow charging station, which takes more than 5 hours to charge the bus. This makes fast charging station a better choice and is expected to increase its rapid implementation in the market.

Competitive Landscape of the U.S. Electric Bus Charging Station Market

The U.S. electric bus charging station market is currently at its growing phase, with the presence of few major charging station manufacturers. Some of the major manufacturers in the country include ABB Ltd., APT Controls Ltd., Heliox B.V., Siemens Mobility GmbH, Proterra Inc., and Advanced Vehicle Manufacturing (AVM) Inc.

Browse report overview with detailed TOC on "U.S. Electric Bus Charging Station Market by Product (Plug-In Charging, Pantograph Charging, Inductive Charging), by Connector (J1772, CCS), by Charger (Off-Board, On-Board), by Charging (Fast Charging, Slow Charging) – Market Size, Share, Development, Growth, and Demand Forecast, 2016–2025" at:https://www.psmarketresearch.com/market-analysis/us-electric-bus-charging-station-market

The manufacturers in the U.S. electric bus charging station market are involved in product launches and client wins to increase their market shares. For instance, in June 2018, Proterra Inc. was awarded a contract of $32 million by the Chicago Transit Board for the purchase of 20 all-electric buses, along with the installation of five quick-charging electric stations at Navy Pier, Austin, Chicago, and the Chicago Transit Authority’s (CTA) Chicago Avenue garage.