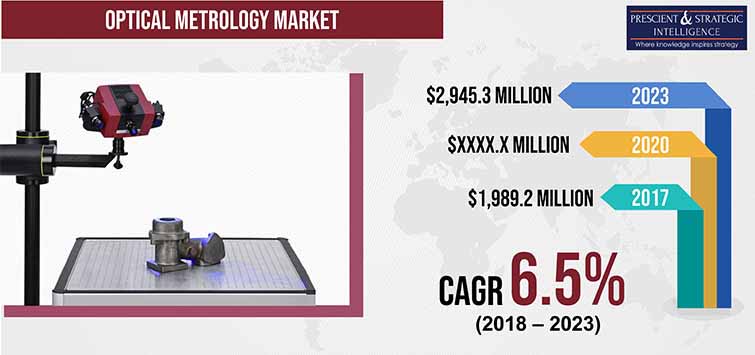

Optical Metrology Market is Expected to Reach $2,945.3 Million by 2023

- Published: October 2018

The optical metrology market is expected to reach $2,945.3 million by 2023, according to P&S Intelligence.

Buoyed by growing need for precise measuring tools and equipment for inspection in semiconductor industry, rise in demand for inspection of cracks and defects in underground pipes in the oil & gas industry, and increasing applications of optical metrology in manufacturing and healthcare industries.

Insights into the market segments

On the basis of product, the optical metrology market is segmented into optical/laser scanners, video measuring machines, and laser micrometery. The optical/laser scanners product category held the largest share of over 70% in 2017. In terms of adoption, optical/laser scanners are largely being preferred over the traditional Coordinate Measuring Machines (CMMs), predominately due to higher speed, comparable accuracy, portability, and scalability.

Based on industry, the market is segmented into automotive, consumer electronics, medical, aerospace and defense, and others, wherein ‘others’ include energy and utility, education, oil and gas, food and beverage, and construction. Of these, automotive industry held the highest share in the market accounting for nearly 39% share in 2017. This is attributed to growing automotive industry in countries like China, U.S., and Germany and increasing demand for optical metrology equipment for inspection and measurement of manufactured parts for automobiles. China is the world’s largest vehicle market with its annual vehicle production accounting for about 30% of global vehicle production in 2016.

Market is projected to record fastest growth in APAC

APAC is expected to witness fastest CAGR during the forecast period, with China anticipated to lead the pack during the same period. The growth can be attributed to rising demand for optical metrology equipment for surface inspection, and measurement of automotive parts, supported by increasing production of vehicles in China, and government initiatives for the launch of electric vehicles in the country. In 2017, around 579,000 units of electric vehicles were sold in China, up from around 336,000 units in 2016. Further, the government of China has targeted to sell 2 million electric vehicles by 2020.

Browse report overview with 85 tables and 51 figures spread through 155 pages and detailed TOC on "Optical Metrology Market by Product (Optical/Laser Scanner, Video Measuring Machine, Laser Micrometery), by Application (Distance Measurement, Surface Inspection, Form Measurement) by Industry (Automotive, Consumer Electronics, Medical, Aerospace & Defense), by Geography (U.S., Canada, China, Japan, India, South Korea, Germany, Italy, France, U.K, Brazil, Argentina, Mexico, U.A.E, Saudi Arabia, South Africa, Turkey, Morocco) – Global Market Size, Share, Development, Growth and Demand Forecast, 2013–2023" at:https://www.psmarketresearch.com/market-analysis/optical-metrology-market

Manufacturing and healthcare industries registering positive growth year-over-year

With growing manufacturing industry in the world, the demand for first article inspections, acceptance testing, and benchmark testing are increasing in this industry. The tools, molds, and assemblies used to manufacture precision parts need to be accurate and defect-free. Hence, they require laser scanners, comparators for measurements of dimensions. Owing to this, the demand for optical metrology is increasing globally.

Moreover, healthcare industry uses 3D scanners for numerous applications including designing prosthetic and orthotic devices, automated measurement of medical components, implant research, plastic surgery and several others. 3D scanners also provide full-field geometric data to inspect medical devices made of plastics, and for further processing in Computer-Aided Design and Manufacturing (CAD/CAM) processes in dentistry. Hence, the increasing need for inspection and measurement of medical devices is fueling the market growth.

Optical Metrology market competitiveness

Companies like Hexagon Manufacturing Intelligence, and Faro Technologies Inc. were the major companies involved in the launch of new products. For instance, Hexagon Manufacturing Intelligence launched GLOBAL Advantage High Throughput and Accuracy (HTA), a metrology solution for the aerospace industry, based on Hexagon’s advanced HP-O Multi optical scanning probe technology for high-speed non-contact measurement of aero- and land-based compressor blades in shop-floor environments.

Some of the players operating in the market include Nikon Metrology NV, Nanometrics Incorporated, Perceptron Inc., Nova Measuring Instruments Ltd., Quality Vision International Inc., Carl Zeiss Optotechnik GmbH, S-T Industries Inc., Hexagon Manufacturing Intelligence, Micro-Vu, KLA-Tencor Corporation, Creaform Inc., GOM GmbH, and Mitutoyo Corporation.

Global Optical Metrology Market Segmentation

Market Segmentation by Product

- Video measuring machines (VMM)

- Optical/Laser scanners

- Laser Micrometry

Market Segmentation by Application

- Distance Measurement

- Surface Inspection

- Form Measurement

Market Segmentation by Industry

- Automotive

- Consumer Electronics

- Medical

- Aerospace and Defense

- Others (include oil and gas, energy and utility, education, food and beverage, construction)

Market Segmentation by Geography

-

North America Optical Metrology Market

- By product

- By application

- By industry

- By country – U.S. and Canada

-

Europe Optical Metrology Market

- By product

- By application

- By industry

- By country – Germany, France, U.K., Italy, and Rest of Europe

-

Asia-Pacific (APAC) Optical Metrology Market

- By product

- By application

- By industry

- By country – Japan, China, India, South Korea, and Rest of Asia-Pacific

-

Latin America (LATAM) Optical Metrology Market

- By product

- By application

- By industry

- By country – Brazil, Mexico, Argentina, and Rest of LATAM

-

Middle East & Africa (MEA) Optical Metrology Market

- By product

- By application

- By industry

- By country – Saudi Arabia, South Africa, Turkey, Morocco and Rest of MEA