U.K. Electric Bus Charging Station Market to Generate Revenue Worth $95.5 Million by 2025

- Published: October 2019

The U.K. electric bus charging station market generated revenue worth $13.3 million in 2018 and is expected to surpass $95.5 million by 2025, advancing at a CAGR of 30.7% during 2019–2025. On the basis of type, overnight chargers held the larger share in the market during the historical period (2017–2018).

Overnight chargers accounted for more than 95% sales volume in the U.K. electric bus charging station market in 2018. The market for these chargers is primarily driven by the increased preference of private and public transport agencies for overnight charging buses. The functional characteristics of these buses are similar to those of diesel buses, thus enabling easy operations throughout the day.

Increased Preference for Overnight Charging Buses as Key Market Trend

At present, majority of the electric buses that are being ordered in the U.K. employ the depot charging technology. This is mainly due to the similar operational characteristics of these buses with respect to those of diesel buses. Furthermore, in recent years, battery prices have fallen significantly, making the prices of these buses competitive with opportunity charging buses. Under the BYD–ADL partnership, electric bus providers BYD Co. Ltd. (BYD) and Alexander Dennis Ltd. (ADL) offer electric buses that employ depot chargers for charging. To date, the partnership has delivered more than 150 such buses in the country. Thus, the increased preference for overnight charging buses can be viewed as a key trend in the U.K. electric bus charging station market.

Rise in Deployment of Electric Buses in Public Transport Fleet Driving Market Growth

The U.K. is actively focusing on replacing diesel buses with electric buses in its public transport fleet. In 2018, nearly 4% of the new bus sales in the country were those of zero-emission buses, with the number of electric buses procured surpassing 130. The sales got increased by more than 55% from the previous year. By the end of 2018, there were more than 300 electric buses on roads in the country. In June 2018, Transport for London (TFL) gave an order to BYD-ADL for the procurement of fully electric double-decker buses. The contract included the supply of 37 Enviro400EV electric buses, and a batch of five electric buses was delivered in July 2019.

Electric buses offer numerous advantages over conventional fuel-based buses, which is why the adoption of these vehicles in public transit fleets is on the rise. Considerably low operating cost and increasing government support (in the form of incentives and subsidies) for electric buses are some of the factors boosting the adoption of electric buses in the country. In view of this, the demand for charging stations is increasing, thus contributing to the growth of the U.K. electric bus charging station market.

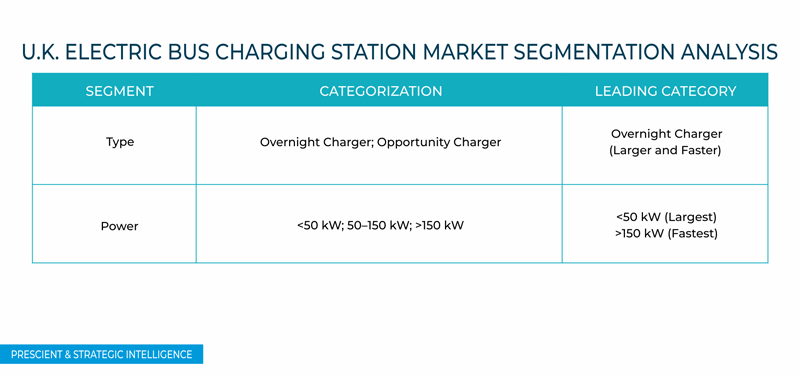

Segmentation Analysis of U.K. Electric Bus Charging Station Market

Under the segmentation by type, the overnight charger category is expected to continue leading the U.K. electric bus charging station market. Battery constitutes a substantial share in the total cost of overnight charging buses, when compared with opportunity charging buses, as these buses deploy smaller batteries. However, battery prices have fallen substantially in recent years, making the prices of these buses competitive with those of opportunity charging buses. This is expected to support the adoption of overnight charging buses during the forecast period as well.

On the basis of power, Ë‚50 kW electric bus charging stations dominated the U.K. electric bus charging station market during the historical period. The market, however, is expected to register the highest CAGR in the category of >150 kW chargers during the forecast period, owing to the growing demand for faster-charging alternatives for electric buses.

Competitive Landscape of U.K. Electric Bus Charging Station Market

The U.K. electric bus charging station market is consolidated in nature, with BYD Co. Ltd. operating as the major player. Other prominent players in the market include APT Controls Ltd. and ABB Ltd.

Browse report overview with detailed TOC on "U.K. Electric Bus Charging Station Market Research Report: By Type (Overnight Charger, Opportunity Charger), Power (<50 kW, 50–150 kW, >150 kW) – Industry Trends and Growth Forecast to 2025" at:https://www.psmarketresearch.com/market-analysis/uk-electric-bus-charging-station-market

In recent years, market players have won several contracts for the supply of electric bus and related charging stations in the country. For instance, in March 2019, Optare PLC received a contract for the supply of 21 double-decker electric buses and related charging infrastructure to First York Ltd., a bus operator in York, England, by the end of 2019. The buses have a capacity of 99 passengers and offer a travel range of over 150 miles on a single overnight charge.

Market Segmentation by Type

- Overnight Charger

- Opportunity Charger

Market Segmentation by Power

- <50 kW

- 50–150 kW

- >150 kW